Bitcoin and Ethereum Brush Off War Fears as Risk-On Sentiment Returns

June 23, 2025

Despite ominous headlines out of the Middle East and escalating rhetoric between the U.S. and Iran, Bitcoin, Ethereum and broader risk assets are sending a clear message: markets aren’t buying into the doomsday narrative.

After a volatile weekend that saw the U.S. strike Iran nuclear locations, leading to Iran launching retaliatory missile strikes on U.S. military bases in the Gulf—including Qatar and the UAE, though notably with no casualties—Bitcoin briefly dipped to $99,500. The first time Bitcoin had dropped below 100K since May.

But by the time Wall Street opened on Monday, the crypto bellwether had snapped back, rallying 2.9% to reclaim the $102,400 level.

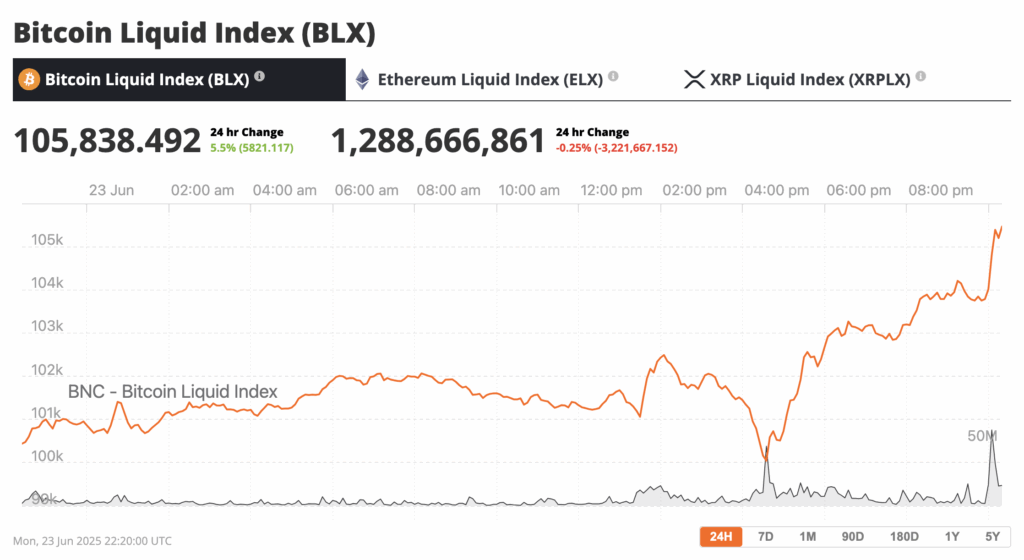

By Monday night, Bitcoin had jumped to nearly $106,000, it’s now up over 5.5% on the day, according to Brave New Coin data. Ethereum meanwhile, was up 10% on the daily, to $2,430.

Bitcoin jumped back to near $106,000, spending almost no time under $100,000, Source: BNC Bitcoin Liquid Index

Gold & Oil Buck the Trend

This move higher wasn’t isolated to crypto. U.S. stocks also surged, ignoring geopolitical tremors. In fact, safe-haven assets like gold and oil bucked the conventional script: gold barely moved, and crude oil actually fell 4%—a counterintuitive drop given Iran’s threat to close the Strait of Hormuz, a vital chokepoint for 20% of the world’s oil and gas supply.

“If we told you Iran’s Parliament would vote to close Hormuz and oil would go down, you’d think we were nuts,” quipped The Kobeissi Letter on X. “But that’s exactly what happened.”

Current Conflict Regionally Contained

This unexpected market resilience signals that investors overwhelmingly believe the current conflict will be short-lived and regionally contained.

Prediction market Polymarket’s odds that Iran will close Hormuz have fallen to 11% after touching 50% just a day ago, Source: Polymarket

Crypto traders, too, appear unshaken. Popular analyst Crypto Caesar told followers, “Bitcoin is holding strong for now. This week is shaping up to be very interesting.” Technical traders like Merlijn pointed to a clean inverse head-and-shoulders reversal forming on BTC/USD—a bullish chart pattern. He wrote Bitcoin is following the script. 2024: New ATH → Retest → Explosion 2025: New ATH → Retest → ??? The next vertical move could be closer than you think. History is loading. Don’t get caught chasing.

Will Bitcoin history repeat? Is a new Bitcoin all-time high imminent? Source: X

Meanwhile, derivatives data shows growing optimism. Trading firm QCP Capital noted that while put skew remains elevated into September, frontend volatility is compressing—a classic sign that traders are pricing out wider contagion risk. “US stock futures, oil, and gold initially reacted to the headlines but have retraced to Friday levels,” QCP added, suggesting investors see this as a regional flare-up, not a full-blown global crisis.

Bitcoin’s bounce also came off a key technical level: $98,000, roughly the average cost basis for short-term holders. From a market structure perspective, this bounce near strong support reinforces the idea that the worst may be behind us—for now.

Adding a final bullish kicker: the CME Bitcoin futures market opened the week with a substantial gap, which typically acts as a magnet for price. Trader Daan Crypto Trades flagged the gap near $104,000 as a likely near-term target. “Over half of that gap has already been filled,” he noted. “Historically, we see these gaps fill early in the week.”

In short, the market has spoken: this isn’t 2020, and Bitcoin is no longer just a risk asset—it’s a barometer of investor confidence. And right now, that confidence is saying one thing loud and clear: don’t panic, this too shall pass. If you’ve been asking when is the right time to buy Bitcoin, you have your answer. Buy and hold for a long-term time horizon. Bitcoin price predictions are already ramping up, if today’s bullishness can follow through, markets look good. For now, let’s hope that peace holds and calmer heads prevail.

Search

RECENT PRESS RELEASES

Related Post