Bitcoin’s Moves Show Strong Hold at $100,000

June 9, 2025

Tesla CEO Elon Musk has spoken out against US President Donald Trump’s “Big Beautiful Bill” economic proposal, describing it as a “disgusting abomination” that would lead to national bankruptcy.

Naturally, Musk’s effort to reduce spending through DOGE is undone by the inflationary bill.

The market became more anxious due to their public social media feud. Both Bitcoin and Tesla experienced price drops. However, despite the volatility, Bitcoin recouped those steep losses late in the week.

Within the wider markets, a 1% gain in the S&P 500 sent the benchmark to 6,000 points at the start of June, which is widely viewed as a quiet month for risk assets.

Wall Street stocks closed at their highest level since February on Friday.

A day after Thursday’s highly public meltdown involving Tesla’s CEO and Trump, the EV maker’s shares and all major industries saw gains. Dip-buying investors rushed to acquire Tesla shares, which recouped 3.8%.

Employment data allayed fears of a near-term economic meltdown. With President Trump stating that negotiators will meet on Monday, investors are hoping that US-China trade tensions will ease, which has led to an increase in equities.

Treasuries fell on both ends of the yield curve, and the two-year yield surpassed 4%.

That shows the fears of high US debt and delayed Fed rate cuts this year. Before the US jobs data, the probability of Fed rate cuts in September in the money markets was reduced to 70% from 90%.

Despite recent data casting doubt on the robustness of US hiring, Friday’s report marginally surpassed expectations, boosting bulls bracing for disappointment following May’s revised lower numbers.

Trump ramped up his pressure campaign against Powell after Friday’s data and pushed the Fed to reduce rates by one full percentage point.

On his social platform, Trump said, “‘Too Late’ at the Fed is a disaster!” Using a derisive nickname for Powell, he said, “Europe has had nine rate cuts; we have had none. Despite him, our country is doing great. Go for a full point, Rocket Fuel!”

However, Federal Reserve officials have indicated a cautious approach as they gather more information about the impact of Trump’s initiatives on the economy. This week’s inflation data could give us more clues about the US economy and the impact of trade war uncertainty.

This year’s trade war upheaval is over, and US stocks are expected to reach new highs. Investors are finally feeling relief after a turbulent two months, as the S&P 500 has posted gains in five of the previous seven weeks.

That is positive news for cryptos, too, as the progress in trade deal talks is likely to drive the overall mood. Interestingly, Bitcoin has a good hold at the $100,000 level.

Technical Indicators Show Bitcoin Surge Due

After overcoming the $100,000 resistance, Bitcoin hit fresh all-time highs. However, after Trump announced a 50% tariff on the EU on June 1, concerns about a trade war revived, quickly stifling crypto momentum.

Bitcoin is immediately testing the once-resistance-turned-support level of $100,000, and it appears to withstand the test.

