Bitcoin Sentiment Turns Greedy Again—Time To Be Cautious?

June 25, 2025

Trusted Editorial content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

As Bitcoin and other digital assets recover, data shows the sentiment among cryptocurrency investors has returned to a state of greed.

Bitcoin Fear & Greed Index Is Pointing At Greed Again

The “Fear & Greed Index” refers to an indicator made by Alternative that measures the net sentiment held by the average trader in the Bitcoin and wider cryptocurrency spaces.

The index uses the data of the following five factors to determine the market sentiment: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends.

Related Reading: Bitcoin Hashrate Plunges 11%—Are Miners Turning Bearish?

The metric represents the calculated mentality as a score lying between 0 and 100. The former end point corresponds to a state of maximum fear, while the latter one to that of maximum greed.

Here’s what the index says regarding the current sentiment among the investors:

Looks like the value of the metric is 65 at the moment | Source: Alternative

As displayed above, the Bitcoin Fear & Greed Index has a value of 65, which suggests the traders currently share a majority sentiment of greed. This is a notable change compared to yesterday, when the indicator was sitting at 47, meaning that the investor mentality was overall neutral.

The trend in the Fear & Greed Index over the past twelve months | Source: Alternative

The holder sentiment earlier declined as a result of the geopolitical situation surrounding the Israel-Iran conflict. Following the announcement of a ceasefire between the nations, prices bounced back and it would appear that with them, so did the investor mood.

The ceasefire has since been violated, so it’s possible that tomorrow’s Fear & Greed Index would be less bullish. That said, Bitcoin has held surprisingly well despite the news, which could imply that the sentiment may also remain the same.

Historically, BTC and digital assets in general have tended to move in the direction that goes against the expectations of the investors. This means that an overly greedy market makes tops likely, while an extremely fearful one bottoms.

At present, the level of greed in the market isn’t too strong, but the fact that it has seen a notable jump alongside the recovery run could still be to take note off. In the scenario that hype keeps increasing in the coming days, another reversal could turn more probable for Bitcoin and company.

Related Reading: War Tensions Shake Bitcoin, But Strategy Announces New $26M Buy

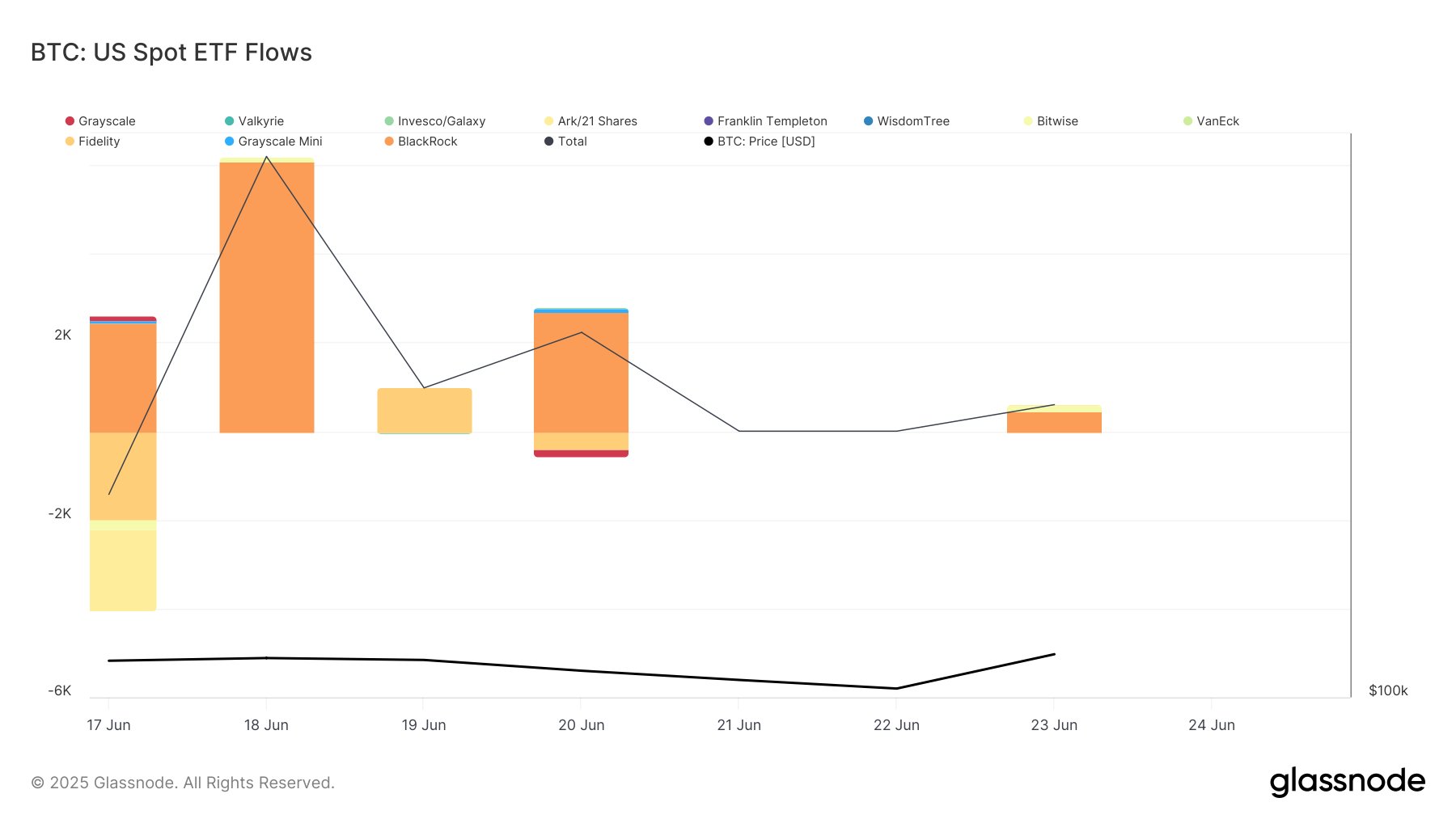

In some other news, the US-based Bitcoin spot exchange-traded funds (ETFs) saw net inflows yesterday, 23rd June, as pointed out by the analytics firm Glassnode in an X post.

The data for the netflows associated with the US spot ETFs | Source: Glassnode on X

As displayed in the above graph, the US Bitcoin spot ETFs saw net inflows of around 598 BTC on this date, despite the geopolitical tensions. “Although the inflows were modest, no major outflows were recorded either, which is notable signal of investor confidence,” notes Glassnode.

BTC Price

Bitcoin has already made recovery beyond the level it was trading at before the plunge, as its price is now back at $106,000.

The asset seems to have shot up during the past day | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, Alternative.me, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Search

RECENT PRESS RELEASES

Related Post