Bitcoin price: hits $93,000, ether tops $3,000 as Venezuela president Maduro in U.S. custo

January 4, 2026

Bitcoin price: hits $93,000, ether tops $3,000 as Venezuela president Maduro in U.S. custody

The rally in crypto was mirrored by a surge in commodities and Asian equities, driven by AI-led momentum and geopolitical developments.

Updated Jan 5, 2026, 5:02 a.m. Published Jan 5, 2026, 4:45 a.m.

- Bitcoin briefly reached $93,000 as traders embraced risk following the U.S. ousting of Venezuela.

- Major cryptocurrencies experienced gains, with XRP and Solana rising, while Dogecoin led with a 17% weekly increase.

- The rally in crypto was mirrored by a surge in commodities and Asian equities, driven by AI-led momentum and geopolitical developments.

Bitcoin BTC$92,410.29 briefly touched $93,000 on Monday as traders leaned into a fresh risk bid across markets following a U.S. ousting of Venezuela, while year-opening flows pushed major tokens higher after a choppy finish to 2025.

BTC traded up about 1% over 24 hours and roughly 3% over seven days, while ether ETH$3,153.26 held near $3,160, also higher on the day. XRP$2.1335 added around 3% to above $2.10, extending its early January outperformance, while solana SOL$135.72 hovered near $136. DOGE$0.1507 eased on the day but remained up 17% over the past week, the highest gains among majors.

STORY CONTINUES BELOW

Derivatives positioning amplified the move. Liquidations crossed $260 million over 24 hours, with shorts accounting for about $200 million, showing late sellers were forced to cover as prices pushed higher.

More than $121 million in short positions were wiped out in the past four hours alone, compared with less than $9 million in longs. Long liquidations remained comparatively modest throughout, pointing to a market where bearish leverage was crowded and vulnerable. On leading decentralized perpetual-focused platform Hyperliquid, shorts still accounted for roughly 54.4% of all liquidated positions versus 45.6% longs, according to HyperDash.

The BTC rally came alongside strength in risk assets and another surge in commodities. Asian equities climbed to a record as investors piled into technology shares, extending last year’s AI-led momentum. Brent crude steadied after early weakness tied to the Venezuela developments, while gold jumped sharply back above $4,400 an ounce and silver posted an even larger move.

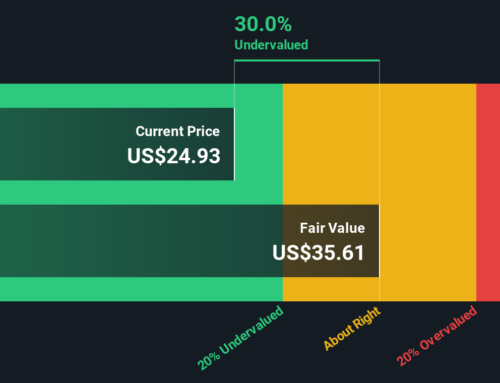

Traders said the start-of-year bid reflects a mix of positioning and relative value, with crypto still far below its peaks while other assets sit near records.

“We believe that in the new year, traders are jumping in to exploit price inefficiencies,” Jeff Mei, chief operating officer at BTSE, said in a Telegram message, noting cryptocurrencies remain well off their all-time highs as equities and precious metals keep printing new records.

A move in markets began over the weekend as the U.S. took Venezuelan president Nicolás Maduro was into custody, with Donald Trump signaling a

He also suggested U.S. troops on the ground would not be necessary as long as acting Venezuelan president Delcy Rodríguez “does what we want.”

More For You

Dec 22, 2025

KuCoin captured a record share of centralised exchange volume in 2025, with more than $1.25tn traded as its volumes grew faster than the wider crypto market.

What to know:

- KuCoin recorded over $1.25 trillion in total trading volume in 2025, equivalent to an average of roughly $114 billion per month, marking its strongest year on record.

- This performance translated into an all-time high share of centralised exchange volume, as KuCoin’s activity expanded faster than aggregate CEX volumes, which slowed during periods of lower market volatility.

- Spot and derivatives volumes were evenly split, each exceeding $500 billion for the year, signalling broad-based usage rather than reliance on a single product line.

- Altcoins accounted for the majority of trading activity, reinforcing KuCoin’s role as a primary liquidity venue beyond BTC and ETH at a time when majors saw more muted turnover.

- Even as overall crypto volumes softened mid-year, KuCoin maintained elevated baseline activity, indicating structurally higher user engagement rather than short-lived volume spikes.

More For You

By Omkar Godbole|Edited by Sam Reynolds

25 minutes ago

Bitcoin rose over 1% during Monday’s Asian trading session, marking a potential five-day winning streak.

What to know:

- Bitcoin rose over 1% during Monday’s Asian trading session, marking a potential five-day winning streak.

- The broader crypto market, including major cryptocurrencies like XRP, solana, and ether, also saw gains of up to 1%.

- Tax-loss selling has subsided, one analyst said explaining the upswing, while others attributed the uptick to haven demand.

-

Back to menu

-

Back to menu

Prices

-

Back to menu

-

Back to menu

Indices -

Back to menu

Research

-

Back to menu

Consensus 2026 -

Back to menu

Sponsored

-

Back to menu

-

Back to menu

Podcasts -

Back to menu

-

Back to menu

Webinars

Select Language

Search

RECENT PRESS RELEASES

Related Post