BitMine Raises $250 Million to Build Major Ethereum Treasury Position

July 1, 2025

BitMine Immersion Technologies has closed a $250 million private placement to implement an Ethereum treasury strategy, positioning the company to become one of the largest publicly traded holders of ETH, the NYSE American-listed mining firm announced in a statement.

It priced 55.5 million shares at $4.50 each, with proceeds funded through a combination of cash and cryptocurrencies.

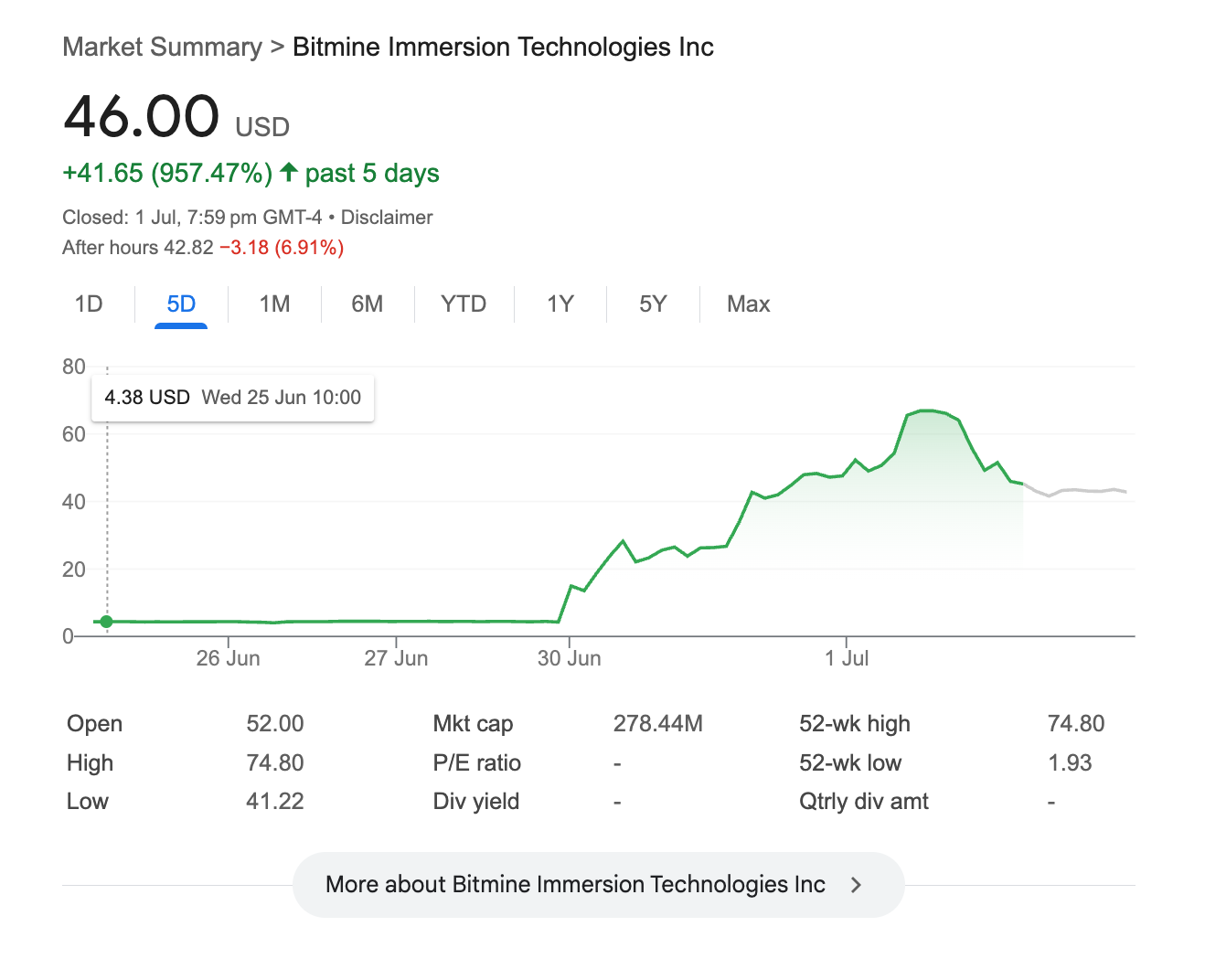

The announcement has driven explosive gains in BitMine’s stock price, with shares currently trading at $46.00, up $41.65 or 957.47% over the past five days. The dramatic surge reflects investor enthusiasm for the company’s pivot toward Ethereum treasury holdings, mirroring the stock performance seen in other crypto treasury adopters.

The transaction was led by MOZAYYX with participation from prominent investors including Founders Fund, Pantera, FalconX, Republic Digital, Kraken, Galaxy Digital, DCG, Diametric Capital, Occam Crest Management, and Thomas Lee. The offering is expected to close on today, subject to NYSE American approval and other customary conditions.

Tom Lee, founder of Fundstrat and the company’s newly appointed chairman of the Board, will lead BitMine’s strategic direction. “This transaction includes the highest quality investors across trad-fi and crypto venture capital, properly reflecting the rapid and continued convergence of traditional financial services and crypto,” Lee said.

The company plans to use net proceeds to acquire ETH as its primary treasury reserve asset, expanding beyond its traditional Bitcoin mining operations. BitMine will leverage Ethereum’s smart contract capabilities and decentralized finance mechanisms, including staking opportunities available on the network.

Lee, a prominent financial strategist and frequent contributor on CNBC, emphasized the strategic rationale behind the Ethereum focus, citing stablecoins as the “chatGPT of crypto” driving rapid adoption. He noted Treasury Secretary Scott Bessent’s recent projection that the stablecoin market could reach $2 trillion compared to the current $250 billion, with most stablecoin transactions occurring on Ethereum.

“One of the key performance metrics for BitMine going forward is to increase the value of ETH held per share,” Lee stated. The company expects to achieve this through reinvestment of cash flows, capital market activities, and ETH price appreciation.

CEO Jonathan Bates said the placement will accelerate BitMine’s treasury strategy following its initial treasury purchase on June 9, 2025. The company has partnered with FalconX, Kraken, and Galaxy Digital to develop its Ethereum treasury operations alongside existing custody partners BitGo and Fidelity Digital.

The company’s treasury holdings are expected to increase by over 16 times following the transaction.

Stay ahead of the curve. Join the Blockhead community on Telegram @blockheadco

Search

RECENT PRESS RELEASES

Related Post