Bitcoin (BTC) Options Expiry Fuels Volatility Spike

December 26, 2025

Key Notes

- The rally is not yet confirmed, noting Bitcoin price must reclaim and hold above $90,500.

- In Q1 2026, BTC might break out of the compression phase, triggering 5-10% swings.

- The upside target remains $100,000 if resistance breaks, and the downside risk is toward $80,000.

.

Bitcoin price is once again showing volatility. On December 26, it spiked 1.63% to more than $89,100, only to hover around $88,500 later.

The latest bounce comes ahead of the $28 billion Friday options expiry. Experts believe that investors should stay vigilant at this point and watch for proper breakout signals before making a fresh entry.

Bitcoin Price Shows Strength Ahead of Options Expiry

Popular crypto analyst Ardi noted that the Bitcoin price move to $89,100 comes amid a major short-covering ahead of the Dec. 26 weekly and monthly options expiry. As per the analyst, the first leg of the upside was due to the closing of short positions.

However, the second leg of the upside shows strength and reflects genuine demand, with high-volume buyers stepping in. The daily trading volume for

BTC

$88 611

24h volatility:

1.3%

Market cap:

$1.77 T

Vol. 24h:

$37.73 B

has surged 36% to $30 billion, indicating bullish trader sentiment.

Bitcoin price surge | Source: TradingView

Despite the strong Bitcoin price action, Ardi cautioned that the move does not yet confirm a sustained bullish reversal. He noted that Bitcoin needs to reclaim and hold above the $90,500 level for a short-term upside.

From a broader technical perspective, Ardi believes the recent momentum would turn bullish only if Bitcoin regains the $94,000 level. Until then, he warned that the market remains vulnerable to a short-term rollover.

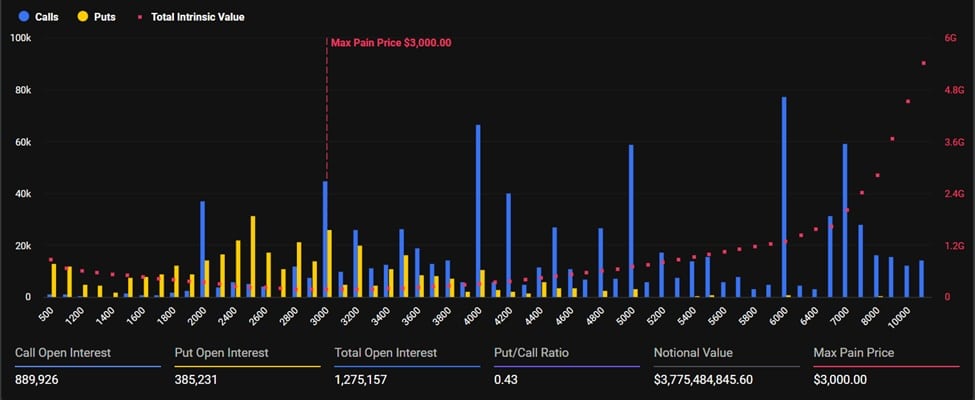

The analyst also highlighted elevated near-term volatility risks, noting that a record $23.7 billion (later corrected by media to $28 billion) in Bitcoin options is set to expire imminently. Large options expiries often lead to sharp price swings as traders reposition. This increases the chances of sharp moves in either direction.

Bitcoin options expiry | Source: Deribit

Bitcoin Price Prediction Today

Against investors’ expectations, 2025 has been disappointing, especially in Q4, with Bitcoin likely to end the year with negative returns. Market experts are now looking to BTC’s performance in Q1 2026 while hoping for a bounce back.

Crypto market analyst Daan Crypto Trades said the Bitcoin price is entering a compression phase that could lead to a decisive move in the coming weeks. According to the analyst, the ongoing compression increases the likelihood of a larger directional move.

He added that January could be a key period in determining Bitcoin’s next major trend. Daan highlighted $94,000 as a critical resistance level. A sustained breakout above this zone, he said, would likely open the door for a move back toward $100,000 and higher.

On the downside, the analyst warned that a breakdown below $80,000 would shift the outlook.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Author

Bhushan Akolkar

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

Search

RECENT PRESS RELEASES

Related Post