Bitcoin (BTC) Positioning Shift: From $140K Calls to $80K Puts

November 19, 2025

Bitcoin (BTC) Positioning Shift: From $140K Calls to $80K Puts

By Omkar Godbole|Edited by Sam Reynolds

Nov 19, 2025, 6:02 a.m.

- Bitcoin options have shifted from bullish to bearish, with puts now leading in open interest.

- Traders are increasingly buying put options for downside protection, with significant activity around the $80,000 strike for December.

- The price of bitcoin has dropped over 25% to $91,000 since Oct. 8.

Bitcoin BTC$90 319,47 options have flipped the script with a full 180-degree shift from last year’s uber bullish bets to a sharply bearish stance.

Since late last year, traders were aggressively chasing bullish moves by piling into call options at strikes of $100,000, $120,000, and $140,000 on Deribit. Up until recent weeks, the $140,000 call was the most popular on Deribit, with notional open interest (OI), or the dollar value of the active contracts, consistently above $2 billion.

STORY CONTINUES BELOW

Now, that’s changed. The $140,000 call’s open interest stands at $1.63 billion. Meanwhile, the $85,000 put has taken the lead with $2.05 billion in open interest. Puts at $80,000 and $90,000 strikes also now eclipse the $140,000 call.

Clearly, the sentiment has shifted decisively bearish, and not surprisingly so, as BTC’s price has collapsed over 25% to $91,000 since Oct. 8, CoinDesk data shows.

Put options give the purchaser the right, but not the obligation, to sell the underlying asset at a predetermined price at a later date. A put buyer is implicitly bearish on the market, looking to profit from or hedge against expected price slides in the underlying asset. A call buyer is bullish.

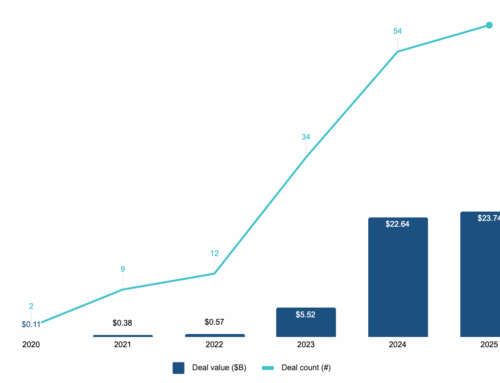

The chart shows the distribution of open interest in BTC options at various strike price levels across expiries. Clearly, OI is getting stacked at lower strike puts, the so-called out-of-the-money put options.

While the number of active calls is still notably higher than puts, the latter are trading at a significant premium (or skew), reflecting downside fears.

“Options reflect caution heading into year-end. Short-dated puts with strikes at $84K to $80K have seen the largest trading volumes today. Front-end implied volatility sits around 50%, and the curve shows a heavy put skew (+5%-6.5%) for downside protection,” Deribit Chief Commercial Officer Jean-David Pequignot said in an email.

Options activity on decentralized exchange Derive.xyz paints a similar bearish picture, with the 30-day skew falling to -5.3% from -2.9%, a sign of traders increasingly paying up for downside insurance, or put options.

“Looking ahead to year-end, there’s now a sizeable concentration of BTC puts building around the December 26 expiry, particularly at the $80K strike,” Dr. Sean Dawson, head of research at leading onchain options platform Derive.xyz, told CoinDesk.

With ongoing concerns about the resilience of the U.S. job market and the probability of a December rate cut slipping to barely above a coin toss, there’s very little in the macro backdrop giving traders a reason to stay bullish into the close of the year, Dawson explained.

While the path of least resistance appears to be on the downside, the selling may soon run out of steam as technical indicators point to oversold conditions and sentiment is at bearish extremes.

“With a Fear & Greed index around 15 and an RSI nearing 30 (oversold but not yet extreme), whale wallets (>1,000 BTC) have increased notably in the past week, hinting at smart-money accumulation at undervalued levels,” Pequignot said.

“Overall, downside fears are justified in the short term and the path of least resistance remains lower for now, but extreme setups like this have rewarded the bold in crypto’s past,” he added.

Больше для вас

Автор CoinDesk Research

14 нояб. 2025 г.

Что нужно знать:

- As of October 2025, GoPlus has generated $4.7M in total revenue across its product lines. The GoPlus App is the primary revenue driver, contributing $2.5M (approx. 53%), followed by the SafeToken Protocol at $1.7M.

- GoPlus Intelligence’s Token Security API averaged 717 million monthly calls year-to-date in 2025 , with a peak of nearly 1 billion calls in February 2025. Total blockchain-level requests, including transaction simulations, averaged an additional 350 million per month.

- Since its January 2025 launch , the $GPS token has registered over $5B in total spot volume and $10B in derivatives volume in 2025. Monthly spot volume peaked in March 2025 at over $1.1B , while derivatives volume peaked the same month at over $4B.

Больше для вас

Автор Sam Reynolds

3 часа назад

Market observers note stable XRP/BTC and ETH/BTC ranges and an unusually balanced top-20 ranking, signaling fundamentals-driven dispersion rather than a broad alt season.

Что нужно знать:

- Bitcoin’s recent slide under $90,000 did not trigger the usual deep correction behavior, indicating a shift from a liquidity-driven to a fundamentals-driven market.

- Tokens with clear utility, staking, or institutional demand are maintaining their value, while speculative assets face pressure.

- Asia-Pacific markets showed mixed results, with Japan’s Nikkei 225 rising 0.5% despite Wall Street’s tech-led declines.

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

Videos -

Back to menu

-

Back to menu

-

Back to menu

Webinars

Select Language

Search

RECENT PRESS RELEASES

Related Post