Bitcoin Price Prediction: Time to Buy the Dip Before November Rally to $125K?

October 30, 2025

A surprisingly hawkish tone from the Fed has sent a chill through risk assets today. Following yesterday’s 25bp rate cut, Chair Jerome Powell warned that the battle against inflation isn’t yet won, leaving the Nasdaq flat and moving Treasury yields higher.

The resulting liquidity drain has hit crypto hard, pushing the CoinMarketCap Fear & Greed Index down to 34. And this macro pressure also exacerbated an already fragile derivatives market. Futures open interest climbed while spot volumes stagnated, creating a dangerous leverage bubble.

Yet these negative factors could be the peak of the bearish pressure. Financial markets often find a bottom when pessimism is at its highest. Reaching this point of maximum pessimism might lead to a rebound – with our latest Bitcoin price prediction pointing to a November rally as high as $125,000.

Such a powerful BTC rally would have a ripple effect across the altcoin space. One new altcoin, Bitcoin Hyper (HYPER), would be well-positioned to benefit, given that it’s building a Layer-2 network for Bitcoin using Solana’s underlying tech.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Bitcoin Struggles Despite Interest Rate Cut

Bitcoin’s price is now below $110,000, down nearly 4% in the past 24 hours. While BTC is still marginally up since last week, its momentum has clearly stalled. Market activity reflects this hesitation, with open interest and spot trading volumes flat.

This lack of conviction suggests traders are waiting for better conditions, and Bitcoin’s technicals add to their caution. BTC’s price broke below a key ascending trendline on the 4-hour chart yesterday. This type of trendline break often leads to a short-term trend flip, with price typically retesting the next major support level.

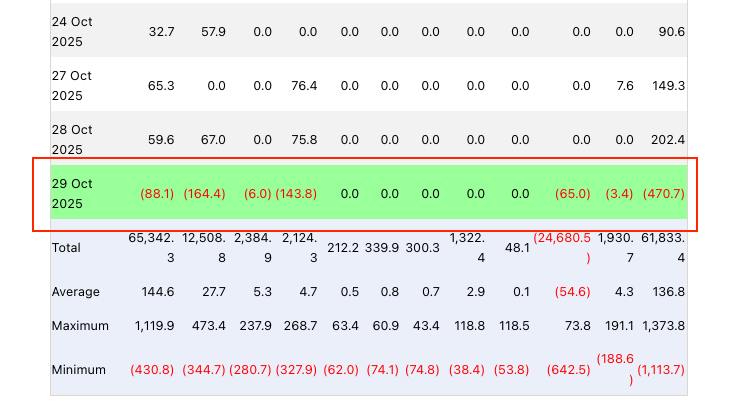

That would suggest a move down to $104,000 if bears maintain control. Also, institutional flows have soured. Spot BTC ETFs recorded $470 million in net outflows yesterday, the second-largest daily withdrawal this year. BlackRock’s IBIT alone saw $88 million exit.

This profit-taking after a 52% year-to-date gain indicates that institutions are becoming more cautious. Yet, this may just be a necessary pullback – shaking out weak hands before a November surge.

Bitcoin Price Prediction – Is a November Rally to $125,000 Possible?

A rally to $125,000 in November is a real possibility, which would be a 13% climb from today’s BTC price. This projection isn’t based on unquestioning optimism, but on a mix of seasonal and fundamental drivers.

Historically, November has been a strong month for Bitcoin. It has posted gains in eight of the last 12 years, averaging 46% each November. Plus, this pattern often intensifies 18 months after a halving event, which aligns perfectly with our current timeline post-April 2024.

So BTC’s dip this week could simply be the final shakeout before seasonal momentum takes hold. And several catalysts could ignite this move. For example, the Fed’s rate cut could flood the system with more liquidity once sentiment improves, boosting risk-on assets like Bitcoin.

Also, the fact that the U.S. now has a pro-crypto government means any big announcements toward year-end are likely to be bullish for Bitcoin. All in all, while things might look bearish today, it might actually be a great time to buy the dip before a November rally.

Could Bitcoin Hyper Benefit from a Bitcoin Rally? New Layer-2 Presale Passes $25.2M

A climb toward $125,000 for Bitcoin would lift the entire crypto ecosystem, but certain altcoins are engineered to capture disproportionate gains. Bitcoin Hyper (HYPER) is one such altcoin – a Layer-2 solution that directly addresses Bitcoin’s limitations.

Its ongoing presale, which has surged past $25.2 million, is attracting lots of investor attention, mainly because of Bitcoin Hyper’s technical architecture. By integrating the Solana Virtual Machine (SVM), this Layer-2 aims to process transactions at Solana-like speeds, which is a stark contrast to Bitcoin’s native 3-7 TPS.

This setup is paired with a canonical bridge that allows users to lock their BTC on the Bitcoin mainnet and use wrapped versions on Bitcoin Hyper. In turn, that will enable activities such as yield farming, meme coin trading, and tokenized RWAs – bringing a full-spectrum DeFi economy to Bitcoin for the first time.

Unsurprisingly, analysts are already buzzing. For example, JRCRYPTEX – who has over 58,000 YouTube subscribers – said that “everyone’s talking” about Bitcoin Hyper and its potential.

Right now, early investors can still buy the native HYPER token in presale for just $0.013195 before it goes live. With a DEX listing planned, staking APYs up to 46%, and multiple code audits complete, HYPER looks primed to explode if Bitcoin rallies to $125,000 in November.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

Tags: altcoins Bitcoin Bitcoin Hyper bitcoin price prediction blackrock buy the dip meme coin price Solana

Search

RECENT PRESS RELEASES

Related Post