Bitmine Immersion Technologies (BMNR): Valuation in Focus After Becoming Ethereum’s Larges

November 1, 2025

Bitmine Immersion Technologies (BMNR) recently expanded its Ethereum holdings to become the largest corporate holder of Ethereum. This move, along with improving macro conditions and supportive analyst coverage, is sparking investor curiosity about the company’s future positioning.

See our latest analysis for Bitmine Immersion Technologies.

After an initial surge earlier this year, Bitmine Immersion Technologies’ share price has shown explosive momentum, with a year-to-date share price return of over 566%. Despite taking a breather in recent weeks, the latest buying spree into Ethereum and remarks from company leaders continue to fuel interest from investors looking for crypto-linked growth. Looking at the bigger picture, total shareholder return has outpaced even the jaw-dropping share price gain, clocking in at an eye-catching 1,066% over the past year. This suggests that positive sentiment is firmly in place.

If Bitmine’s bold moves have sparked your curiosity, this could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But as Bitmine’s recent gains push its valuation higher, investors are left wondering if the stock is still undervalued or if all the optimism surrounding Ethereum has already been priced in, leaving little room for upside.

Advertisement

Price-to-Book Ratio of 4615.6x: Is it justified?

Bitmine Immersion Technologies now trades at a staggering price-to-book ratio of 4615.6x, vastly exceeding both its industry and peer averages. This valuation puts the company’s last close at $46.65 firmly in “premium territory,” raising questions about whether fundamentals support such a lofty figure.

The price-to-book ratio compares a company’s market price to its book value. It serves as a simple gauge for how much investors are paying for net assets on the balance sheet. For technology and software companies, high multiples can signal strong growth expectations or major intangible assets. However, extremes like Bitmine’s suggest the market is pricing in extraordinary growth, far beyond today’s fundamentals.

Against the backdrop of the US software industry average of just 4x and a peer average of 14.7x, Bitmine’s price-to-book ratio stands out as exceptionally high. Investors should be cautious, as such a valuation leaves little margin for error should growth expectations falter.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 4615.6x (OVERVALUED)

However, rapid valuation expansion and ongoing net losses mean that any slowdown in revenue growth or a shift in crypto market sentiment could trigger swift reversals.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

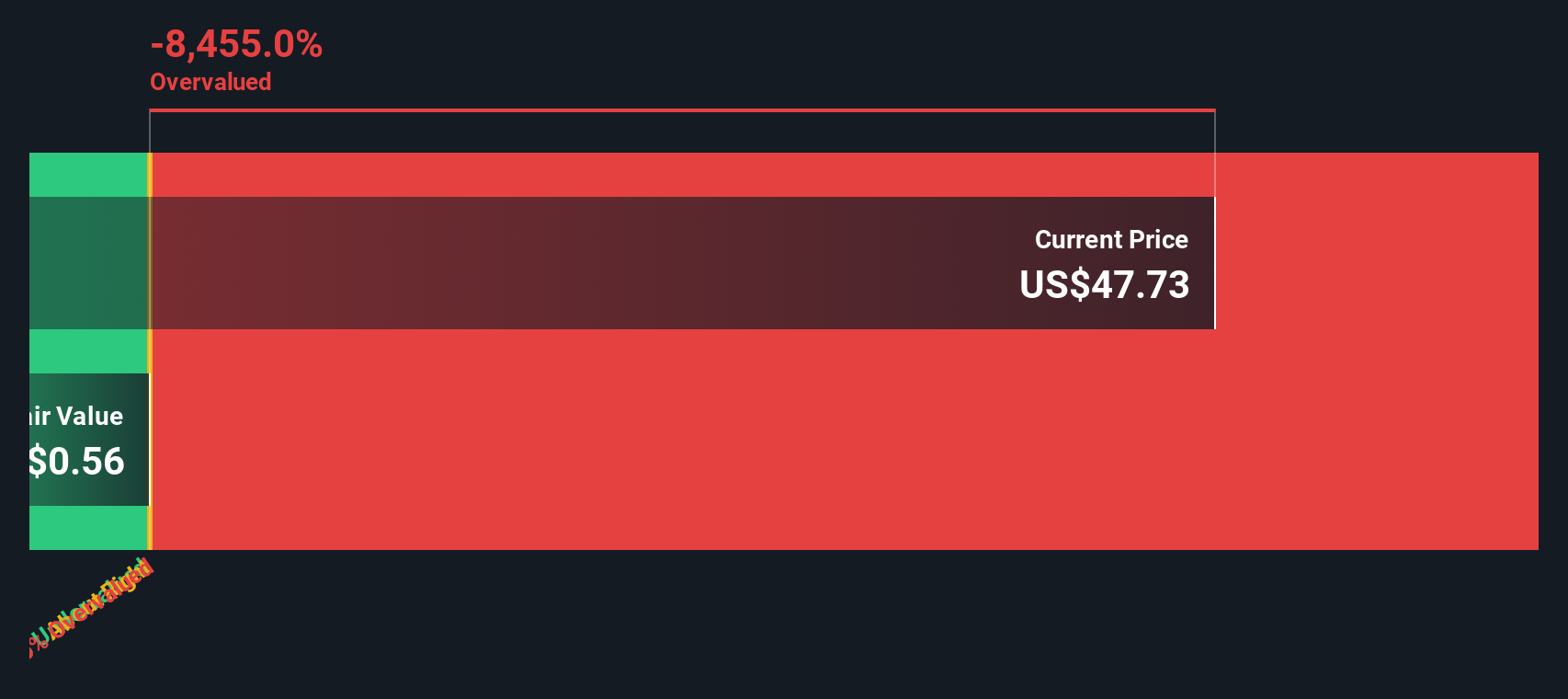

Another View: DCF Model Paints a Starker Picture

Looking at Bitmine Immersion Technologies through the lens of our SWS DCF model, the outlook is even more cautious. The DCF calculation places fair value at just $0.34, which suggests the current share price is dramatically above underlying cash flow expectations. Does this mean sentiment has run too far ahead of reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you’re looking to draw your own conclusions or want to dig deeper into the numbers, you can easily build a personalized analysis in just a few minutes. Do it your way

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not settle for just one opportunity. The market is filled with hidden gems and breakthrough trends. Step ahead by using these handpicked tools for smarter investing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post