Bitcoin falls under $102K: Analysts say BTC is ‘underpriced’ based on fundamentals

November 4, 2025

Key takeaways:

-

Bitcoin’s decline mirrors Nasdaq weakness but lacks a fundamental justification.

-

Spot BTC ETF inflows have cooled but remain net positive, showing resilient investor demand.

-

Stablecoin liquidity and onchain accumulation suggest conditions for a rebound.

Bitcoin (BTC) extended its decline to $100,800 on Tuesday, dropping 10%+ this week and mirroring the Nasdaq 100 futures’ 1.67% drop as risk assets came under pressure. Historically, when the Nasdaq falls by more than 1.5% in a single day, Bitcoin has a 75% probability of posting a negative return, averaging a decline of –2.4%, according to data from EcoinBitcoin-Nasdaqitcoin Nasdaq correlation by Ecoinometrics. Source: X

Despite the macroeconomic drag, the analyst argued that Bitcoin’s price weakness isn’t fully justified by fundamentals. Financial conditions remain loose, and equity markets recently hit record highs.

“Bitcoin has been underpriced relative to the macro backdrop,” Ecoinometrics noted, emphasizing that the current dip appears more sentiment-driven than structural.

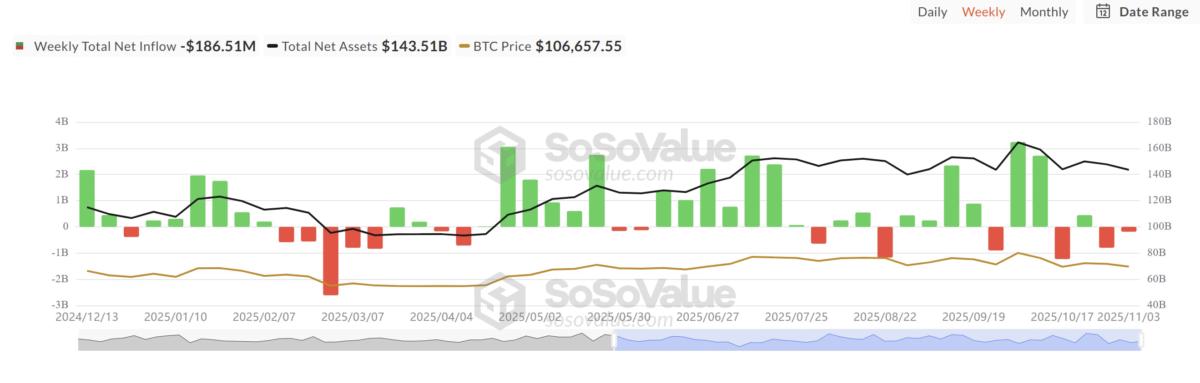

However, spot Bitcoin ETF inflows have slowed notably since early October. The first two weeks of Q4 generated over $5 billion in net inflows, while the past four weeks have seen cumulative outflows of approximately $1.5 billion. Although this shift suggests some cooling of demand, the overall net inflow balance remains positive, indicating that long-term investor appetite for BTC exposure remains resilient.

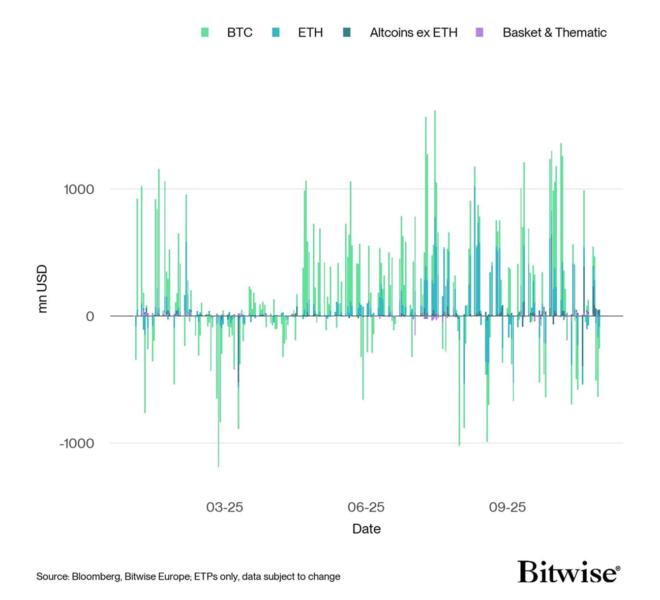

Globally, the slowdown has been echoed across crypto exchange-traded products (ETPs). Last week saw $246.6 million in net outflows from all crypto ETPs, largely driven by $752 million in Bitcoin outflows. Notably, the iShares Bitcoin Trust (IBIT) led with $403 million in outflows, while Grayscale’s GBTC saw $68 million exit.

Onchain metrics add nuance to the picture. Sell-side pressure has eased from $835 million to $469 million week-over-week, while long-term accumulation remains strong. Bitcoin whales sent modest inflows of around 4,900 BTC to exchanges, a sign of cautious repositioning rather than panic.

Exchange-held reserves fell to 2.85 million BTC, reinforcing the broader accumulation trend even as BTC trades below its 200-day moving average ($108,000) and short-term holder cost basis of $113,000.

Related: Bitcoin long-term holders offload 400K BTC: How low can BTC price go?

Bitcoin liquidity signals turning point

Data from CryptoQuant suggested that the Stablecoin Supply Ratio (SSR) has dropped back to the 13–14 range, the same zone seen before Bitcoin’s rebound earlier this year. Historically, this level has marked liquidity turning points, where increasing stablecoin balances signal rising “buying power” on the sidelines.

Currently, with Bitcoin trading at $101,800, the low SSR suggests that stablecoin liquidity is quietly building again, potentially setting the stage for a relief rally or the final bullish leg of this cycle.

However, each successive SSR rebound has grown weaker, suggesting that while another upside phase may still be possible, the market’s underlying liquidity momentum could be fading.

Related: Bitcoin price gets $92K target as new buyers enter ‘capitulation’ mode

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Search

RECENT PRESS RELEASES

Related Post