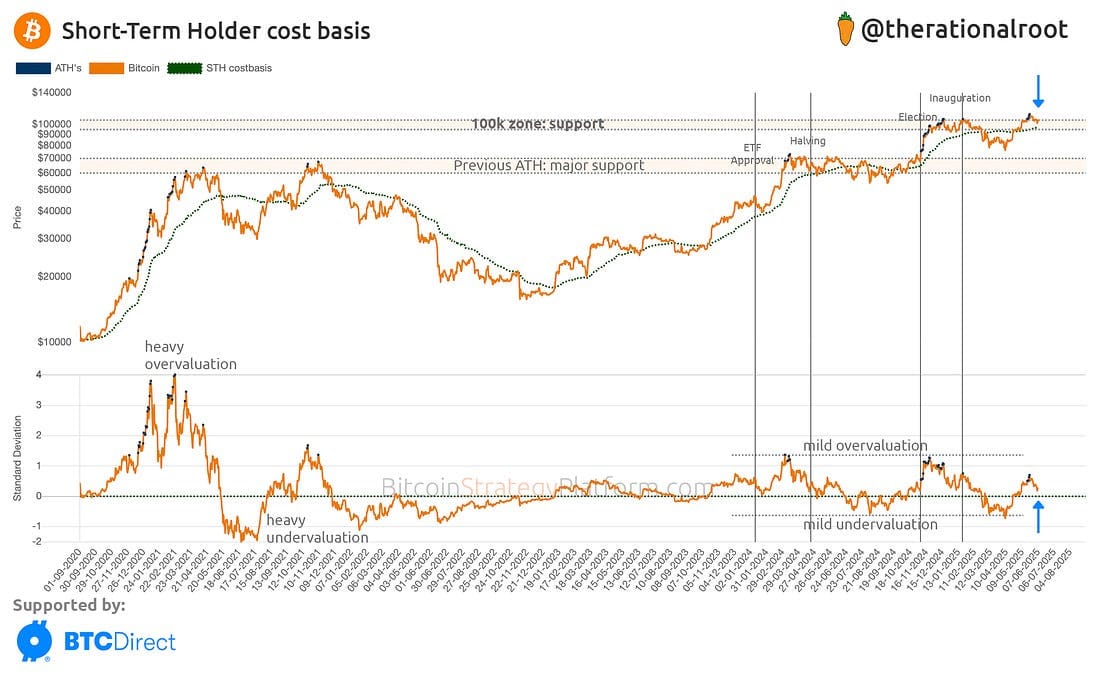

According to BTCDirect, Bitcoin’s current position relative to the $95,000-$105,000 support zone is increasing, and the cost basis for Short-Term Holders (STHs) is currently at $97,200.

The standard deviation gap is narrowing as the cost basis gets higher. The short-term holder (STH) cost base is experiencing a complete reset ahead of the next leg up. If so, it might spark a fresh effort to break records.

Regarding overvaluation, the present decline in standard deviations is comparable to during the slump post-ETF approvals last year. Despite the recent setback, Bitcoin’s positive trend remains unaffected. Prices may continue to grind higher, even as volatility is underwhelming.

Because of the persistently favorable market conditions, a fascinating trading opportunity centered on a “Spot ETH Staking ETF” (Solano also) will soon emerge.

Staking incentives seem like a great incentive for institutional investors to “buy-hold” the assets since there’s almost no difference between the futures prices of Ethereum and Bitcoin right now.

