Bitcoin Stalls Below $90,000 as On-Chain Data Points to Consolidation, Not Reversal

November 25, 2025

Bitcoin is attempting to regain upward momentum after recent declines, but the crypto king’s recovery is being met with caution.

While sentiment has softened, the current structure suggests consolidation rather than a major bearish reversal.

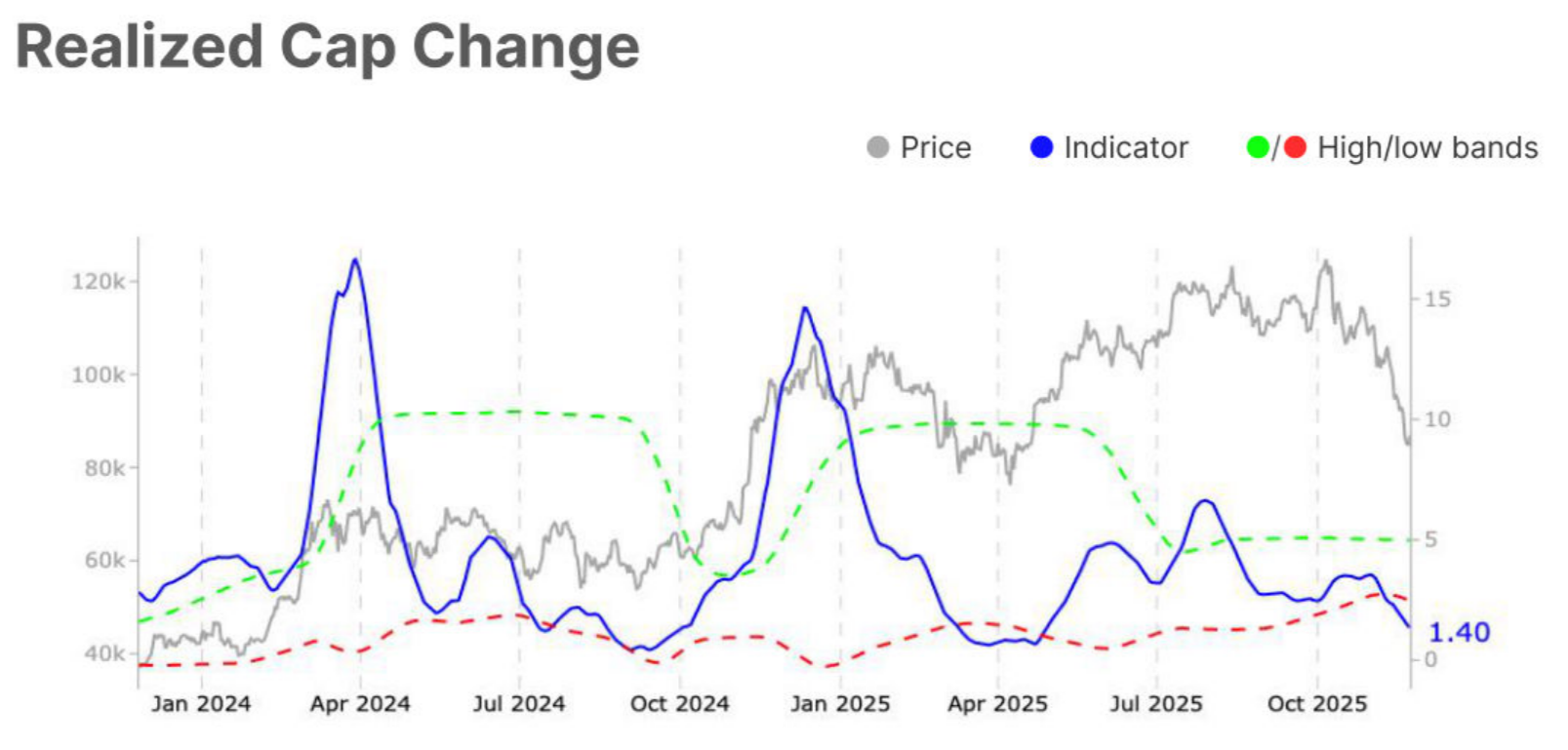

One of the clearest signals of cooling momentum is the sharp decline in Realized Cap Change, which has fallen to 1.4%. This marks a 28.1% drop and places the metric below its lower band. The shift reflects softer net inflows and lighter demand across the market. These conditions are consistent with consolidation phases, where investors prefer to observe rather than aggressively accumulate.

