Bitcoin Reclaims $91K On Geopolitical Jolt, Short Liquidations Drive Rally

January 3, 2026

The Saturday rally was mostly driven by Bitcoin’s liquidation figures of roughly $64.2 million in total liquidations over the past 24 hours.

- On Saturday night, Dogecoin outperformed Bitcoin in 24-hour gains, as Bitcoin hit $91,000.

- The price of TRON over the past 24 hours seems to be spot-led and low-leverage.

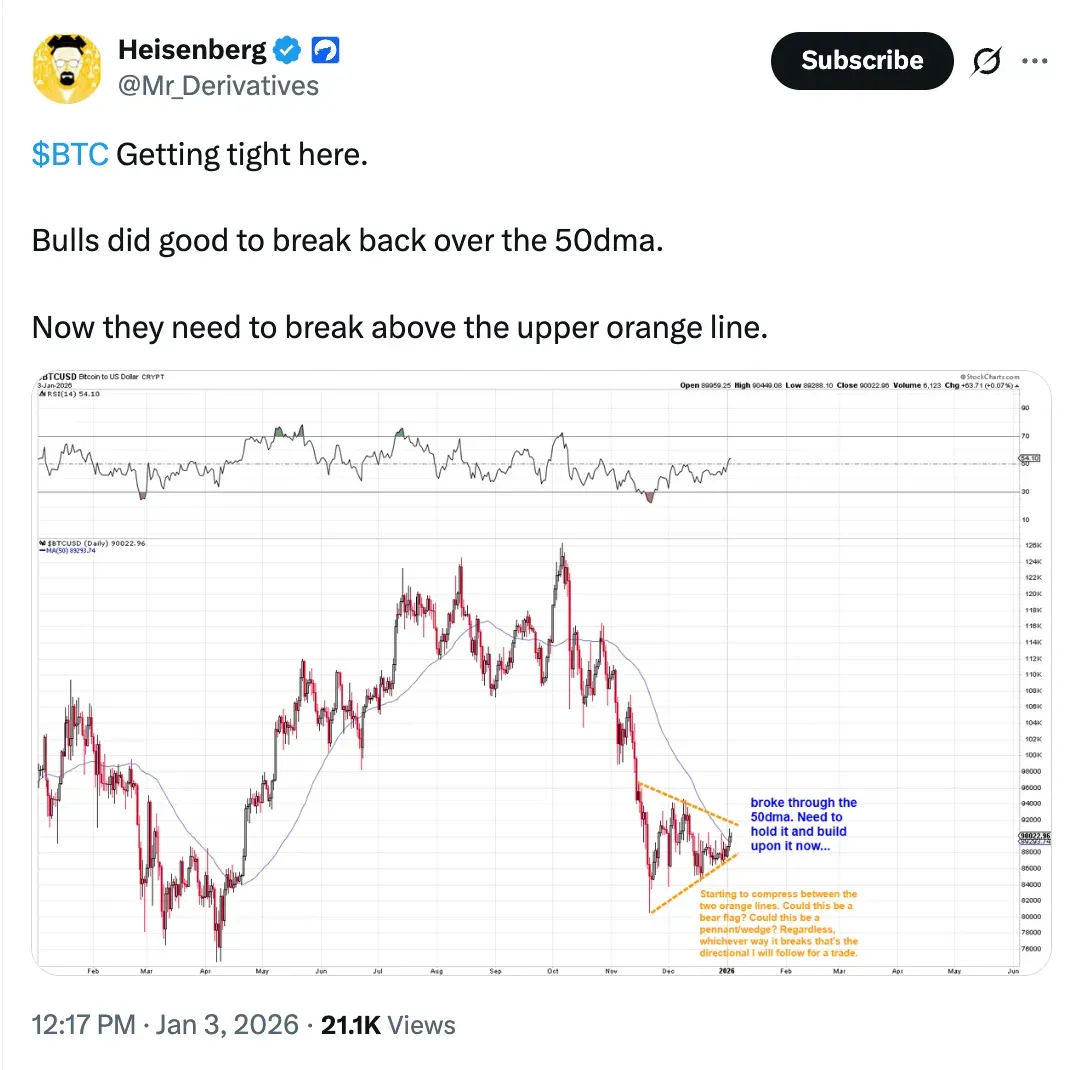

- Bitcoin recaptured its 50-day moving average, but derivatives trader Heisenberg said it must break resistance or plummet below $75,000.

