BitMine Shares Tumble After Earnings as Ethereum Price Falls, Treasury Hype Fades

November 21, 2025

In brief

- BitMine disclosed $328 million in full-year income.

- The company will pay a one cent dividend next month.

- BitMine’s Ethereum holdings are down $1.8 billion.

BitMine Immersion Technologies, the largest corporate holder of Ethereum, reported $328 million in full-year income on Friday while declaring its first dividend, but its share price fell amid concerns about digital asset treasury strategies and ETH’s recent price drop.

The company that owns $9.6 billion worth of Ethereum plans to pay common stockholders a dividend of one cent per share next month, according to an SEC filing. BitMine said the move “reflects the company’s commitment to create shareholder value.”

BitMine shares recently changed hands around $24.65, a 5.3% decrease on the day, according to Yahoo Finance. The company’s stock price has plunged 52% over the past month, as many crypto treasury firms have been battered by swooning crypto prices.

“History shows crypto prices stage V-shaped recoveries after a lingering and drawn out decline, and we expect this to again be the case in this current drawdown,” BitMine Chairman and Fundstrat co-founder Tom Lee said in a statement.

Lee linked the current route to a drop in market liquidity on Oct. 10 last month, when $19 billion worth of leveraged positions were liquidated in the crypto market. Lee noted that the fallout represented the largest liquidation event in the crypto market’s history.

Unlike Bitcoin, Ethereum can be natively staked, allowing firms like Bitmine to grow their holdings by validating transactions and earning rewards. But the company hasn’t staked any of its Ethereum holdings in a material way yet.

BitMine is building a “Made in America” validator network, which plans to go live in the first quarter of next year. Along those lines, the company said it’s selected three pilot partners “to conduct a live test of their staking capabilities using a small portion of our ETH.”

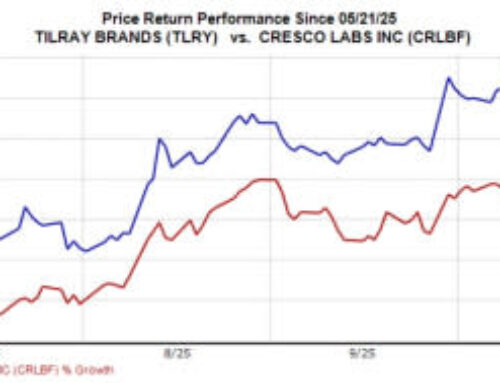

BitMine’s stock price has underperformed Ethereum as the digital asset’s price has fallen 28% over the past month to a four-month low of $2,700, according to crypto data provider CoinGecko. When BitMine first purchased Ethereum, it was valued around $3,600 in July.

BitMine currently owns 192 Bitcoin, as well as 3.55 million Ethereum, the latter of which was purchased at an average cost of around $3,120, according to a previous press release. It also owns a stake in the crypto treasury firm, Worldcoin, alongside $607 million in unencumbered cash.

Although crypto prices haven’t recovered since Oct. 10, Lee said the current market cycle’s peak could be as far as three years away, while acknowledging that the performance would be a departure from the four-year cycles that crypto prices have historically followed.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Search

RECENT PRESS RELEASES

Meta is building a ChatGPT-rival with an early morning social twist

SWI Editorial Staff2025-11-21T12:07:58-08:00November 21, 2025|

Facebook Tests ‘Project Luna’: Will It Challenge ChatGPT?

SWI Editorial Staff2025-11-21T12:07:37-08:00November 21, 2025|

Facebook Tests ‘Project Luna’: Will It Challenge ChatGPT?

SWI Editorial Staff2025-11-21T12:07:06-08:00November 21, 2025|

Waste management SVP Carrasco sells $299k in stock By Investing.com

SWI Editorial Staff2025-11-21T11:24:14-08:00November 21, 2025|

Keybanc starts bullish on Elanco and Zoetis By Investing.com

SWI Editorial Staff2025-11-21T11:23:52-08:00November 21, 2025|

Exclusive-Glass Lewis mulls US investment adviser registration, could ease criticism By Re

SWI Editorial Staff2025-11-21T11:23:29-08:00November 21, 2025|

Related Post