SponsoredSponsored

The slowdown also hints that Bitcoin’s recent price weakness stems not from capitulation but from reduced urgency among buyers. Historically, such periods precede re-accumulation rather than dramatic price breakdowns. As long as demand remains steady — even if subdued — BTC is likely to maintain structural stability.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

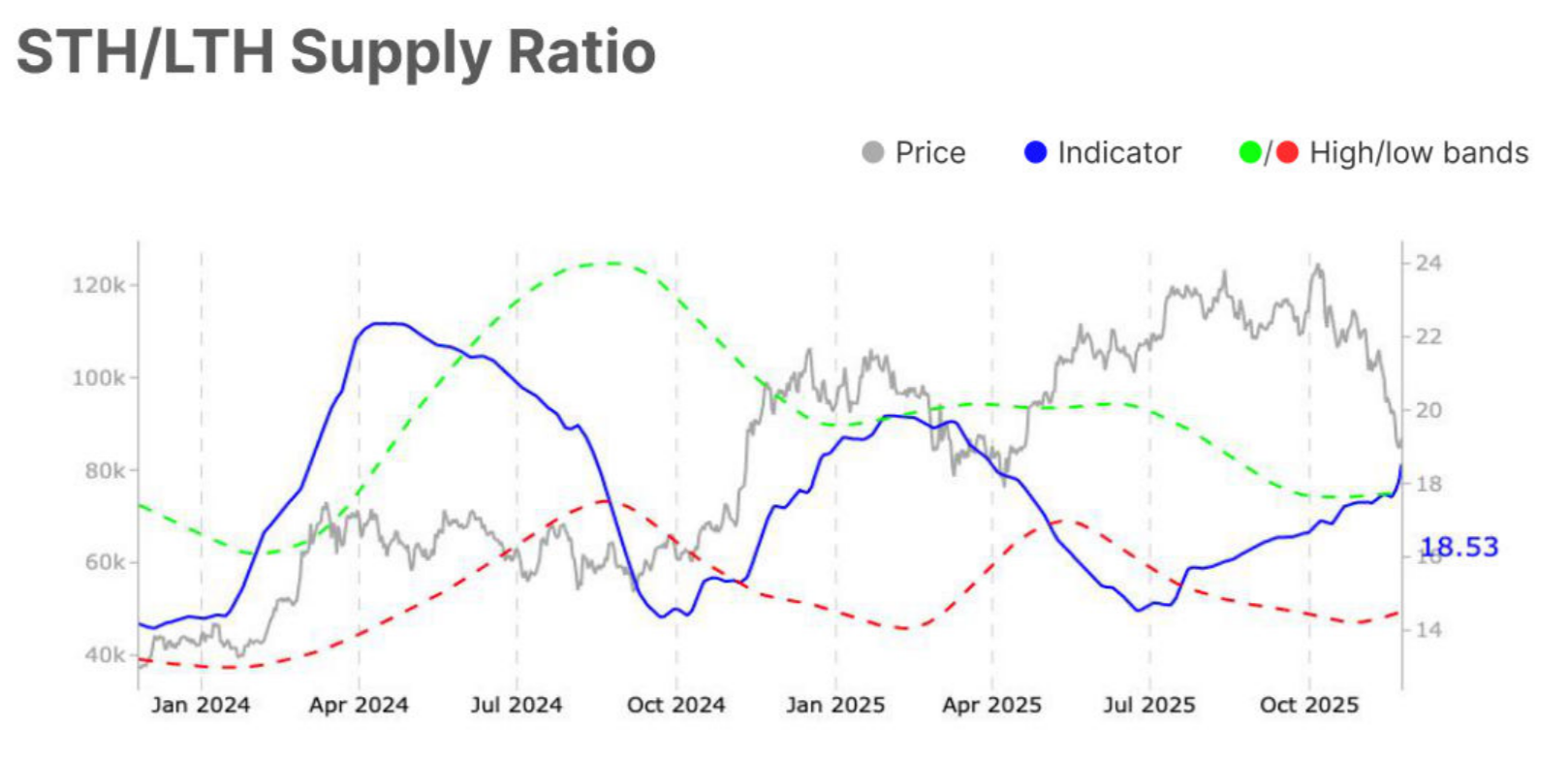

The STH-LTH Supply Ratio has climbed to 18.5%, breaking above its high band and signaling rising participation from short-term holders. This development suggests that speculative liquidity is entering the market at a faster rate. While this can support volatility and trading activity, it also raises the probability of sharper, shorter price swings.

A higher share of short-term Bitcoin holders typically indicates a liquid market, but not necessarily a strongly directional one. The increased presence of speculative traders often aligns with consolidation phases, where prices oscillate within a defined range rather than trending decisively upward or downward.

