Bitcoin and Ethereum in 2026: ChatGPT’s Bold Market Prediction

November 8, 2025

As the crypto market matures and institutional adoption accelerates, investors are already turning their attention toward 2026 – a year that could mark the peak of the next major bull cycle for digital assets.

Following the 2024 Bitcoin halving and significant regulatory progress across global markets, both Bitcoin (BTC) and Ethereum (ETH) appear positioned for strong long-term growth. While short-term volatility remains inevitable, the fundamental trends driving both assets point toward higher valuations and deeper integration within the traditional financial system.

Bitcoin: Post-Halving Momentum and Institutional Expansion

By 2026, Bitcoin may be entering the final stage of its next bull run, propelled by the supply shock caused by the April 2024 halving. Historically, each halving has reduced the daily issuance of new BTC, creating upward pressure on price roughly 18 to 24 months later. This timeline suggests that the end of 2025 through mid-2026 could align with another potential market top.

Institutional adoption continues to be a powerful catalyst. The introduction of spot Bitcoin ETFs has opened the asset class to traditional investors and corporate treasuries, providing sustained capital inflows. As global inflation cools and central banks begin to ease monetary policy, Bitcoin could benefit from renewed interest in scarce, non-sovereign assets.

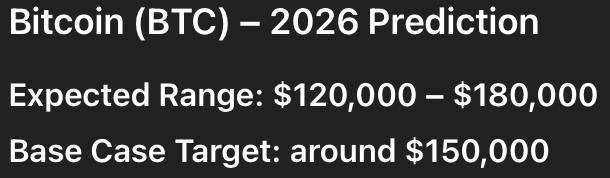

ChatGPT thinks that the price of Bitcoin might reach around $150,000 under typical market conditions, with a possible range between $120,000 and $180,000. In a more optimistic scenario – driven by growing institutional demand or global economic uncertainty — Bitcoin could potentially push beyond $200,000. However, ChatGPT also believes that if regulatory hurdles return or macroeconomic stress persists, the asset might consolidate in the $80,000–$100,000 zone instead.

Ethereum: Scaling the Next Frontier of Onchain Finance

According to ChatHPT Ethereum’s growth story remains centered on scalability, utility, and its evolving economic model. By 2026, Layer 2 solutions such as Arbitrum, Optimism, zkSync, and Base are expected to reach full maturity, dramatically increasing network throughput while lowering fees. This expansion will likely attract more real-world asset tokenization, institutional DeFi activity, and global adoption of Ethereum’s native asset, ETH.

Ethereum’s post-Merge transformation into a deflationary asset further strengthens its long-term appeal. The network’s fee-burning mechanism, combined with steady staking growth, continues to reduce circulating supply during high usage periods. As a result, ETH could become one of the most fundamentally sound assets in the digital economy.

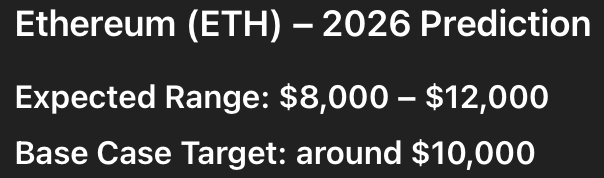

Based on these fundamentals, ChatGPT thinks that Ethereum’s price might hover around $10,000 as a base case in 2026, within a broader range of $8,000 to $12,000. In a bullish environment marked by strong institutional activity and wider onchain adoption, ChatGPT predicts ETH could rise above $15,000. On the other hand, if competition from faster blockchains intensifies or the market cools, ChatGPT estimates that Ethereum might settle closer to $5,000–$6,000.

Tags: Bitcoin Ethereum Layer 2 price scaling

Search

RECENT PRESS RELEASES

Related Post