On Saturday night, crypto markets traded strongly higher, with Bitcoin breaking above $91,000 amid escalating geopolitical tensions around Venezuela.

Saturday’s session was affected by both macroeconomic and geopolitical factors. The rally came after a rise in risk sentiment following reports that Venezuelan President Nicolás Maduro and his wife were taken into custody by the US military overnight. This caused global markets to shake up in the short term before risk assets stabilized.

Bitcoin (BTC) was trading at about $91,170, up about 1.1% in the last 24 hours. The last time this price level was reached was on December 12. Liquidation data from Coinglass also showed that BTC led forced unwinds, with about $58.3 million in shorts being liquidated compared to about $5.9 million in long positions. This shows that the move was driven by short covering rather than aggressive spot accumulation. Retail sentiment around Bitcoin remained in ‘bullish’ territory on Stocktwits, while chatter remained at ‘normal’ levels over the past day.

Derivatives trader Heisenberg noted on X that BTC had successfully reclaimed its 50-day moving average, but bulls must now clear the next resistance band to confirm follow-through. Otherwise, the price could hit $75,000.

Separately, The Kobessi Letter reported that over $60 million in leveraged BTC shorts were liquidated in a single hour as Bitcoin surged above $91,000, extending a roughly $3,000 recovery from recent lows.

Ethereum (ETH) was trading at about $3,142, up about 0.7% from the day before. ETH liquidations totaled $30.97 million, and, again, the majority were shorts. On Stocktwits, retail sentiment about Ethereum stayed in ‘neutral’ territory, with ‘normal’ chatter levels over the past day.

Altcoin markets, in general, also showed steady gains. Solana (SOL) went up about 0.8% to around $133.7. Short positions led to liquidations of about $8.1 million. On Stocktwits, retail sentiment around Solana remained in ‘bearish’ territory, with ‘low’ levels of chatter over the past day.

Ripple’s XRP (XRP) was trading at $2.03, up 0.7%, with shorts making up most of the $6.2 million in liquidations. On Stocktwits, retail sentiment around XRP remained in ‘bullish’ territory, accompanied by ‘high’ chatter levels over the past day.

Dogecoin (DOGE) outperformed Bitcoin, rising to about $0.147, up more than 3%, with liquidations close to $3.6 million, mostly on the short side. On Stocktwits, Dogecoin was trending at number 1, with retail sentiment in ‘extremely bullish’ territory and chatter in ‘extremely high’ levels, no change over the past day.

Cardano (ADA) was trading at $0.395, up about 0.4% over the past day, with $1,309,800 in total liquidations. On Stocktwits, retail sentiment around Cardano remained in ‘bullish’ territory, accompanied by ‘high’ chatter levels over the past day.

Binance Coin (BNB) stayed around $881, up about 0.5%, with not much leverage activity, with 398,620 in total liquidation. On Stocktwits, retail sentiment around Binance Coin changed from ‘bullish’ to ‘extremely bullish’ territory, accompanied by ‘normal’ chatter levels over the past day.

TRON (TRX) went up to about $0.295, which is more than 2%, with only $5200 in short-side liquidations and $241000 on the long side. On Stocktwits, retail sentiment around Tron remained in ‘bullish’ territory, with ‘normal’ chatter levels over the past day.

The total liquidation figure on the crypto market stood at $181.81 million over the past day.

Read also: Ark Invest’s Cathie Wood-Backed Quantum Solutions Bought $20.58 Million In Ethereum

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post