Bitcoin Mining Difficulty Hit Another All-Time High

September 20, 2025

Bitcoin’s mining difficulty — the measure of how hard it is to add a new block to the chain — just hit a record-smashing 142.3 trillion on Friday. That’s not just a number, it’s a signal: the arms race for hash power is accelerating, and the barrier to entry is climbing like never before.

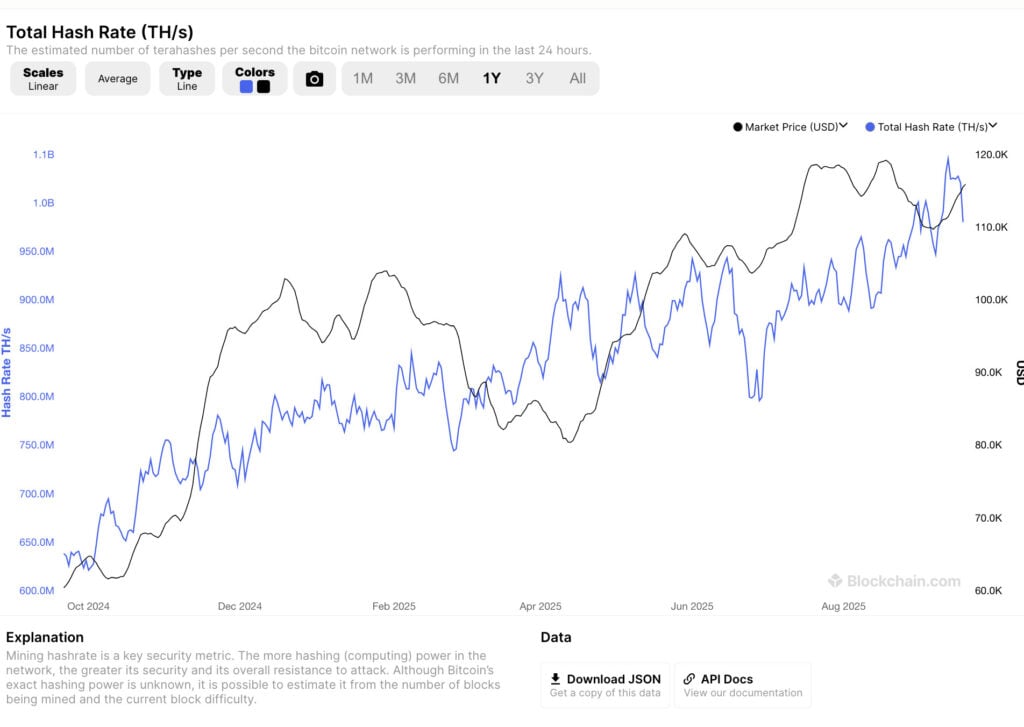

This milestone follows back-to-back all-time highs in August and September, powered by a flood of new rigs coming online. The network hashrate — the combined computing horsepower securing the Bitcoin protocol — also surged, crossing an eye-watering 1.1 trillion hashes per second, according to CryptoQuant.

On the surface, this looks bullish. More security, more resilience, more proof that Bitcoin isn’t going anywhere. But beneath the hood? It’s messy. The rise in difficulty makes life brutal for smaller operators and even mid-tier mining corporations. Industrial-scale farms and sovereign states are muscling in, while independent miners are getting pushed out. The narrative of Bitcoin as a decentralized, “anyone can join” network is colliding with harsh economic reality.

Bitcoin’s hash rate continues to climb, source: Blockchain

The Centralization Creep

Here’s the uncomfortable truth: Bitcoin mining is tilting toward centralization. Mining now demands energy-hungry, high-performance computing infrastructure that most individuals simply can’t afford. The players left standing are those with:

- Deep pockets (publicly traded mining firms).

- Access to subsidized or free power (read: governments).

- Control over the energy grid itself (increasingly, utilities).

Governments are no longer just regulators — they’re competitors. Bhutan, El Salvador, and even Pakistan have waded in, using cheap or surplus energy to mine Bitcoin. Pakistan, for example, earmarked 2,000 megawatts of surplus electricity for mining this year as part of a crypto-friendly policy shift. That’s the kind of advantage no retail miner can match.

Meanwhile, in Texas, the story is different but just as telling. Energy companies, working with ERCOT (the state’s grid operator), are weaving Bitcoin mining into grid-balancing operations. When demand is low, they fire up rigs to absorb the excess. When demand spikes, they shut them down instantly. This makes mining not just profitable, but strategically valuable — effectively turning Bitcoin into a pressure valve for the energy grid. And because these firms own the energy, their marginal cost is near zero. Compare that to a Nasdaq-listed miner paying through the nose for electricity contracts, and you see why Wall Street mining firms are getting squeezed.

The Big Picture

The mining boom is bullish for Bitcoin’s security, but it also highlights the concentration of power in the hands of governments and energy monopolies. The ideological dream of a truly decentralized, permissionless network is bumping up against industrial economics.

If this continues, we could see Bitcoin mining evolve into something closer to a geopolitical sport: nations, utilities, and corporations duking it out with terawatts of energy. It’s not quite the pleb-miner utopia Satoshi envisioned, but it’s the reality of Bitcoin at $115,000+ and counting.

The real question: when energy titans and governments dominate block production, does Bitcoin’s decentralization become more myth than reality?

Search

RECENT PRESS RELEASES

Related Post