Bitcoin, Ethereum Rise As Short Liquidations Fuel Late-Session Bounce

December 30, 2025

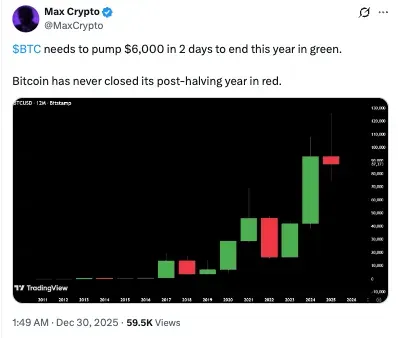

Bitcoin might need nearly $6,000 inflow to end this year in green, some market watchers have pointed out.

- In the past 24 hours alone, $138.6 million in crypto positions have been liquidated on derivatives markets.

- Bitcoin and Ethereum accounted for a bulk of the liquidations, with most altcoins in green except Cardano.

- While Cardano’s price was down, retail sentiment on Stocktwits around the token was in ‘bullish’ territory over the past day.

Cryptocurrency markets experienced a notable upswing on Tuesday night, with both Bitcoin and Ethereum seeing gains. A wave of short liquidations across the market significantly aided this upward movement.

Bitcoin (BTC) was trading around $88,470, gaining 1.4% over the previous 24 hours. By liquidation volume, BTC saw approximately $45.9 million worth of total liquidations, with shorts contributing the lion’s share, amounting to $30.5 million, according to Coinglass data. Retail sentiment on Bitcoin was in the ‘bearish’ territory on Stocktwits, though chatter increased from ‘low’ to ‘normal’ over the past day.

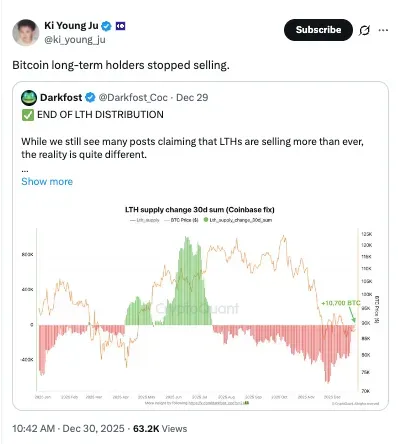

Some market watchers believe that if Bitcoin still retains its larger bull-market structure, the present cycle could be in a rally, as the asset’s long-term holders have stopped selling, indicating a bullish sentiment. However, some have pointed out that Bitcoin would need to see nearly $6,000 in inflows to end this year in the green.

Ethereum (ETH) was also up, trading around $2,972 and rising roughly 1.2% over the past 24 hours. ETH saw about $39.3 million in liquidations in total, once again skewed heavily toward shorts at $25.9 million versus longs at $13.4 million – possible evidence that the move was structurally driven by leverage rather than a decisive shift in trend. Retail sentiment around Ethereum remained in ‘bearish’ territory on Stocktwits, with chatter staying at ‘low’ levels over the past day.

Cardano (ADA) underperformed the rest of the crypto majors, falling to around $0.351 after dropping 0.1% over 24 hours. Liquidations came in at approximately $0.26 million and were primarily long-lead. Retail sentiment around Cardano stayed in ‘bullish’ territory on Stocktwits, though chatter cooled from ‘high’ to ‘normal’ levels over the past day.

Solana (SOL) was among the best performers from the large-cap segment, hovering around $125.30, up around 1.5% in the last 24 hours. Liquidations amounted to around $3.9 million, with shorts edging out longs slightly. Retail sentiment around Solana was in the ‘bearish’ territory, improving from the ‘extremely bearish’ zone on Stocktwits, although chatter increased to ‘normal’ from ‘low’ levels over the past day.

Ripple’s XRP (XRP) traded 0.8% higher for the day at around $1.87. Liquidations were relatively muted at around $0.74 million, but short positions ruled the day as incremental bearish exposure was flushed out. Retail sentiment around Ripple was in ‘extremely bearish’ territory on Stocktwits, while chatter remained at ‘normal’ levels over the past day.

Binance Coin (BNB) climbed to roughly $859, adding 0.8%. Liquidations were relatively small, less than $0.1 million, indicating that the move was predominantly spot-based, with only minor leverage participation. Retail sentiment around Binance Coin was in ‘bullish’ territory on Stocktwits, with chatter at ‘normal’ levels over the past day.

Dogecoin (DOGE) traded around $0.123, flat on the day. DOGE saw roughly $0.79 million of liquidations, lopsidedly on the long side, suggesting further de-risking in the meme-coin space. Retail sentiment around Dogecoin was in ‘bullish’ territory on Stocktwits, with chatter at ‘normal’ levels over the past day.

TRON (TRX) traded at around $0.2855, up 0.2%, with marginal liquidations, which showed low speculative interest. On Stocktwits, retail sentiment around Tron shifted from ‘bearish’ toward ‘neutral’ territory, while chatter remained at ‘low’ levels over the past day.

The total liquidation stood at $138.6 million in the last 24 hours, with Bitcoin leading the rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com

Search

RECENT PRESS RELEASES

Related Post