Bitcoin (BTC) Price Prediction: Analysts Suggest Bitcoin Could Hit $201K Median Target Aft

October 2, 2025

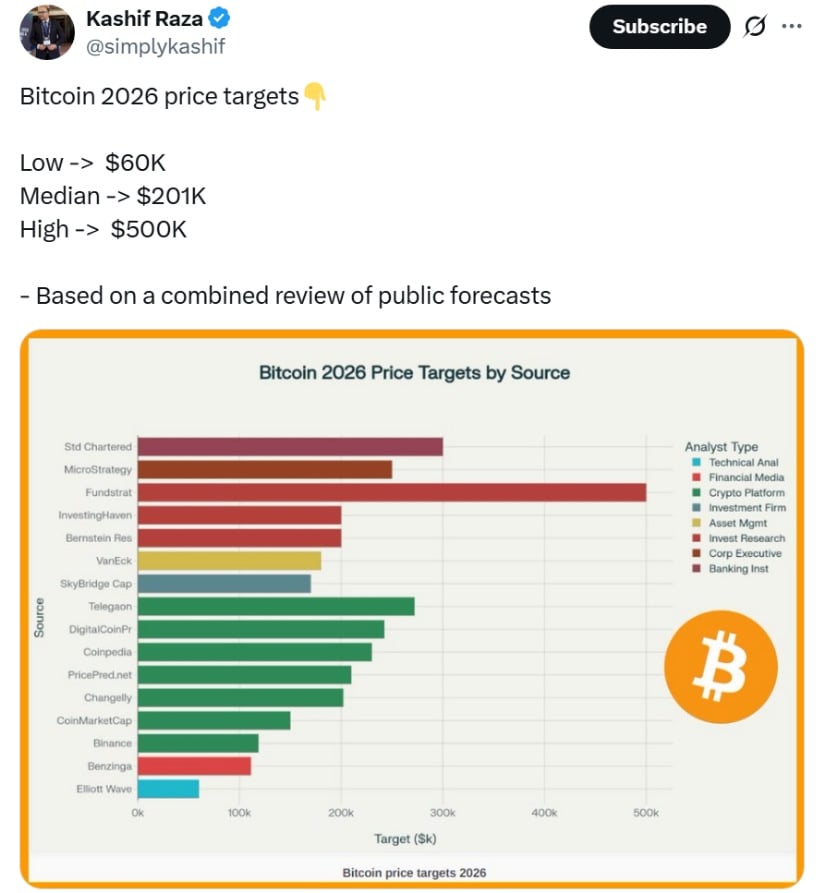

A new aggregation of forecasts from 16 crypto and financial analysts suggests that Bitcoin (BTC) could target a median price of $201,000 for 2026, highlighting both optimism and wide uncertainty in the market.

The compilation, spearheaded by crypto analyst Kashif Raza, presents a range of analyst targets running from $75,000 (via Elliott Wave projections) up to $450,000 (per Fundstrat forecasts). According to Raza’s summary, the median of all forecasts sits at $201K.

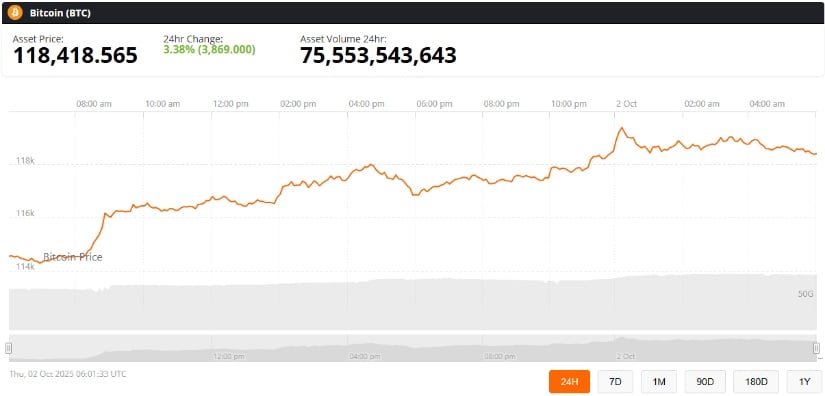

This outlook arrives amid a broader debate about Bitcoin’s post-halving trajectory and resonates with ongoing price momentum as bitcoin price today hovers near $118,500 (on October 2, 2025) — implying a potential upside of roughly 69 %.