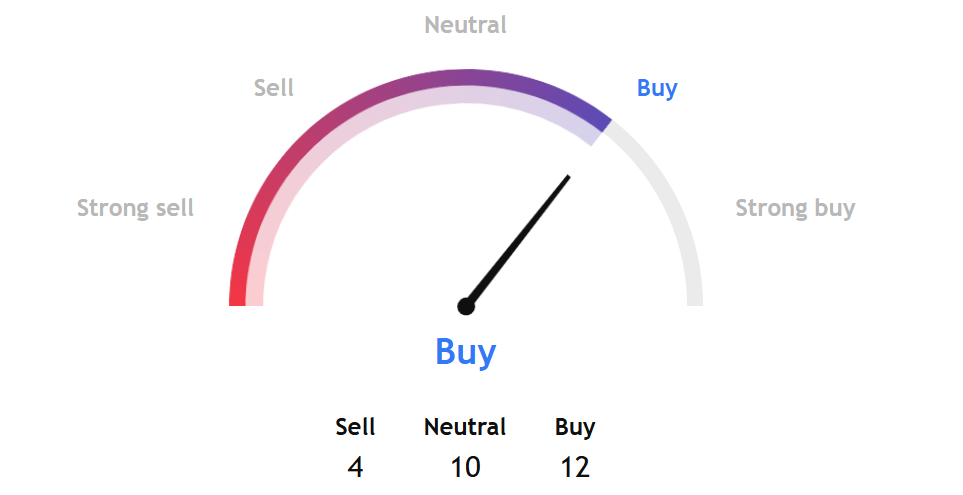

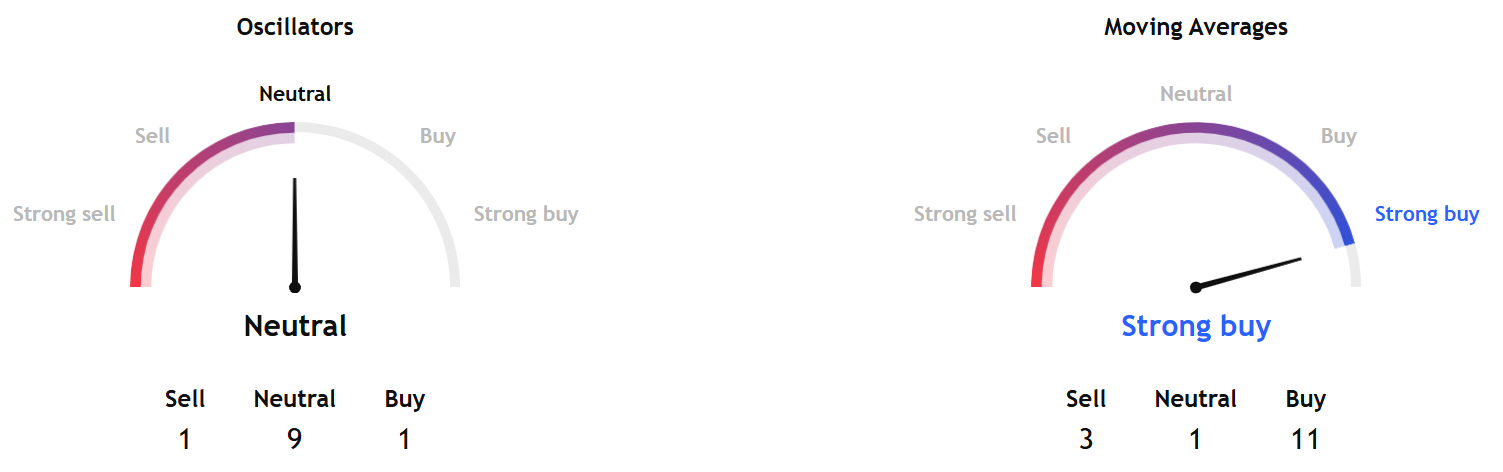

TradingView’s BTCUSD technical analysis summary gives a buy signal, with fewer indicators flashing ‘sell.’

The oscillators and moving averages indicators also show a similar trend, with fewer technical readings for a sell signal.

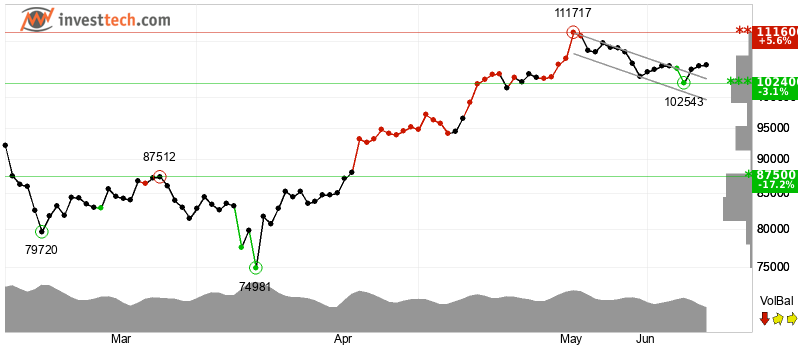

However, InvestTech’s overall algorithmic analysis suggests a hold signal.

Bitcoin has broken the short-term ceiling of a falling trend channel. This signal indicates either a more gradual decline or the beginning of a more horizontal trend.

The token has a support level of $102,400 and a resistance level of $111,600. There is a potential for a downward reaction when the RSI diverges negatively from the price.

In the short term, the OG token is considered slightly negative from a technical standpoint, according to InvestTech.

In the medium term, the trend, according to InvestTech’s overall algorithmic analysis, shows a somewhat subdued price action for Bitcoin.

The Daily Total Net Open Interest (Delta), according to SoSoValue, shows -847.05 million, which indicates an increase in open contracts for Puts.

That suggests market makers will have to sell assets to cover their bets, which means more ETFs will be sold. This metric is useful for learning about market dynamics and the strategies used by market makers to mitigate risk.

The daily net flows fell 47.82 million on Friday, according to SoSoValue, with the cumulative at 44.2 billion as of last week.

ETF flows at the end of last week still point to positive engagement for Bitcoin, despite the upheaval during the first week of June, and bets show another healthy outlook for this week.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan, entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you’re new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Fideum’s Anastasija Plotnikova on Building Regulated Crypto Infrastructure

In this episode, your host Takatoshi Shibayama sits down with Anastasia Plotnikova, CEO of Fideum, a regulated digital asset infrastructure company operating across Lithuania and Canada. They dive into what it’s like to build in Europe under the new MiCA regulation, the practical challenges of regulation, and the global dichotomy between CeFi and DeFi. Anastasia shares her journey from law enforcement to crypto, and how growing up in the post-Soviet era shaped her deep appreciation for decentralized finance.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets.

Search

RECENT PRESS RELEASES

Related Post