Bitcoin Weekly Forecast: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

March 14, 2025

- Bitcoin opened Friday’s session at $83,000, posting 8% gains from the weekly low of $76,000.

- Intensifying US-Canada trade war rhetoric has overshadowed crypto investors’ reaction to easing inflation.

- With market volumes declining for the third consecutive week, BTC faces major downside risks.

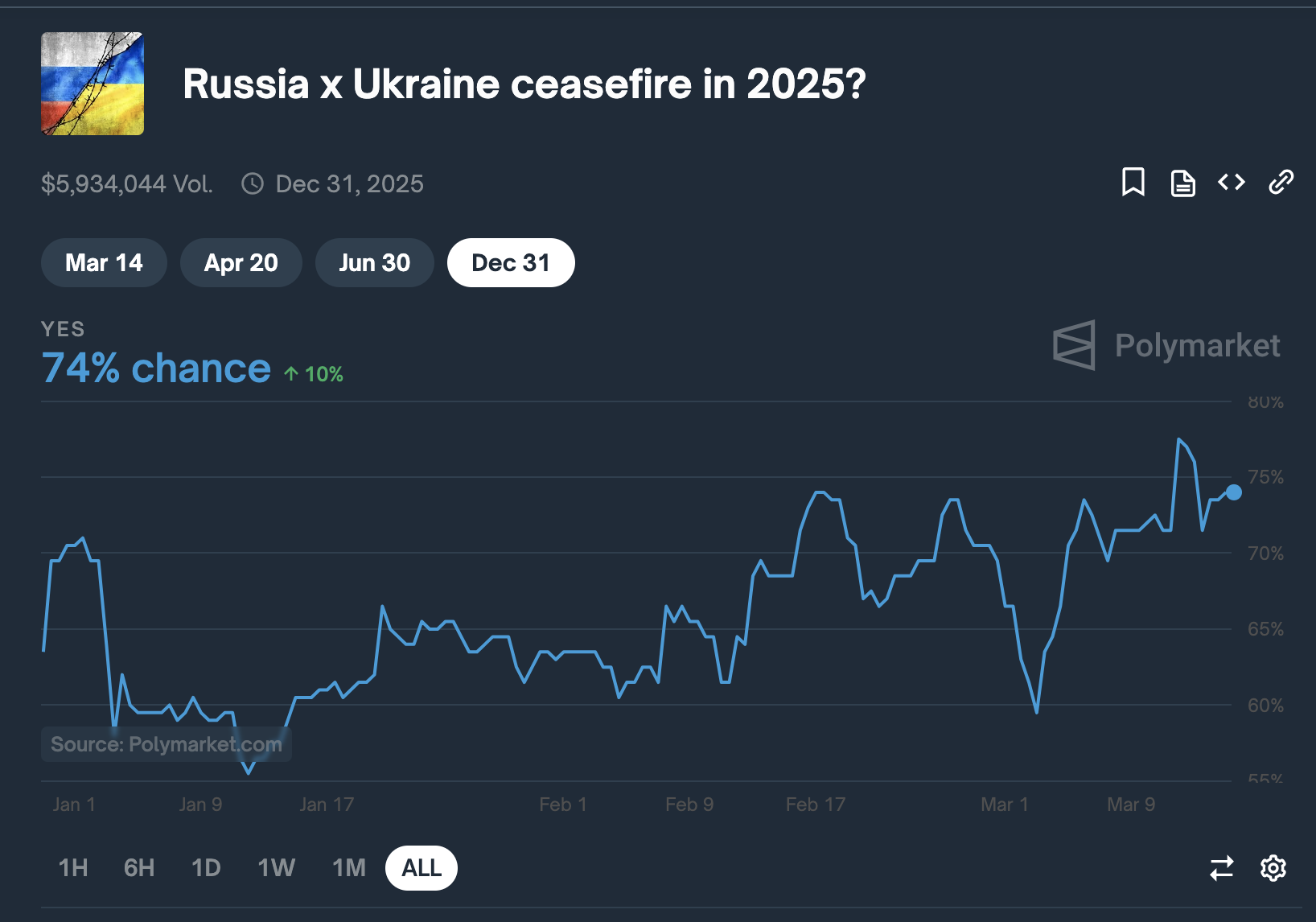

- Polymarket bettors price in a 99% chance of a Fed rate pause in March, while the odds of a Russia-Ukraine ceasefire nearing 75%.

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

Bitcoin (BTC) faces considerable volatility this week. With conflicting market signals counteracting short-term, traders were unable to establish any dominant directional trend across the crypto markets this week.

Bitcoin price action | BTCUSD Weekly Chart | Source: TradingView

The current price chart shows BTC trading above the $83,300 mark on Friday. In relative terms: Bitcoin is posting 3% gains for the week, rising from the opening price of around $80,700 on Sunday.

This represents a significant recovery compared to last week when United States President Donald Trump’s confirmation of trade tariffs on Canada and Mexico had triggered an 8% sell-off with over $900 million in liquidations.

In other notable price movements this week, Bitcoin prices briefly plunged below the $80,000 support for three consecutive days between Tuesday and Thursday.

Bitcoin price may face weaker support if prices plunge that low in the coming week, as recent retests may have prompted traders to adjust their stop losses or close out long positions to avoid losses from the next retest.

The Trump trade war narrative intensified this week, with Canada’s Prime Minister Justin Trudeau promising retaliatory measures.

Heading into the week, global markets were on edge due to inflation risks in the initial US Nonarm Payrolls data released last Friday.

