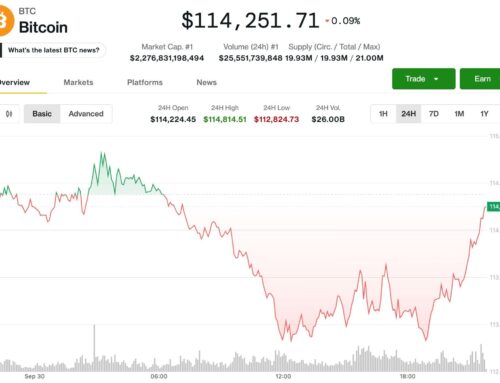

Bitcoin’s rare September gains defy history: Data predicts 50% Q4 rally to $170K

September 30, 2025

Bitcoin moves closer to a positive monthly close, which has historically been followed by strong double-digit rallies in Q4. Is $170,000 possible by the end of 2025?

Market Update

Key takeaways:

-

Bitcoin aims to close September with a 4.50% gain, a setup that historically precedes strong Q4 rallies.

-

Onchain data shows spot demand strengthening, led by US investors.

Bitcoin (BTC) is on track to close September in positive territory, up 4.50% at around $113,100 on the final trading day of the month. Historically, a green September has been a powerful setup for the market, often preceding strong rallies in the final quarter of the year.

According to data, when Bitcoin closed a green monthly candle in September 2015, 2016, 2023, and 2024, Q4 produced average returns of more than 53%. Breaking it down further, October averaged 21.8%, November 10.8%, and December was down 3.2%, highlighting October as the key ignition point while year-end performance varied.

In those instances, Bitcoin went on to post Q4 returns ranging between 45% and 66%, often leading BTC to new highs. If a similar pattern plays out, BTC could be eyeing the $170,000 region before year-end based on current levels.

Seasonality data shows that October typically acts as the launchpad, with gains extending into November and, in certain years, December. The effect has been profitable in post-halving years, as capital inflows and market positioning push Bitcoin into fresh price discovery.

Cointelegraph recently reported insights from Bitcoin network economist Timothy Peterson, who noted that roughly 60% of Bitcoin’s annual performance tends to occur after Oct. 3, with momentum often extending well into June. The analyst further suggested there is a 50% probability of BTC reaching $200,000 by mid-2026, supported by recurring seasonality-driven bull phases. However, Peterson also added,

“This year, it is almost certain to be positive based on history and developing market conditions. However, most of the time, the big gains don’t start until about the third week.”

While past performance does not guarantee future results, the tendency for BTC to accelerate higher after a green September adds weight to bullish projections for the coming months. With Bitcoin trading firmly above $110,000, the final quarter could again prove decisive for the asset.

Related: Did Bitcoin price bottom at $108K? 3 reasons that the worst is over

BTC spot activity indicators turn bullish

Onchain metrics also reflected a strengthening bullish outlook for Bitcoin. The Spot Taker CVD (Cumulative Volume Delta) on a 90-day basis flipped positive on Monday, marking its first green signal since July 14. This indicator tracks the cumulative difference between market buy and market sell volumes, with a positive reading suggesting a Taker Buy Dominant Phase where buying pressure outweighs selling activity.

At the same time, the Coinbase premium index has highlighted consistent accumulation by US investors. Data showed concentrated clusters of green activity during the third quarter, signaling aggressive spot demand not seen since early July. The alignment of the Coinbase premium with the Spot Taker CVD shift reinforces the view that buying momentum is building in the market.

Related: Bitcoin gears up for ‘Uptober’ after $114K rally revives bulls

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Search

RECENT PRESS RELEASES

Related Post