BlackRock’s $2.5B BUIDL Fund Hits BNB Chain as BNB Outperforms Bitcoin and Ethereum Year t

November 15, 2025

Now BNB is getting a double boost as BlackRock moves its $2.5 billion BUIDL fund onto BNB Chain and Binance starts taking the tokenized Treasuries as collateral. At the same time, fresh performance data show BNB beating Bitcoin, Ethereum and other majors year to date, underscoring the network’s growing pull with institutions and traders.

BlackRock has launched its USD Institutional Digital Liquidity Fund (BUIDL) on BNB Chain, bringing more than $2.5 billion in tokenized U.S. Treasuries to the network through a new share class.

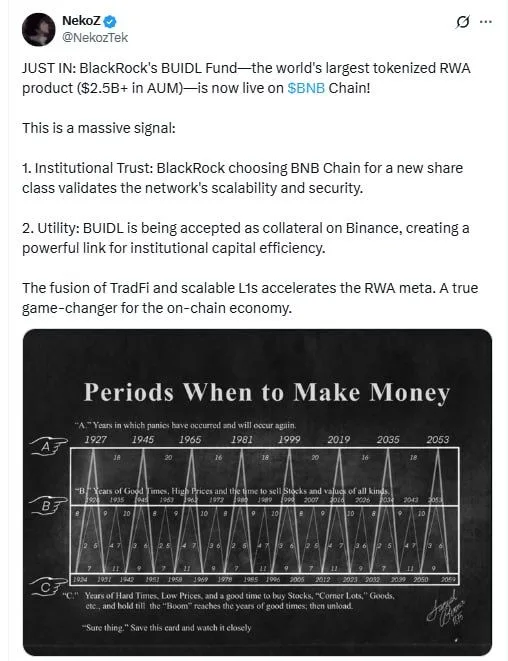

BlackRock BUIDL on BNB Chain. Source: NekoZ

The move signals deeper institutional use of BNB Chain, highlighting its capacity to handle tokenized securities at scale. BUIDL already operates on other public blockchains, and this expansion adds another venue for qualified investors to hold on-chain fund shares.

At the same time, Binance is accepting BUIDL as collateral, linking tokenized Treasuries directly to trading activity on the exchange. Institutions can post BUIDL positions to back strategies while maintaining exposure to short-term U.S. debt, reinforcing the broader shift toward real-world assets on public blockchains.

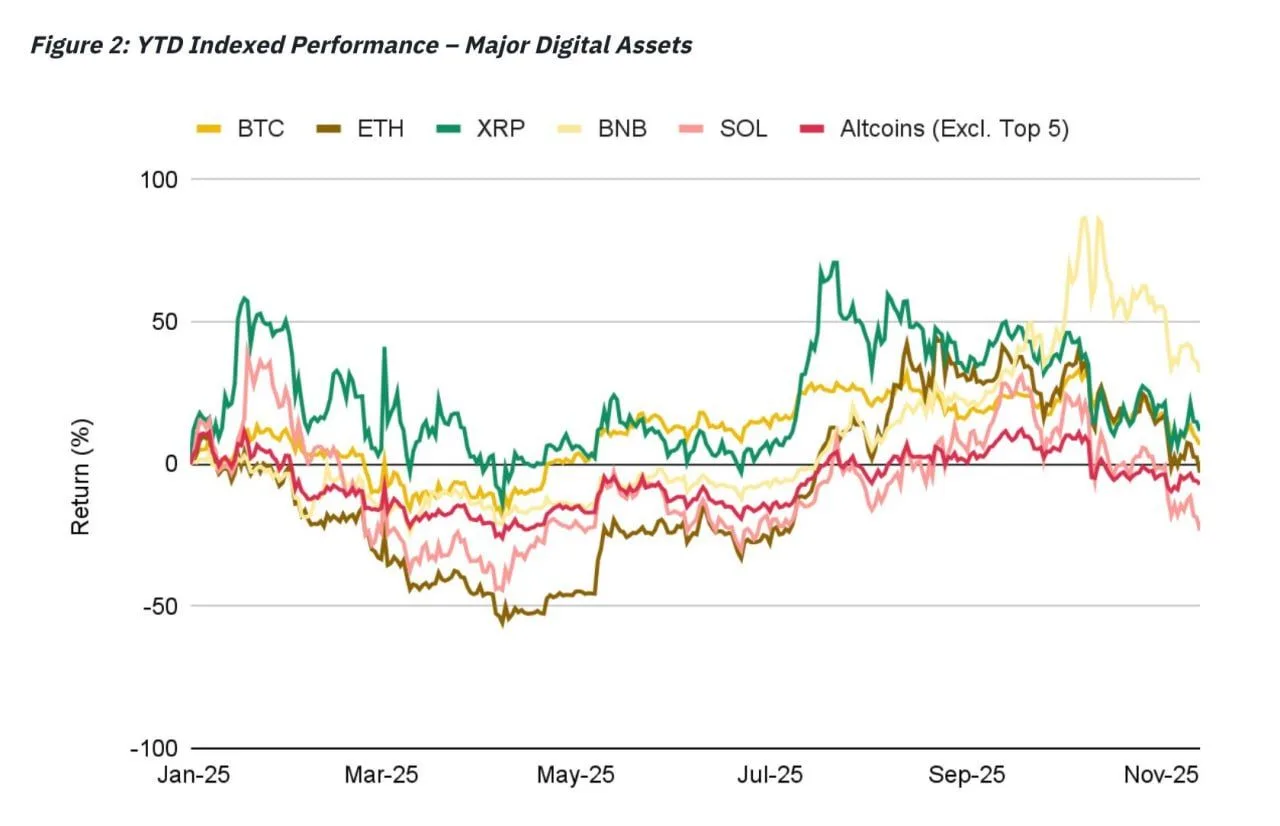

Meanwhile, year-to-date performance data show BNB holding the strongest position among the major digital assets. The chart shared by Rand illustrates how BNB stayed above its peers through multiple market swings, even as other top assets struggled to maintain positive returns.

BNB Year To Date Outperformance. Source: Rand

Through the first-quarter volatility, BNB moved back toward the breakeven line faster than Bitcoin, Ethereum and Solana. As the year advanced, the token kept a steadier trajectory while competing assets dipped into deeper drawdowns, especially during mid-year corrections. The chart also shows XRP’s wide spikes early in the year, yet its gains faded as BNB continued to hold a more consistent lead.

Toward the final stretch of the year, BNB remained the only major asset to sustain meaningful positive returns. Bitcoin and Ethereum hovered near or below zero, while Solana and the broader altcoin group slipped into negative territory.

Search

RECENT PRESS RELEASES

Related Post