Bitcoin and Gold Jump as Stocks Dip Amid US Government Shutdown

October 1, 2025

In brief

- Bitcoin rose above $117,000 and gold hit a new all-time high Wednesday, with both assets benefiting from safe-haven demand.

- Stocks fell after the U.S. entered its first government shutdown in nearly seven years, with the S&P 500 and Nasdaq each down about 0.5% upon open.

- The shutdown’s duration remains uncertain, echoing the record 35-day standoff in late 2018 that rattled markets significantly.

Popular stores of value like Bitcoin and gold jumped Wednesday, diverging from a spooked stock market that contracted in the wake of the U.S. government’s first shutdown in nearly seven years.

Bitcoin is up 3.6% in the last 24 hours, to $117,293 at writing, reaching its highest price in about two weeks. The token has spiked over 7% since Sunday.

Gold, meanwhile, soared to a new all-time high Wednesday morning above $3,922 per ounce, according to Yahoo Finance. It has remained closed to the mark, recently priced at $3,902 per ounce—up 4.6% in the last week.

Those bullish moves contrast current sentiments in the traditional financial market, where prices slipped Wednesday following the U.S. government’s shutdown last night at midnight. The S&P 500 fell half a percentage point at market opening, to $6,658. The Nasdaq composite similarly dipped half a point to $22,530.

As of this writing, the major stock indices have pulled closer to even on the day.

It’s unclear as of yet how long the shutdown might last, or what impact it will have on America’s macroeconomic outlook. During government shutdowns, most federal agency functions grind to a halt, including the collection of key economic data.

The nation’s last shutdown, during President Donald Trump’s first term in late 2018, was the longest in U.S. history, spanning 35 days.

During that shutdown, in December 2018, the S&P shed more than 9%—the worst December on record since 1931.

Though Bitcoin has risen and fallen with the stock market historically, recent trends have indicated that the world’s top cryptocurrency may finally be decoupling with Wall Street, Eric Balchunas, a senior analyst at Bloomberg, told Decrypt.

“That’s good, because you want Bitcoin to move differently,” Balchunas said. “That will make it much more attractive to a whole set of big fish investors who are looking for something to further diversify their portfolios.”

The analyst noted Bitcoin was down much of last month as stocks rose—another good sign. Now, the token may be spiking in part due to expectations of an impending rate cut from the Federal Reserve—one that is “almost guaranteed” given the central bank’s recent change of heart, Balchunas said.

Should Bitcoin prove itself capable of moving independently of the stock market over the longer term, the upside for the cryptocurrency could be massive, Balchunas predicted.

“I think all you need is zero correlation for it to be really valued,” he said. “Gold is zero.”

Crypto market sentiment is currently bullish that Bitcoin will continue to surge in the relatively near term. A Myriad market puts the odds of BTC breaking another all-time price record and surging to $125,000 as overwhelmingly more likely (65% odds) than the token first falling to $105,000.

Editor’s note: This story was updated after publication with comments and additional details.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

How a California Clean Energy Program Became a Boon for Big Dairies

SWI Editorial Staff2025-10-01T11:32:24-07:00October 1, 2025|

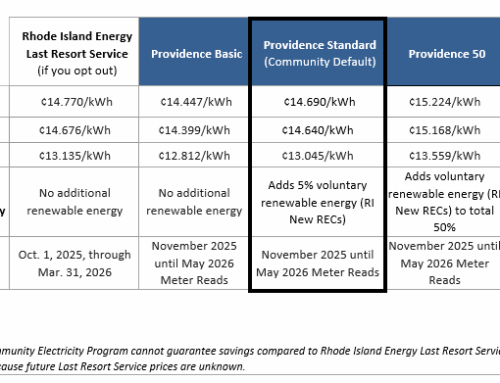

City of Providence Announces Winter Rates for Providence Community Electricity Program

SWI Editorial Staff2025-10-01T11:31:32-07:00October 1, 2025|

Amazon Signs Deal for Solar Energy to Power Data Centers in U.S.

SWI Editorial Staff2025-10-01T11:30:42-07:00October 1, 2025|

Blame Game: GOP spotlights ‘Schumer shutdown’ while Dems lash out at Republicans

SWI Editorial Staff2025-10-01T11:29:44-07:00October 1, 2025|

Amazon Prime members: You may be entitled to part of this $2.5 billion settlement

SWI Editorial Staff2025-10-01T11:29:13-07:00October 1, 2025|

A look at the new changes coming to Amazon Prime memberships

SWI Editorial Staff2025-10-01T11:28:34-07:00October 1, 2025|

Related Post