Bitcoin price news: BTC climbs above $70,000 as Bernstein makes bull case

February 9, 2026

Bitcoin price news: BTC climbs above $70,000 as Bernstein makes bull case

“What we are experiencing is the weakest bitcoin bear case in its history,” wrote Bernstein’s Gautam Chhugani.

By Helene Braun, Stephen Alpher|Edited by Stephen Alpher

Feb 9, 2026, 6:09 p.m.

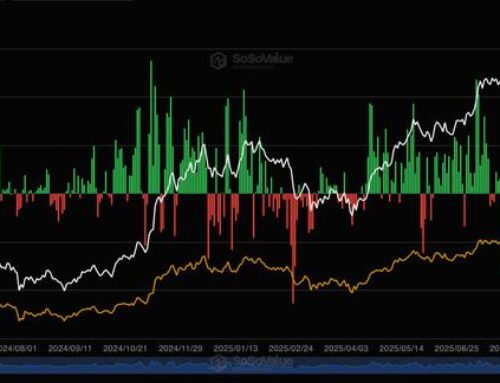

- In early afternoon U.S. trade, bitcoin has climbed more than 3% off of the day’s low to $70,800.

- Wall Street firm Bernstein reiterated its $150,000 year-end price target on BTC.

- Crypto-related stocks were higher across the board, led by a 14% gain for Bullish (BLSH) and an 8% advance for Galaxy Digital (GLXY).

Breaking a familiar pattern, bitcoin BTC$70 496,28 is on the rise during the U.S. session, climbing to $70,800 after falling to just above $68,000 earlier in the day.

Bitcoin is now higher by 0.5% over the past 24 hours, with ether ETH$2 121,39, XRP XRP$1,4471 and solana SOL$85,45 ahead closer to 1.5% over the same time frame.

STORY CONTINUES BELOW

Risk assets are generally in the green on Monday, with the Nasdaq up 1% and the S&P 500 up 0.5%. Gold is ahead 1.9% to $5,075 per ounce, and silver is up 7.4% to $82.50 per ounce.

“What we are experiencing is the weakest bitcoin bear case in its history,” wrote Bernstein’s Gautam Chhugani, reiterating the firm’s $150,000 year-end price target on bitcoin.

“When all stars are aligned, [the] Bitcoin community manufactures a self-imposed crisis of confidence,” Chhugani continued. “Nothing blew up, no skeletons will unravel; [the] media is back again to write an obituary.”

“Time,” said Chhugani, “remains a flat circle on Bitcoin.”

Getting a bit more technical, Schwab’s Jim Ferraioli said it is helpful to look to bitcoin miners to determine when the bottom is in.

“Previous selloffs have usually bottomed near bitcoin’s cost of production,” said Ferraioli. “Miners with less efficient equipment will often shut down operations temporarily … We can see this in real time by watching the mining difficulty adjustment — as more miners leave the network, difficulty falls. Once it starts to rise again, that is confirmation the bottom may be in.”

Indeed, CoinDesk reported earlier that bitcoin mining difficulty just dropped by its largest amount since 2021 as at least some miners did capitulate to plunging prices.

Crypto platform Bullish (BLSH) is leading the sector higher on Monday with a 14..2% gain. Other big advancers include Galaxy Digital (GLXY), up 8.2% and Circle Financial (CRCL), up 5.1%. Strategy (MSTR) is up 3% and Coinbase (COIN) 1%.

Bitcoin miners who have pivoted to AI infrastructure are posting large gains as well as Morgan Stanley initiated positive coverage on TeraWulf (WULF) and Cipher Mining (CIFR) — both are up 14%. Hut 8 (HUT), IREN (IREN) and Bitfarms (BITF) are each ahead about 7%.

Search

RECENT PRESS RELEASES

Related Post