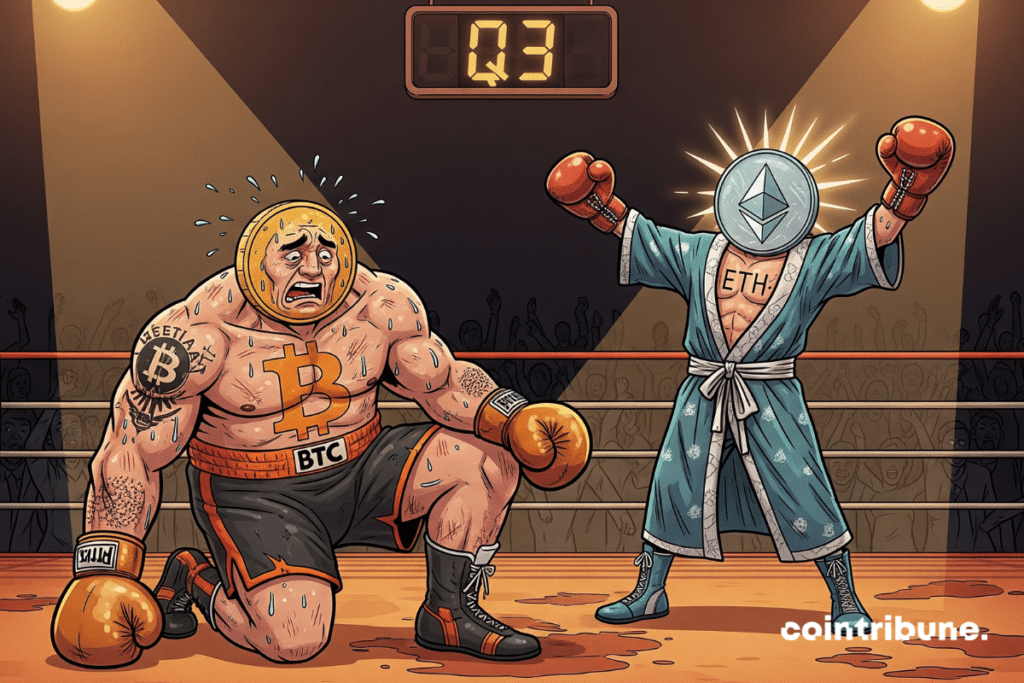

Bitcoin Threatened In Q3: Ethereum Could Gain A Decisive Advantage

June 12, 2025

16h05 ▪

3

min read ▪ by

Ariela R.

Bitcoin shows relative stability as summer approaches. According to some crypto analysts, however, this calm could precede a more difficult phase. Between trader frustration, unfavorable seasonality, and excessive optimism, warning signs are multiplying. Detailed analysis in the following paragraphs!

In brief

- Bitcoin could underperform this summer, held back by investor euphoria and seasonality.

- Ethereum is attracting analysts’ attention, benefiting from a catch-up as bitcoin remains stagnant below its peaks.

Bitcoin faces its worst historical quarter

According to CoinGlass, the third quarter is historically the worst performing for BTC. Data shows an average return of only 6.03% since 2013. In comparison, the fourth quarter boasts an impressive 85.42%. The crypto market thus seems to follow a well-established seasonal trend.

For many crypto analysts, bitcoin will likely underperform in the third quarter of 2025. One reason cited is the Fed’s monetary policy, which maintains its interest rates stable despite pressures. This stance indeed reduces bitcoin’s appeal as an alternative yield asset.

That’s not all! The arrival of summer holidays could also cause a drop in trading volume, increasing the risks of unexpected volatility! Retail investors might then be tempted to take profits, making the crypto market more unpredictable.

Too much optimism might harm bitcoin

Brian Quinlivan, an analyst at Santiment, notes growing euphoria around a new high for the BTC price. According to him, this excessive anticipation often results in the opposite effect. In other words, the crypto market could move contrary to retail investor expectations.

Certainly, bitcoin is trading only 2.1% below its all-time high. Nevertheless, a technical resistance might prevent price increases. This situation could open the way to a potential catch-up by Ethereum, whose recent rebound is attracting growing attention.

Indeed, Ethereum has surged nearly 90% since April (compared to a more moderate rise in bitcoin). If the bull cycle of the crypto queen is exhausting, the second-largest capitalization could benefit. Some analysts even predict a price of $3,000 within a few days.

Your 1st cryptos with Coinbase

This link uses an affiliate program.

The rest of the summer thus looks uncertain for bitcoin. Between historical data, technical analysis, and psychological dynamics, the market could well surprise… to the downside. What if it were finally time for Ethereum?

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post