Bitcoin ‘Death Cross’ Could Signal Decline Is Hitting Bottom

November 16, 2025

After a bad week, bitcoin could be headed into “death cross” territory.

That’s according to a report Sunday (Nov. 16) by Coindesk, which says that phrase is a technical analysis term that could denote signs of a bearish market, as it reflects waning short-term momentum compared to longer trends.

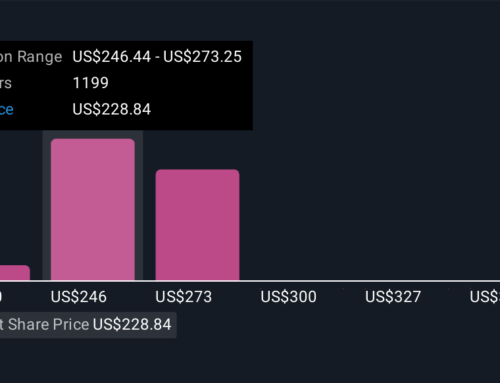

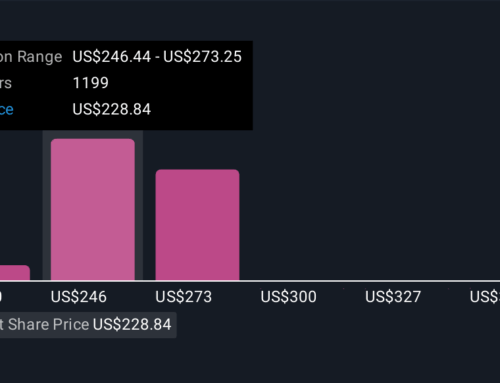

However, the report added, a death cross can also serve as a positive signal. Bitcoin is down around 25% from its record high of $126,000 in October. This would mark the fourth death cross since the cycle started in 2023, with each past instance lining up with “major local bottoms,” as Coindesk described it.

Previous bottoms came in September 2023 ($25,000), August 2024 ($49,000) and April of this year, fueled by uncertainty tied to U.S. tariff policy ($75,000).

This time, bitcoin has dropped to $94,000 and in all four past instances the market put in its low just ahead of the death cross, which Coindesk says raises the question of whether the same pattern may be happening again.

Bitcoin was down nearly 9% throughout last week, a decline triggered in part by investors selling cryptocurrency in response to a pullback in Big Tech stocks, as many of the crypto investors also have interests in tech companies.

Advertisement: Scroll to Continue

Those stocks had been sliding recently due to concerns about companies’ spending on artificial intelligence (AI). Days after bitcoin’s October record, the token suffered the biggest liquidation event in digital asset history, fueled by a surprise tariff announcement from the White House.

In other digital assets news, PYMNTS wrote last week about the potential limitations of blockchain-based payments.

As that report noted, there is an ongoing industry narrative that once blockchain hits a critical mass of adoption in one area — whether that is cross-border transfers, merchant payments or remittances — its utility will naturally bleed into adjacent domains.

“However, the payments industry is deeply heterogeneous, and the challenges that blockchain can solve in one vertical may not translate neatly to others,” the report added.

“Looking ahead, it is entirely plausible that blockchain payments could expand through a series of vertical footholds rather than a broad-based platform expansion. Each foothold may be defined by specific economic pain points, like invoice reconciliation, loyalty point settlement, corporate treasury netting and tax operation, rather than general-purpose transactions.”

Search

RECENT PRESS RELEASES

Bitcoin Crashes Back to Earth as Trump Tariffs Trigger $30K Meltdown

SWI Editorial Staff2025-11-17T10:24:43-08:00November 17, 2025|

Bitcoin Crashes Back to Earth as Trump Tariffs Trigger $30K Meltdown

SWI Editorial Staff2025-11-17T10:24:24-08:00November 17, 2025|

Why Bitcoin Could Hit $150,000 in 2026

SWI Editorial Staff2025-11-17T10:23:57-08:00November 17, 2025|

Why Bitcoin Could Hit $150,000 in 2026

SWI Editorial Staff2025-11-17T10:23:45-08:00November 17, 2025|

Tom Lee Calls for 100x Ethereum ‘Supercycle’ Like Bitcoin as BitMine Adds More ETH

SWI Editorial Staff2025-11-17T10:23:25-08:00November 17, 2025|

Tom Lee Calls for 100x Ethereum ‘Supercycle’ Like Bitcoin as BitMine Adds More ETH

SWI Editorial Staff2025-11-17T10:23:12-08:00November 17, 2025|

Related Post