Bitcoin, Ethereum ETFs Add $3.4 Billion in Major Comeback Week

April 28, 2025

In brief

- Investors poured $3.4 billion into digital asset investment products last week, according to CoinShares research.

- A week before, year-to-date inflows stood at just $171 million after a sustained period of outflows.

- Bitcoin accounted for 93% of last week’s inflows.

Investors poured $3.4 billion into digital asset investment products last week, snatching up shares in spot Bitcoin exchange-traded funds as weeks of tariff-fueled turmoil subsided, according to a report from crypto asset manager CoinShares.

It was the third best week of all time for crypto funds, including those that track popular altcoins, such as Ethereum, Solana, and XRP. A week before, year-to-date inflows stood at just $171 million after a sustained period of outflows.

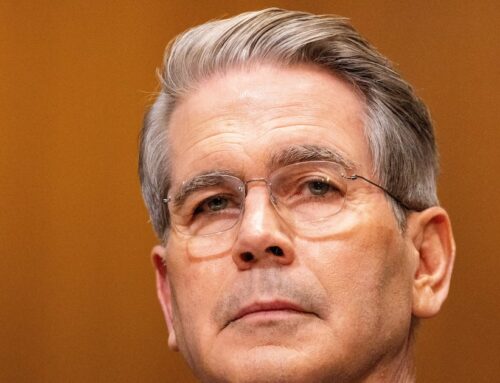

“We’re now at $3.5 billion, recovering from close to zero at one point,” CoinShares Head of Research James Butterfill told Decrypt. “It’s cautiously optimistic, I’d say.”

Bitcoin, which climbed above $95,000 last week for the first time since U.S. President Donald Trump unveiled “reciprocal” tariffs, accounted for 93% of last week’s inflows, followed by Ethereum and XRP, which attracted $183 million and $31 million, respectively.

Although crypto funds are rebounding with one of their best weeks on record, Butterfill said year-to-date inflows stood at $7.4 billion at one point this year, suggesting that at least one more week of blockbuster inflows would be needed to put adoption trends fully back on track.

Using a so-called basis trade, institutions can capitalize on the difference between an asset’s spot price and its price in the futures market. There are signs that institutional participation has increased in that regard for Bitcoin, Butterfill said, but it’s been a modest increase recently.

With the asset trading hands well above where it was on April 2—when Trump threatened to impose tariffs on most countries—it appears institutions are taking a back seat, as individual investors push forward with allocations, Butterfill added.

Last year, crypto funds pulled in $29 billion, with the approval of spot Bitcoin ETFs in the U.S. largely driving that historic performance. But as Trump’s tariffs stoke uncertainty about the global economic outlook, it’s unclear whether last year’s breakneck pace can persist.

Butterfill said that the public will get a better sense of where Wall Street stands when institutional investment managers file their next round of 13F filings in mid-May, which will make their recent investment activities and holdings more transparent.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

Here’s where investors sought income and performance in January

SWI Editorial Staff2026-02-04T12:31:06-08:00February 4, 2026|

CANNABIS MARKET UPDATE JANUARY 2026 – A New Year and New Hope ?

SWI Editorial Staff2026-02-04T11:33:26-08:00February 4, 2026|

Trump Administration Is Delaying Hundreds of Wind and Solar Projects

SWI Editorial Staff2026-02-04T11:25:44-08:00February 4, 2026|

TotalEnergies Inks Deal with SWM for 10-Year, 800 GWh Renewable Energy Deal

SWI Editorial Staff2026-02-04T11:24:48-08:00February 4, 2026|

Puget Sound Energy Expands Community Solar Program

SWI Editorial Staff2026-02-04T11:24:04-08:00February 4, 2026|

Amazon Pulls ‘Melania’ From Movie Theater Due to Jokes on Its Marquee

SWI Editorial Staff2026-02-04T11:23:14-08:00February 4, 2026|

Related Post