Bitcoin: Strategy Loses 5.91 Billion In 3 Months In 2025

April 7, 2025

20h05 ▪

3

min read ▪ by

Eddy S.

Strategy has just announced massive unrealized losses of $5.91 billion on its bitcoin holdings in the first quarter of 2025. In a recent 8-K filing submitted to the SEC on April 7, 2025, the company of Michael Saylor highlights the brutal impact of macroeconomic conditions on its accumulation strategy.

Bitcoin: Strategy records nearly $6 billion in losses in Q1 2025

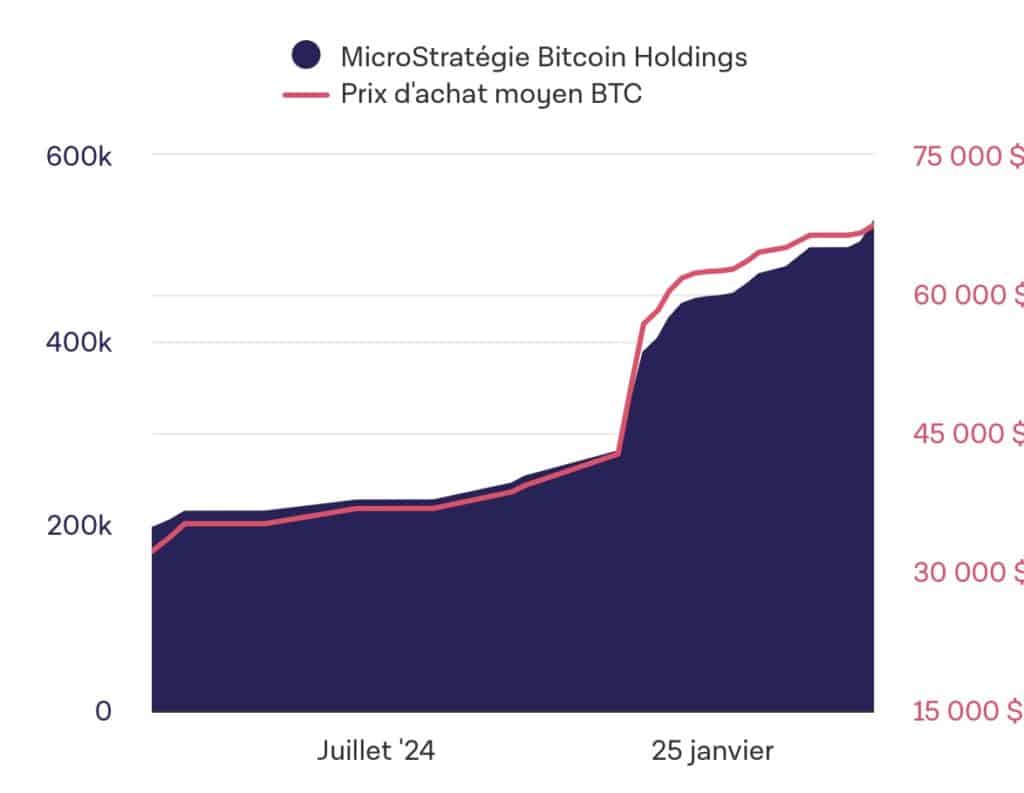

Between January and March 2025, Strategy purchased 80,715 BTC for a total of $7.66 billion, through its stock issuance program on the market. The average acquisition price was $94,922, while bitcoin closed the quarter below $84,000. Thus recording a decline of 11.82%, its worst quarterly performance since 2018.

This price drop has worsened the company’s unrealized losses, already heavily exposed to market volatility. In fact, Strategy did not acquire any new bitcoin between March 31 and April 4, due to a lack of demand for its common stock (MSTR) and for STRK, its preferred perpetual yield offering.

Your 1st cryptos with Coinbase

This link uses an affiliate program.

In total, the company now holds 528,185 BTC, acquired for approximately $36 billion, representing an average purchase price of $67,458. Despite the losses, the current valuation of this cash exceeds $43 billion, representing about 3% of the total circulating bitcoin supply (21 million coins).

BTC under pressure: what direction for Strategy?

After dropping below $75,000, bitcoin is currently struggling to cross $80,000, putting Strategy in a delicate position. Although the company remains technically in profit on its past acquisitions at an average price of $67,458, recent purchases at $94,922 are already causing unrealized losses of about 15%.

If bitcoin stagnates around $80,000, Strategy could continue to accumulate unrealized losses, especially if the bearish market persists. Conversely, a rebound above $90,000 would provide some respite. However, if the price drops below $70,000, the situation would become risky for the company, questioning its aggressive accumulation strategy.

Strategy remains heavily exposed to bitcoin volatility. While its BTC accumulation strategy continues to offer impressive valuation, the company will need to closely monitor market fluctuations. Any prolonged decline could jeopardize its position and future profitability.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post