Bitcoin Primed To Hit $180,000 Amid Rapid Economic Slowdown Ahead, Says Investor Dan Tapie

May 1, 2025

Macro investor and fund manager Dan Tapiero believes that Bitcoin (BTC) is gearing up for explosive rallies as macroeconomic conditions worsen.

In a new post, Tapiero tells his 129,100 followers on the social media platform X that Bitcoin may soar more than 90% of its current value due to likely Fed rate cuts to boost the economy.

Tapiero believes the liquidity increase will be the catalyst to send Bitcoin to a new all-time high of $180,000.

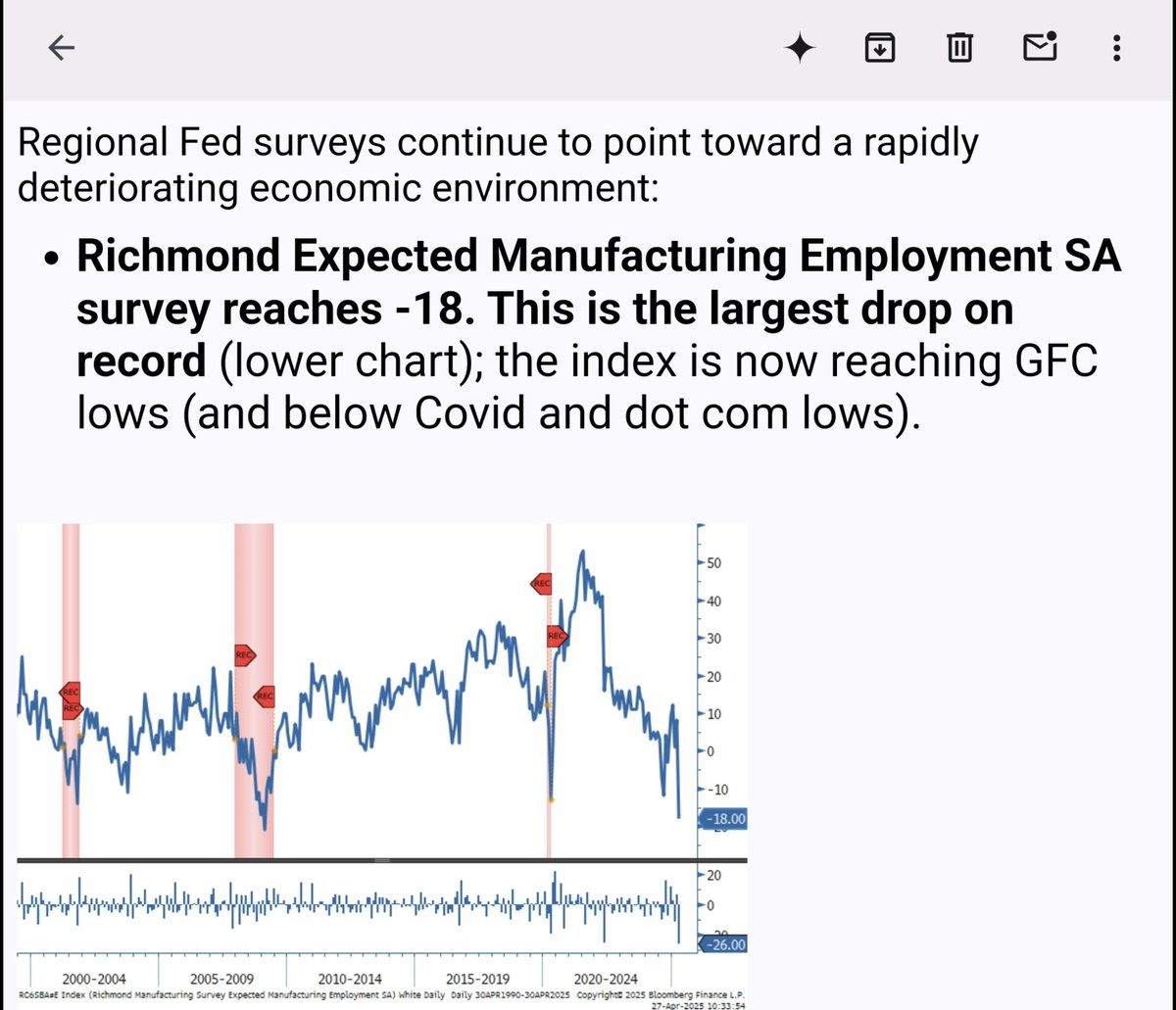

Among the economic metrics he looks at is the Federal Reserve Bank of Richmond’s Expected Manufacturing Employment index, which has plummeted to levels seen only during economic crises.

“Here we go again. More second-tier macro data signaling a rapid slowdown ahead. Largest drop ever – back to ’08 lows. It’s a Fed survey, so hard for them to ignore. Short rates at 4% are way too high.

Same theme: more liquidity coming. BTC to $180,000 before Summer ’26…

[The Richmond Expected Manufacturing Employment index is] just an indicator that shows we are at an extreme very rarely if ever reached. I search for these extreme outliers as they increase the odds that the slowdown is more severe than is currently priced in.”

Tapiero also says the worsening economic conditions will likely lead to more money printing, which will debase the US dollar. He believes the currency debasement will cause investors to pour into Bitcoin as a hedge.

“Fed is playing with fire. Massive collapse in consumer expectations for the economy in the next six months (hits 54.4). Back to March 2009 lows, well below Covid panic lows. This is extreme data. Much lower rates and USD needed to offset fiscal austerity. Fiat debasement equals +BTC.”

Bitcoin is trading for $94,277 at time of writing, flat on the day.

Follow us on X, Facebook and TelegramDon’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox Check Price ActionSurf The Daily Hodl Mix

Generated Image: Midjourney

Search

RECENT PRESS RELEASES

Related Post