BitMine Immersion Technologies (BMNR): Valuation in Focus After Building World’s Largest E

October 25, 2025

Bitmine Immersion Technologies (BMNR) just made headlines after acquiring more than 200,000 Ethereum in a matter of days. This brings its holdings to over 3.2 million ETH. Now holding 2.7% of the total supply, Bitmine is firmly establishing itself as the world’s largest Ethereum treasury.

See our latest analysis for Bitmine Immersion Technologies.

BMNR’s rapid accumulation of Ethereum, coupled with strong institutional backing, has brought a surge of attention and trading to the stock. Recent waves of buying activity have coincided with sharp moves in the crypto market, and BMNR’s 620% year-to-date share price return is a testament to the momentum building behind its Ethereum strategy. Over the longer term, the company boasts a 1,234% total shareholder return in just the past year, marking it as one of the market’s most explosive performers.

Curious where else momentum is surging? Now’s the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership.

With BMNR trading well below analyst price targets even after an explosive rally, investors now face a pivotal question: does the current price reflect all the upside from Bitmine’s Ethereum strategy, or could further gains lie ahead?

Advertisement

Price-to-Book Ratio of 4987.6x: Is it justified?

Bitmine Immersion Technologies is trading at a staggering price-to-book ratio of 4987.6x, putting the last close of $50.41 in sharp perspective and positioning it far above both industry peers and the software sector average.

The price-to-book multiple compares a company’s market value to its book value, giving investors a sense of how much they are paying for the company’s net assets. For tech and software companies, this ratio tends to be elevated due to intangible assets and growth expectations. However, BMNR’s figure exceeds even the loftiest benchmarks.

This extreme valuation signals the market is pricing in significant future potential, possibly attributed to its Ethereum holdings and anticipated revenue growth. Such a premium is unusual, even by aggressive software industry standards, where the average price-to-book is just 4x. The peer group average of 13.9x is much lower by comparison, suggesting BMNR’s current valuation is well beyond conventional multiples and reflects exceptional optimism about its outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 4987.6x (OVERVALUED)

However, sustained losses and reliance on Ethereum price momentum could undermine Bitmine’s lofty valuation if crypto markets turn or earnings disappoint investors.

Find out about the key risks to this Bitmine Immersion Technologies narrative.

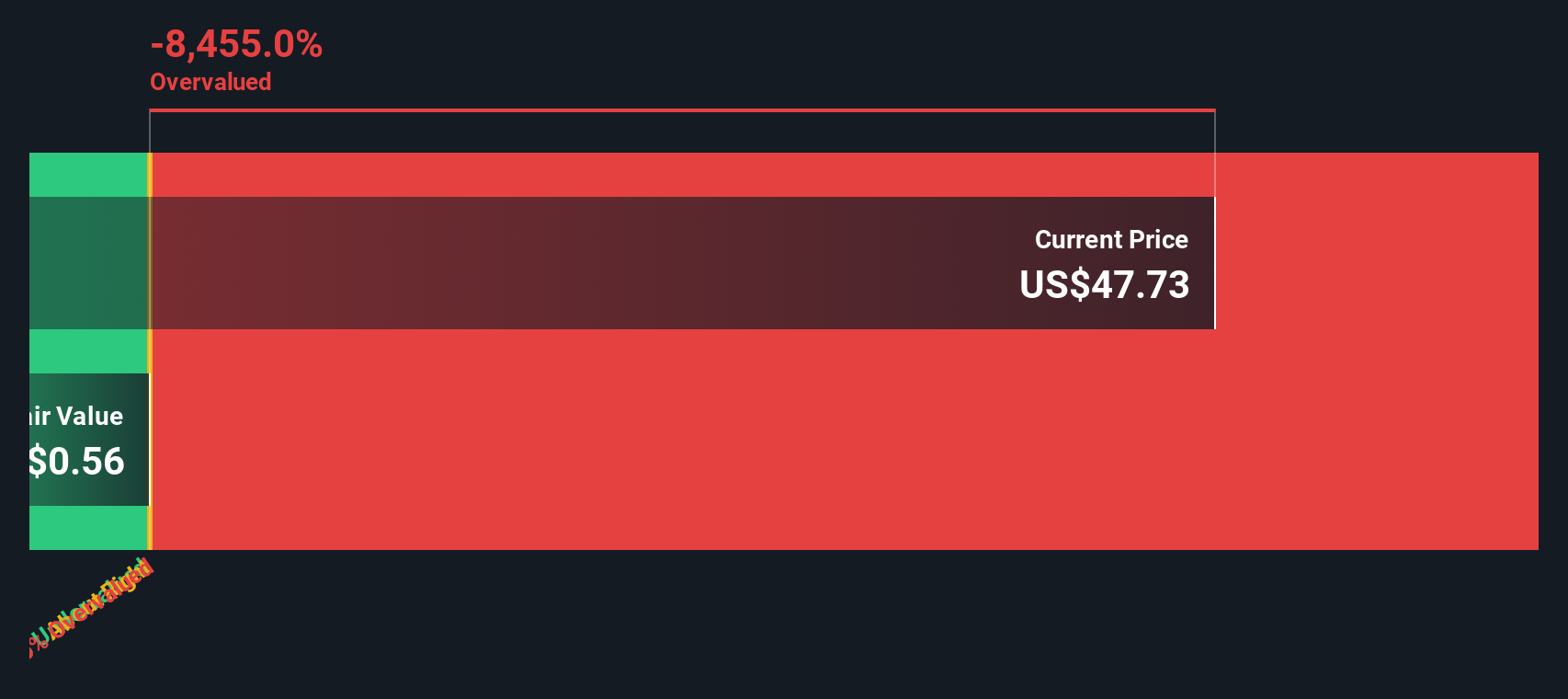

Another View: Discounted Cash Flow Tells a Different Story

Taking a step back from headline multiples, our DCF model tells a sharply different story on valuation. Based on fundamental cash flow projections, Bitmine Immersion Technologies appears significantly overvalued, with the latest fair value estimate sitting far below the current share price. Could the optimism around Ethereum be outpacing the company’s long-term fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bitmine Immersion Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Bitmine Immersion Technologies Narrative

If you think there’s another angle or want to dig deeper into the numbers yourself, you can build your own story about Bitmine Immersion Technologies in just a few minutes with Do it your way.

A great starting point for your Bitmine Immersion Technologies research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the biggest opportunities often go unnoticed until it’s too late. Don’t limit yourself; broaden your view with these hand-picked stock ideas and get ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Bitmine Immersion Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post