Bitcoin Price Prediction: $165K Bull Pennant: Breakout Incoming

June 25, 2025

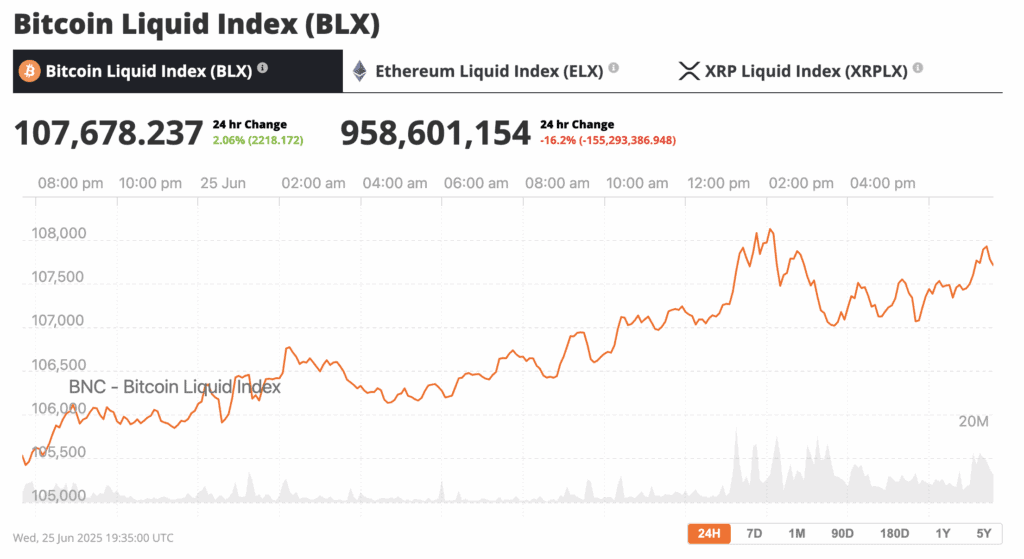

Bitcoin is dancing on the edge of something big—or at least, that’s what the charts are whispering. After bouncing nearly 10% off local lows to hit $108,200 on June 25, Bitcoin is once again approaching its all-time high at $112,000. Meanwhile exchange flows are drying up cutting off supply, and if you believe in the power of technical patterns, we might be staring down the barrel of a bull pennant that screams $165,000 as a Bitcoin price target.

Welcome to crypto, where the math meets the magic, and sentiment writes the rules.

The Bull Pennant

Let’s start with the setup. Bitcoin surged 42% from early April to late May, topping out at $112K before entering what chartists call a “bull pennant”—a sideways consolidation after a parabolic rally. Think of it like a rocket refueling mid-air. If the pattern plays out, the implied Bitcoin price target is a jaw-dropping $165,000—a 54% rip from current levels.

Bitcoin is sitting above $107,000 and looking strong, Source: BNC Bitcoin Liquid Index

Analyst Jelle posted on X, “BTC reclaimed key support and is back inside the pennant. Break above $110K, and this flies a lot higher.” The momentum is clearly building, and BTC just reclaimed its 50-day EMA, a technical milestone that’s often a springboard for breakout rallies.

Break above $110K, and this flies a lot higher, Source: X

Now, before you mortgage your cat for sats, it’s worth noting that bull pennants are among the least reliable technical setups. Historically, they hit their targets only 54% of the time. A coin toss with a bias. If you’re asking if this is a good time to buy Bitcoin, take note that Michael Saylor from Strategy would say yes, but it’s important to manage your risk.

The Vanishing Bitcoin Act

This Bitcoin price prediction isn’t just about lines on a chart. It’s about where the coins are going—or more importantly, where they’re not.

According to CryptoQuant, centralized exchange flows have hit a 10-year low, with only 40,000 BTC moving daily. That’s fewer coins sloshing around than during the FTX panic in 2022 or even the COVID crash. This drop is not from apathy; it’s from conviction. Investors are pulling their coins off exchanges and into cold wallets, betting on long-term upside.

A significant portion of BTC has left the platforms, which is a sign of consolidation and a potential liquidity shortage. If demand spikes while supply sits locked in digital vaults, prices can move fast and violently. We’ve seen Bitcoin do exactly this in previous bull markets.