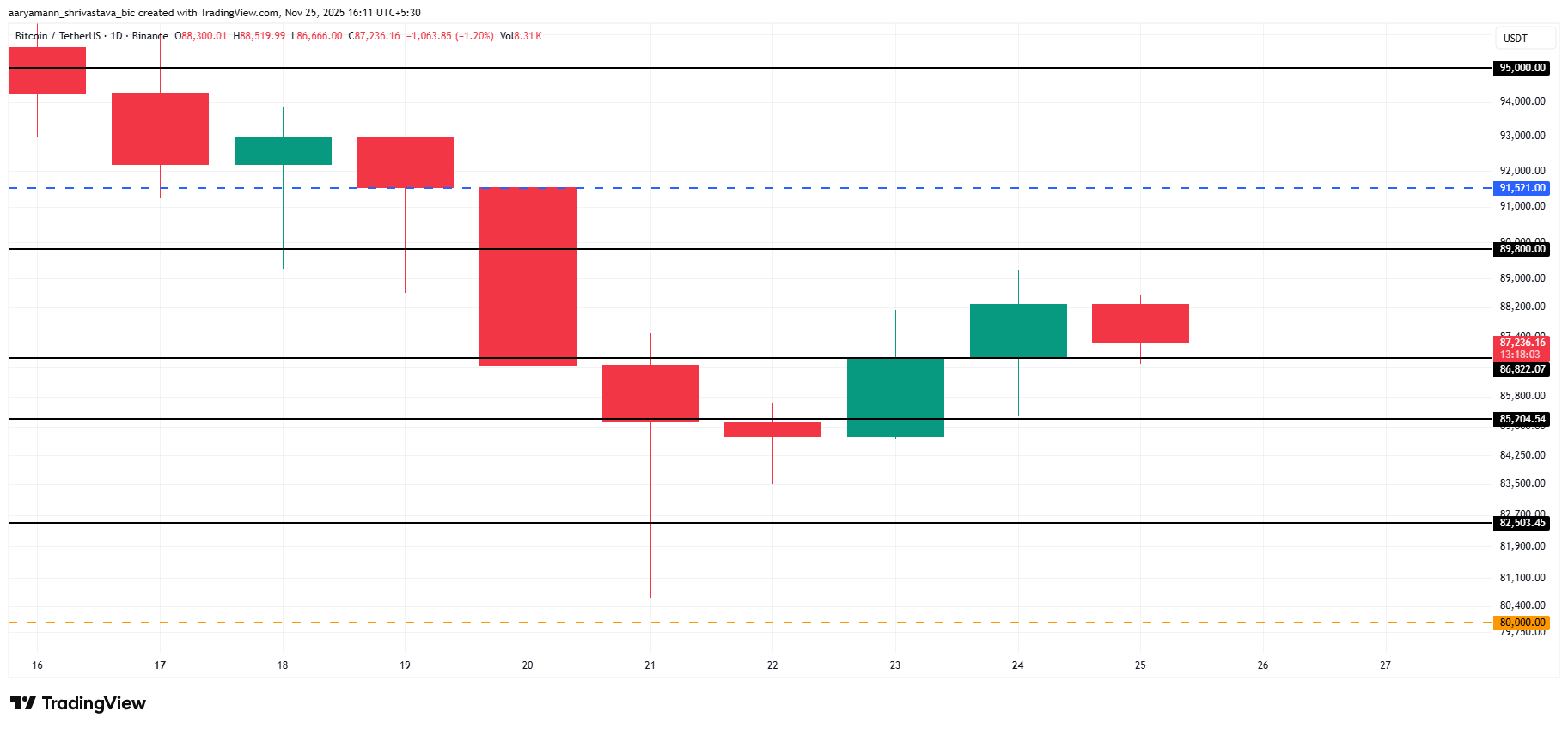

Bitcoin is trading at $87,236, holding above the crucial $86,822 support level. Despite multiple attempts, BTC has remained stuck below the $89,800 resistance for several days. This range-bound behavior reinforces the idea of consolidation rather than reversal.

Given the current mix of soft demand and heightened short-term speculation, Bitcoin will likely remain under the $89,800 resistance unless stronger buying pressure emerges. The short-term outlook leans bearish-neutral, with BTC expected to maintain stability above $85,000 for the most part.

If broader market conditions improve, Bitcoin could break through the $89,800 barrier. A successful breach would open the path toward $91,521, with the potential to extend toward the $95,000 resistance. Such a move would invalidate the consolidation thesis and reestablish bullish momentum.

Search

RECENT PRESS RELEASES

Related Post