However, those fears eased momentarily after the US CPI and PPI data showed easing inflation metrics this week.

US CPI data, March 2025 | Source: TradingEconomics

US CPI data, March 2025 | Source: TradingEconomics

Historically, Bitcoin demand surges when markets anticipate less hawkish Fed decisions, but current macro pressures surrounding the trade war are suppressing risk appetite, especially among retail traders.

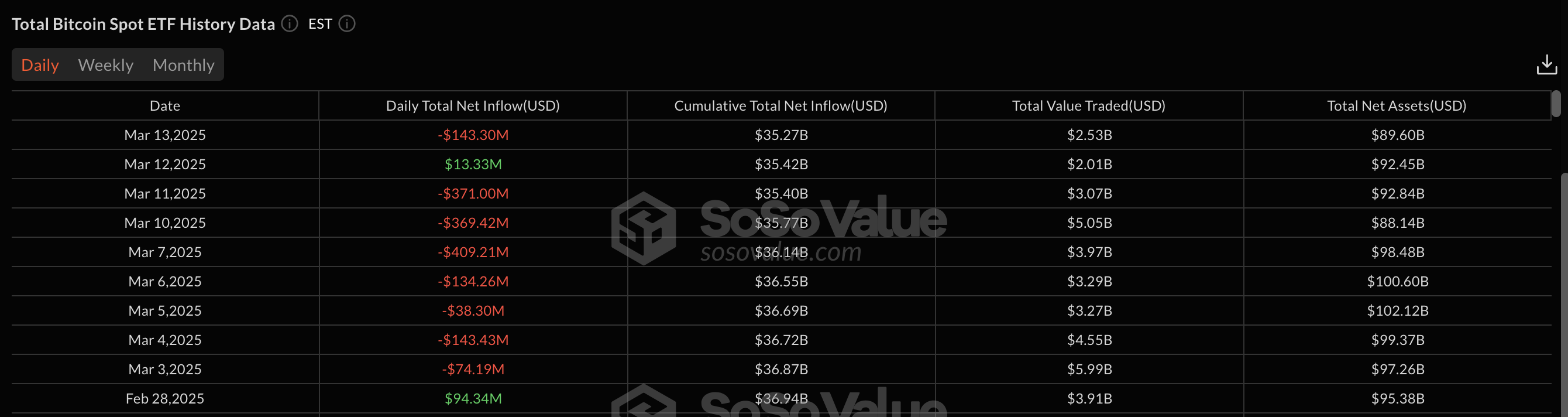

Bitcoin ETFs saw $143 million in outflows on Thursday, following $13 million in inflows on Wednesday—the first positive flows since the start of March.

In total, investors withdrew another $830 million this week, bringing total outflows in March to $1.7 billion.

Bitcoin ETF Flows | March 2025 | Source: SosoValue

Bitcoin ETF Flows | March 2025 | Source: SosoValue

Persistent ETF sell-offs continue to fuel short-term volatility in Bitcoin prices as uncertainty around the US trade war and Trump’s crypto strategic reserve proposal unsettles investors.

Florida governor candidate Byron Donalds is preparing to introduce legislation to codify Donald Trump’s executive order establishing a strategic Bitcoin reserve, Bloomberg reported on Friday.

The bill aims to prevent future administrations from overturning Trump’s policy, which allows the US Treasury to hold 200,000 Bitcoin and prohibits the sale of reserve Bitcoin. Donalds positioned the move as a defense against what he calls the Democrats’ “war on crypto.”

The bill faces significant hurdles, requiring 60 votes in the Senate and a majority in the House of Representatives to advance.

Texas lawmakers have introduced HB 4258, a legislative proposal to allocate $250 million from the state’s economic stabilization fund to Bitcoin and other digital assets.

The bill follows SB 778, which recently gained bipartisan support in the Texas Senate. If enacted, HB 4258 would take effect in 2025 and allow municipalities and counties to invest up to $10 million in digital assets.

The overhang of multiple bearish macro pressures means that Bitcoin price remains at major downside risks despite 3% gains this week.

On the positive side, crypto bettors on prediction market platforms Polymarkets anticipate a Fed rate pause next week, while others are counting on easing geopolitical pressure between Russia and Ukraine.

Polymarket bettors price in 99% chance of a Fed rate cut pause in March, with odds on Russia-Ukraine ceasefire nearing 80%.

Odds on US Fed decision in March | Source: Polymarket

If these expectations materialize, improved risk appetite could drive renewed inflows into Bitcoin and crypto assets, supporting further upside momentum next week.

Bitcoin price is trading at $84,833.67 after posting 5% gains the week.

However, with BTC yet to recoup last week’s 8% losses, technical indicators show that bulls are not in complete dominance of the markets.

First, the Parabolic SAR dots remain above the current BTC price, indicating bearish momentum.

Likewise, the Bollinger Bands show tightening volatility, with resistance at $110,676 and support near $76,505.

Bitcoin Price Forecast | BTCUSD Weekly Chart

If delayed Fed rate hike and easing geopolitical tensions between Ukraine and Russia ease up, Bitcoin price must break above the mid-Bollinger Band at $93,591, it could signal a return to bullish momentum.

Conversely, a bearish breakdown could see Bitcoin testing the lower Bollinger Band at $76,505.

Increased sell volume, as seen in recent weeks, suggests a risk of deeper downside. In this scenario, a close below $75,000 could accelerate selling pressure, leading to a potential retest of $68K or lower.

Share:

Cryptos feed

Search

RECENT PRESS RELEASES

Related Post