BitMine builds massive Ethereum treasury as ETH price struggles to recover

February 9, 2026

A growing disconnect is emerging between Ethereum’s price performance and corporate balance-sheet demand, as BitMine Immersion Technologies continues to accumulate ETH during a prolonged drawdown.

Data from CoinGecko shows BitMine now holds approximately 4.33 million ETH, equivalent to about 3.6% of the total ETH supply. This makes it by far the largest publicly disclosed corporate holder of Ethereum.

Over the past 30 days alone, the company added more than 180,000 ETH, highlighting active accumulation rather than a legacy position.

Ethereum accumulation accelerates during price weakness

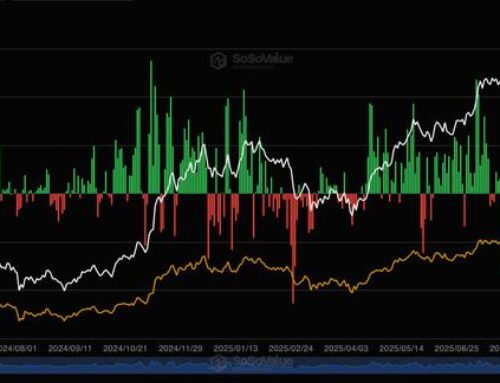

BitMine’s buildup comes as ETH trades near $2,100, down more than 60% from its 2025 highs. The sell-off intensified into late January before prices attempted to stabilize in early February.

However, the broader trend remains fragile, with ETH still well below prior support levels. While price action has struggled to regain momentum, BitMine’s accumulation has accelerated.

According to the company’s latest disclosure, ETH now represents the core of its crypto treasury, alongside smaller Bitcoin holdings, cash, and minority stakes in other ventures.

At current prices, BitMine’s ETH position alone is valued at over $9 billion.

Staking activity remains stable

On-chain data adds important context to the accumulation story. Despite the sharp decline in ETH’s market price, the market-cap-weighted Ethereum staking rate has remained relatively stable at around 2.7%.

This indicates that validator participation has not meaningfully deteriorated alongside price.

This stability suggests that, while market sentiment has weakened, network participation and security have held steady. BitMine has leaned into this dynamic, with roughly two-thirds of its ETH holdings staked, generating ongoing yield while effectively locking in supply.

A concentration gap emerges

The scale of BitMine’s holdings stands out sharply against its peers. CoinGecko’s treasury rankings show the next-largest public ETH holder controls less than 1% of total supply, leaving BitMine with a concentration several times larger than any comparable entity.

That gap shows a broader shift in how some public companies are approaching crypto exposure. Rather than treating ETH as a marginal treasury asset, BitMine is positioning Ethereum as a strategic, long-term balance-sheet anchor.

Price lags balance-sheet demand

So far, BitMine’s accumulation has not translated into a sustained price recovery. ETH remains under pressure, and there is little evidence that corporate buying alone has altered broader market dynamics.

Still, the concentration of supply into a single corporate treasury introduces a new variable into Ethereum’s market structure—one that did not exist at this scale in prior cycles.

As ETH continues to search for a durable base, the contrast between weak price action and aggressive corporate accumulation is becoming harder to ignore.

Final Thoughts

- BitMine’s rapid ETH accumulation during a deep drawdown highlights growing corporate concentration in Ethereum supply.

- Despite stable staking participation, ETH price recovery has yet to reflect balance-sheet demand.

Search

RECENT PRESS RELEASES

Related Post