Bitcoin Price Forecast: BTC retreats further as chances of major breakthrough in Russia-Uk

May 15, 2025

- Bitcoin price edges below $102,000 on Thursday after repeated rejections at the $105,000 resistance over the past five days.

- Neither US President Donald Trump nor Russian President Vladimir Putin are expected to attend the Ukraine-Russia peace talks in Turkey.

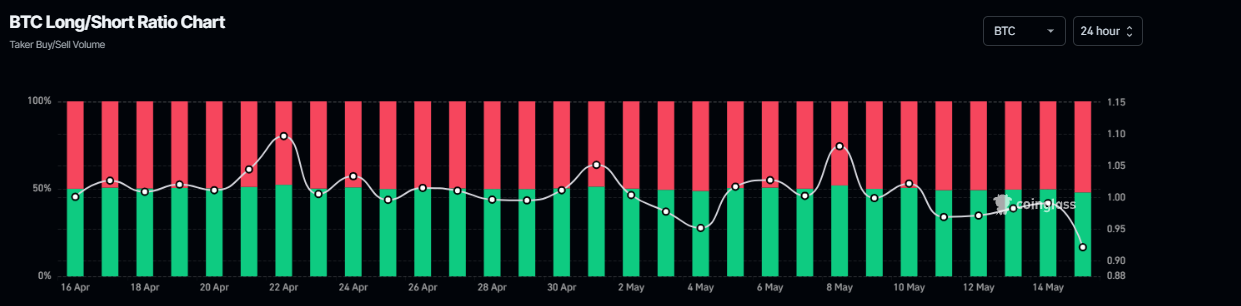

- Traders should be cautious as the BTC long-to-short ratio reaches its lowest level in a month, increasing bearish bets.

Bitcoin (BTC) price is edging below $102,000 at the time of writing on Thursday after repeated rejections at the $105,000 resistance over the past five days. Traders look towards Turkey, where Ukraine-Russia peace talks are held, although chances of a major breakthrough look dim as neither US President Donald Trump nor Russian President Vladimir Putin are expected to attend the meetings.

Russian President Vladimir Putin will not attend Thursday’s proposed peace talks between Russia and Ukraine in Turkey, Reuters reported. As for Trump, the US President said he would go to the talks on Friday “if it is appropriate.”

Russia will instead send a delegation led by presidential adviser Vladimir Medinsky and Deputy Defence Minister Alexander Fomin.

Ukrainian President Volodymyr Zelenskiy, who has firmly stated he would only engage directly with Putin, is expected to decide on Kyiv’s participation after a meeting with Turkish President Tayyip Erdogan later on Thursday. From the US, Secretary of State Marco Rubio and envoys Steve Witkoff and Keith Kellogg are expected to attend.

Ukraine has yet to officially confirm its presence or name a delegation, casting uncertainty over its response. The likelihood of talks yielding meaningful progress toward ending the Russia-Ukraine war is slim without top leaders.

However, any positive outcome could restore investor confidence, trigger a risk-on sentiment across markets, and drive up prices of risk assets like Bitcoin.

CoinGlass’s long-to-short ratio of the largest cryptocurrency by market capitalization reads 0.92, the lowest level in over a month. This ratio below one reflects bearish sentiment in the markets as more traders are betting on the Bitcoin price to fall.

BTC long-to-short ratio chart. Source: CoinGlass

However, the institutional demand returned after a slight outflow on Tuesday. According to SoSoValue, the US spot Bitcoin ETF has recorded an inflow of $319.56 on Wednesday after a mild outflow of $96.14 million the previous day. For the bullish momentum to be sustained, the inflows should continue and intensify to support the BTC price rally.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Bitcoin has failed to close above the $105,000 resistance level and has faced multiple rejections since Sunday. BTC recovered slightly on Tuesday, but failed to maintain its rebound and declined the next day. At the time of writing on Thursday, BTC edges below $102,000.

If BTC continues its correction, it could extend the decline to retest the psychological support level at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 64 and points downwards, giving a sell signal after slipping below its overbought level of 70. The Moving Average Convergence Divergence (MACD) indicator is also flipping to a bearish crossover on the daily chart. If the crossover consummates, it would give a confirmation of another sell signal.

BTC/USDT daily chart

However, if BTC recovers and closes above the $105,000 resistance level, it could open the door for a rally toward the all-time high of $109,588 set on January 20.

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin’s market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post