Bit Digital CEO talks Bitcoin mining to Ethereum and AI Infrastructure

January 29, 2026

Bit Digital CEO Sam Tabar joined Steve Darling from Proactive to discuss his annual letter to shareholders, outlining a significant strategic shift that repositions the company away from bitcoin mining and toward Ethereum-based infrastructure and artificial intelligence compute assets as the core pillars of its business.

Tabar described 2025 as a pivotal transition year in which Bit Digital evolved into what it now calls a “strategic asset company.” Under this model, the company is focused on deploying, owning, and operating infrastructure assets rather than passively holding digital assets. As part of this transformation, Bit Digital exited bitcoin mining operations and consolidated its digital asset exposure around Ethereum, while simultaneously expanding its presence in AI infrastructure through its ownership stake in WhiteFiber.

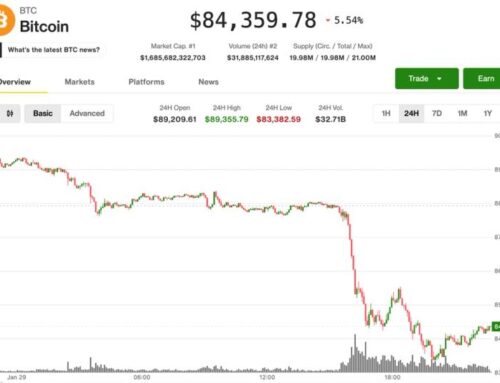

In the shareholder letter, Tabar explained that bitcoin mining had become a less efficient use of capital compared with opportunities that offer recurring yield and greater operational leverage. The decision to exit mining reflects a broader move toward more flexible and durable infrastructure investments, while maintaining the company’s long-term conviction in digital assets as a foundational technology.

Ethereum has emerged as Bit Digital’s primary economic infrastructure exposure. The company reported holding more than 150,000 ETH as of the third quarter, with the majority of those holdings staked to generate protocol-native rewards. This approach allows Bit Digital to earn yield while maintaining liquidity and adhering to institutional-grade custody and risk management standards.

Alongside its Ethereum strategy, Bit Digital emphasized its commitment to artificial intelligence infrastructure through WhiteFiber, which the company views as a long-term strategic asset. Tabar pointed to structural constraints in power availability, data center capacity, and construction timelines as key factors supporting sustained demand for AI compute, positioning WhiteFiber to benefit from long-duration growth trends.

To support its strategic transformation, Bit Digital completed an unsecured convertible note offering, which Tabar described as an innovative financing structure within the digital asset sector. The transaction allowed the company to raise capital at a premium to underlying asset value while preserving balance sheet flexibility and avoiding near-term dilution.

Looking ahead to 2026, Tabar said Bit Digital is moving from transformation to execution, with a focus on strengthening its ability to self-fund growth through durable cash flow generation while maintaining financial flexibility. While current returns remain linked to broader market performance in Ethereum and WhiteFiber, the company plans to pursue differentiated value creation through disciplined operational execution and strategic capital allocation.

#proactiveinvestors #bitdigitalinc #nasdaq #btbt #bitcoin #ShareholderLetter #Ethereum #ETHStaking #AIInfrastructure #WhiteFiber #DigitalAssets #StrategicAssets #CryptoInfrastructure #AICompute #BlockchainTechnology #CapitalAllocation #FinTech #Web3

Search

RECENT PRESS RELEASES

Related Post