Bitcoin Regains Ground After Hitting April Low – Ethereum Could Be Poised For ‘Supercycle’

November 17, 2025

The apex cryptocurrency declined 0.3% to $95,636.64 at the time of writing, according to CoinMarketCap data, while Ethereum fell 0.5% to $3,195.93.

- The U.S. dollar advanced on Monday against a basket of other currencies as the chances of a Federal Reserve rate cut edged even lower.

- According to SoSoValue data, spot Bitcoin exchange-traded funds logged net outflows of $1.11 billion last week, marking the third-straight week of outflows.

- “The path higher is not a straight line,” — Lee.

Bitcoin pared some losses and stabilized over $95,000 on Monday, as investors looked to possible cues from policymakers over the Federal Reserve’s interest rate path.

The apex cryptocurrency declined 0.3% to $95,636.64 at the time of writing, according to CoinMarketCap data, while Ethereum fell 0.5% to $3,195.93. Among other tokens, Solana slipped 0.6%, and Dogecoin fell 1.2%. On Sunday, Bitcoin briefly dropped to $93,000, its lowest since April, erasing all of the gains made this year.

The U.S. dollar advanced on Monday against a basket of other currencies as the chances of a Federal Reserve rate cut edged even lower. According to the CME Group’s FedWatch tool, around 43.6% traders have priced in a rate cut in the U.S. central bank’s next policymaker meeting on December 9-10, compared with over 93% a month earlier.

The bearish sentiment has followed several Fed officials’ cautious remarks about sticky inflation. The Fed officials may also have to contend with the fact that the October jobs and inflation data may not be released due to the U.S. government shutdown.

According to SoSoValue data, spot Bitcoin exchange-traded funds (ETFs) logged net outflows of $1.11 billion last week, marking the third consecutive week of outflows. Spot Ethereum ETFs record net outflows of nearly $729 million, the third-highest in record.

While the first-ever XRP ETF recorded inflows of $243 million, the cryptocurrency’s price did not rise much. Over the past week, it has fallen by more than 8%.

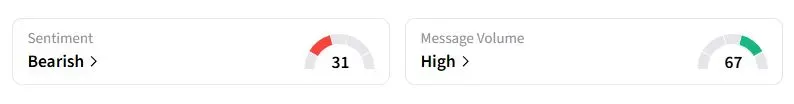

Retail sentiment on Stocktwits on Bitcoin was in the ‘bearish’ territory compared with ‘bullish’ a week ago.

“Good dip buying opportunity/ potentially the best risk/reward in the entire market to park money in currently,” one trader wrote.

Funstrat’s Tom Lee said Sunday that Ethereum could soon embark on a 100x supercycle like Bitcoin.

He said in a post on X that Bitcoin was first recommended to Fundstrat clients in 2017, when it was trading at around $1,000. After eight and a half years, and despite several large pullbacks, Bitcoin has generated approximately 100x returns.

“To have gained from that 100x Supercycle, one had to stomach existential moments to HODL,” Lee said. HODL, or Hold on For Dear Life, is a commonly used term in cryptocurrency markets to denote long-term holdings. “The path higher is not a straight line, HODL,” he added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post