Bit Digital (BTBT): Valuation Insights After Analyst Focus on Ethereum Shift, AI Growth, a

November 1, 2025

Bit Digital (BTBT) filed a shelf registration that allows it to offer a range of securities, including ordinary shares, preference shares, debt instruments, and warrants. This move gives the company flexibility for potential future capital raises, which tends to prompt investor curiosity about upcoming growth plans.

See our latest analysis for Bit Digital.

The recent shelf registration adds to an already eventful period for Bit Digital. With the share price gaining 34.6% over the past 90 days and up 17.3% year-to-date, momentum has definitely picked up. While its 1-year total shareholder return stands at a modest 2.8%, the three-year figure is a stellar 235.8%, reflecting the company’s evolving crypto and AI strategy. The market’s response suggests investors are taking the potential for new growth seriously, especially as Bit Digital pivots towards Ethereum, strengthens its role in HPC-AI infrastructure, and benefits from an undervalued stake in WhiteFiber.

If the latest developments have you wondering what other fast-moving companies are out there, now’s an ideal time to discover fast growing stocks with high insider ownership

But with analyst price targets far above the current share price and momentum building, is Bit Digital trading below its true value, or is the recent optimism already reflected, leaving little room for buyers to capitalize?

Advertisement

Most Popular Narrative: 35.8% Undervalued

With Bit Digital closing at $3.66, the most widely followed fair value narrative points to a target price well above current levels. The substantial gap indicates expectations for meaningful future growth, setting the stage for a closer look at why sentiment is this bullish.

Monetizing the WhiteFiber stake provides nondilutive capital, allowing agile ETH expansion and positioning the company as a premium, yield-generating platform for Ethereum investors. However, Bit Digital’s shift to an Ethereum staking model increases concentration, counterparty, regulatory, and dilution risks, which could potentially limit growth, margins, and long-term shareholder value.

What’s behind this ambitious price target? Tucked away in the full narrative are blockbuster projections for revenue growth, margin highs, and sharp profitability swings—all driving this value judgment. Eager to see what assumptions are fueling this bold forecast? Read on to uncover which strategic pivots and risk-reward tradeoffs justify the optimism.

Result: Fair Value of $5.70 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, risk remains if Ethereum prices stumble or if Bit Digital faces increased dilution from new share offerings. Both of these factors could limit upside.

Find out about the key risks to this Bit Digital narrative.

Another View: Multiples Challenge the Optimism

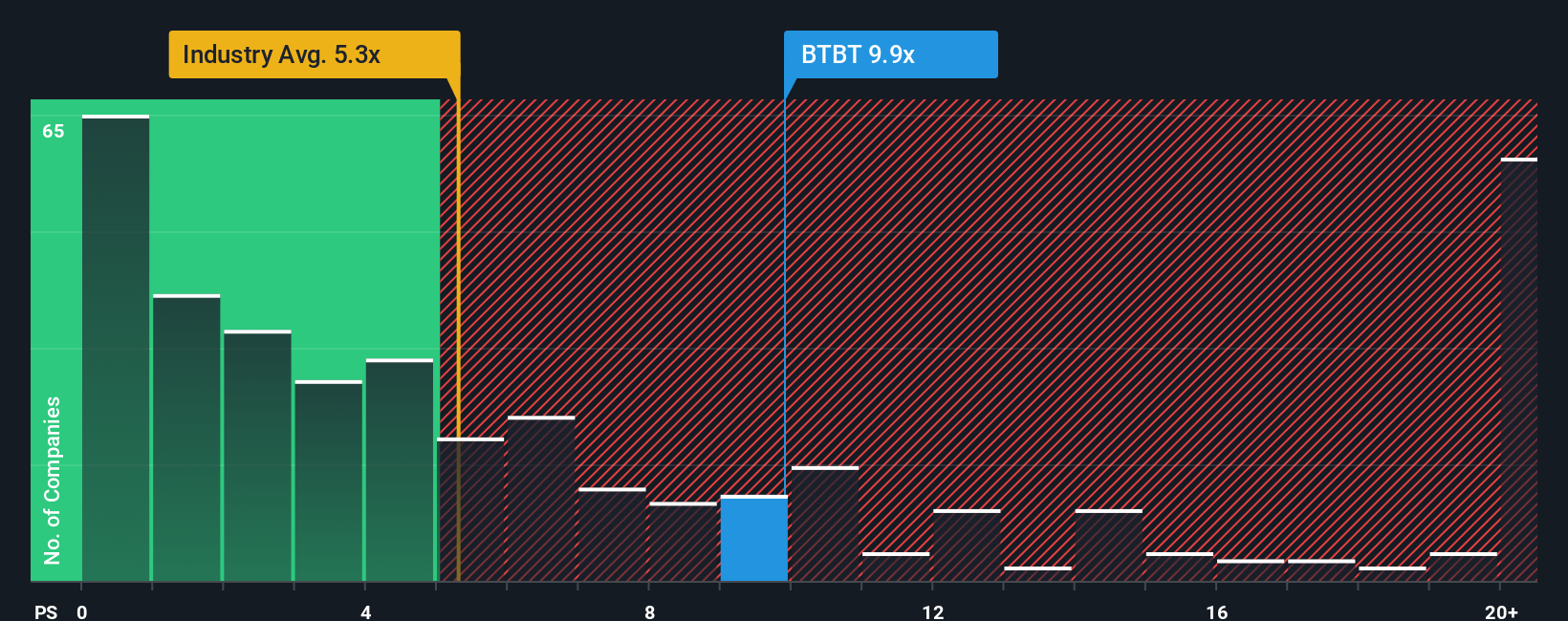

While fair value estimates appear attractive, a multiples analysis suggests caution. Bit Digital trades at a price-to-sales ratio of 12x, which is much higher than the US software industry average of 5.2x and its peer group at 2.9x. The fair ratio is 10.8x, so unless the market closes this premium, investors may be taking on more valuation risk than it seems. Are the forecasts strong enough to make this price tag worthwhile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bit Digital Narrative

If you have a different take on Bit Digital or want to dive into the numbers yourself, you can craft your own narrative in just minutes: Do it your way

A great starting point for your Bit Digital research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Move quickly to catch the next wave of opportunities with these focused stock picks, hand-curated by the Simply Wall Street Screener. Don’t let standout investments pass you by while others take action.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post