Analyst Forecasts Reflect Broad Divergence

The wide variety in predictions underscores Bitcoin’s volatility and how diverging methodologies lead to dramatically different outcomes. Some platforms lean conservative, while others adopt aggressive valuations grounded in institutional flows and macro themes.

Bitcoin’s 2026 price forecasts range from $60K to $500K, with a median target of $201K based on aggregated public analyst projections. Source: Kashif Raza via X

Raza’s report visually clusters forecasts into groups—crypto exchanges, research firms, banks—to highlight differences in approach and risk tolerance.

Echoing this dispersion, a recent Reddit thread sparked debate over the “forecast gap” between bullish and cautious analysts, reinforcing that bitcoin predictions remain far from consensus.

Why Halving Matters: Historical Lifts, Then Headwinds

Historical Post-Halving Gains

Bitcoin halvings—events that reduce the new supply of BTC rewarded to miners—have historically preceded sharp price rallies. For example:

- After the 2012 halving, Bitcoin soared over 8,000 % within a year, fueled by adoption and media attention.

- The 2016 halving led to a more gradual ramp but still culminated in the 2017 bull cycle, where prices multiplied about 30x from the halving day to peak.

- Following the 2020 halving, with macro tailwinds and stimulus, BTC rose roughly 567 % in the first year.

These cycles lend weight to the idea that supply-side constraints, coupled with demand, can produce outsized returns.

Bitcoin (BTC) was trading at around $118,418, up 3.38% in the last 24 hours at press time. Source: Bitcoin Price via Brave New Coin

The 2024 Halving and Mixed Start

The 2024 halving, however, had a rocky start. Some analysts labeled the initial months as the “worst-ever” post-halving stretch, citing early declines and ETF outflows. Over time, though, Bitcoin regained strength, climbing approximately 86% to approach $119,000 (as of October 2025).

This recovery suggests that key price surges may come later—potentially during late 2025 or into 2026—if historical post-halving patterns persist.

Market Momentum: Uptober and Macro Tailwinds

Strong Q4 Start

In October 2025, Bitcoin’s momentum appears reinforced. Rising above $118,000, BTC initiated what many market watchers call an “Uptober” rally—October’s historically strong performance window for crypto assets.

Analysts point to factors such as dollar weakness (amid a U.S. government shutdown), rising ETF demand, and positive seasonal trends. Some experts expect October and Q4 to deliver strong gains, citing historical averages.

October has historically been Bitcoin’s strongest month, with post-halving years typically delivering gains of 40% or more. Source: Mark Harvey via X

On-Chain Signals and Liquidity

New data indicates that the Stablecoin Supply Ratio (SSR) is flashing “buy”—a sign that stablecoin liquidity is poised to fuel crypto inflows.

At the same time, long-term BTC holders continue to accumulate, now holding over 298,000 BTC in accumulation addresses—another bullish signal according to on-chain analysis.

These metrics suggest that some of the infrastructure and sentiment needed for a sustained rally may already be building.

Risks & Caveats: No Guarantees in Crypto

While historical patterns and current indicators align around the possibility of a strong bull cycle, skepticism is warranted.

- Regulatory uncertainty remains a top risk. Changes in U.S. or global policy toward cryptocurrencies, taxation, or exchanges could dampen investor enthusiasm.

- Macro variables—interest rates, inflation, geopolitical stress—can override crypto fundamentals, as seen in prior drawdowns.

- As charts mature, the magnitude of gains seen in early cycles may compress. In other words, as bitcoin market cap rises and adoption deepens, returns could moderate even during bullish phases.

Looking Ahead: $201K as a Symbolic Benchmark

Analysts pinning a $201K median target are not signaling certainty, but painting a scenario grounded in combined sentiment, models, and optimistic macro assumptions. The aim is not precision, but a reference point—something that captures both ambition and caution in the 2026 outlook for bitcoin price forecast.

As market conditions evolve in Q4 2025 and beyond, that median will face stress tests. Whether BTC can rally from ~$118K toward that symbolic number will depend on continued adoption, regulatory clarity, and macro stability.

Search

RECENT PRESS RELEASES

Related Post