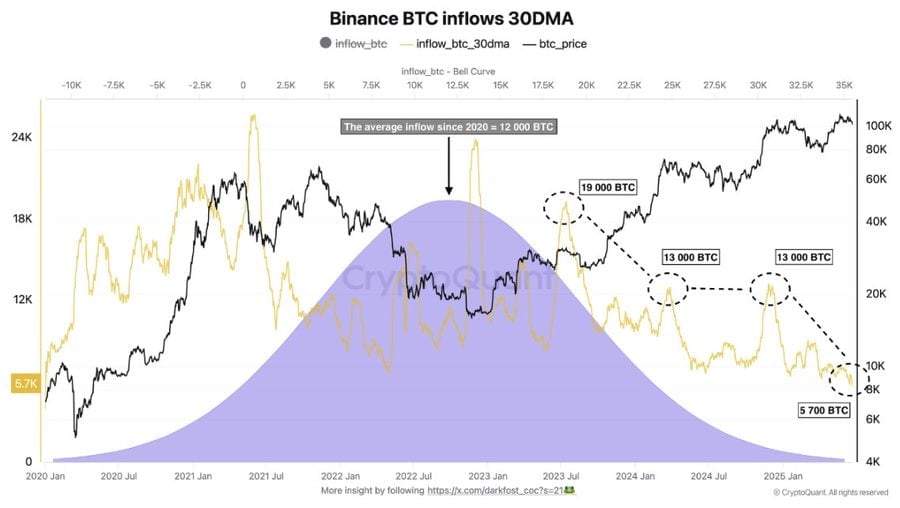

Binance Data Tells the Same Story

On the largest exchange, Binance, inflows have cratered to 5,147 BTC—a number that’s not just low, it’s less than half of what we saw during bear markets. For context, December 2024 saw inflows of over 13,000 BTC at lower prices. What does it say when people don’t want to sell even above $100K? They’re holding on for more.

CryptoQuant’s data paints a clear picture: the 30-day moving average of inflows is in steep decline, while the inflow/outflow ratio remains high—just like it did at the start of the last bull run.

So what we’re looking at isn’t just a lack of selling. It’s a supply crunch in slow motion. Add in renewed institutional demand, a maturing ETF market, and macro tailwinds like U.S. tax cuts and ballooning debt, and you’ve got rocket fuel.

Average BTC inflows to Binance fall below bear market benchmarks. “Bitcoin trades above $105,000, monthly inflows have dropped to just 5,700 BTC, a historically low level, even lower than those recorded during the last bear market.” Source: X

Coinbase: Riding Bitcoin’s Coattails

It’s not just BTC that’s popping. Coinbase stock (COIN) hit a fresh 52-week high this week, surging 133% from its April lows. It’s now trading around $352, brushing up against its all-time high of $357 from the 2021 cycle peak.

The stock rally mirrors rising BTC prices and is being juiced by bullish regulation and strong fundamentals. Q1 revenues came in at $2.03 billion—up 24% YoY. Subscription and services revenue, mainly from stablecoins, jumped over 36%.

Coinbase also benefits from its close ties with Circle, whose stock recently mooned after its IPO. The two companies are the driving force behind USDC, and Circle is now a top holding in VanEck’s global crypto equity index. Translation: Wall Street is paying attention.

So… Are We Going to $165K?

Look, if you’re betting purely on technicals, the breakout setup is there. If you’re watching fundamentals, the supply crunch is real. If you’re a macro junkie, you know the U.S. election cycle, dovish Fed signals, and fiscal madness all tilt bullish for risk assets.

But it’s crypto, and crypto doesn’t move in straight lines. One black swan, one regulation shock, one hacked exchange—and the mood flips. Still, this particular convergence of sentiment, scarcity, and structure doesn’t happen often.

So yes, the breakout to $165K is on the table. But as always: position accordingly, use protection, and don’t be the guy buying the top on leverage with rent money.

Because in the end, Bitcoin always punishes the greedy and rewards the stubborn.

Written by Troy Miller – for the SuperFuture crowd who know the past but bet on the next.

Search

RECENT PRESS RELEASES

Related Post