Brazil’s Renewable Energy Faces Crippling Curtailment Challenges

October 3, 2025

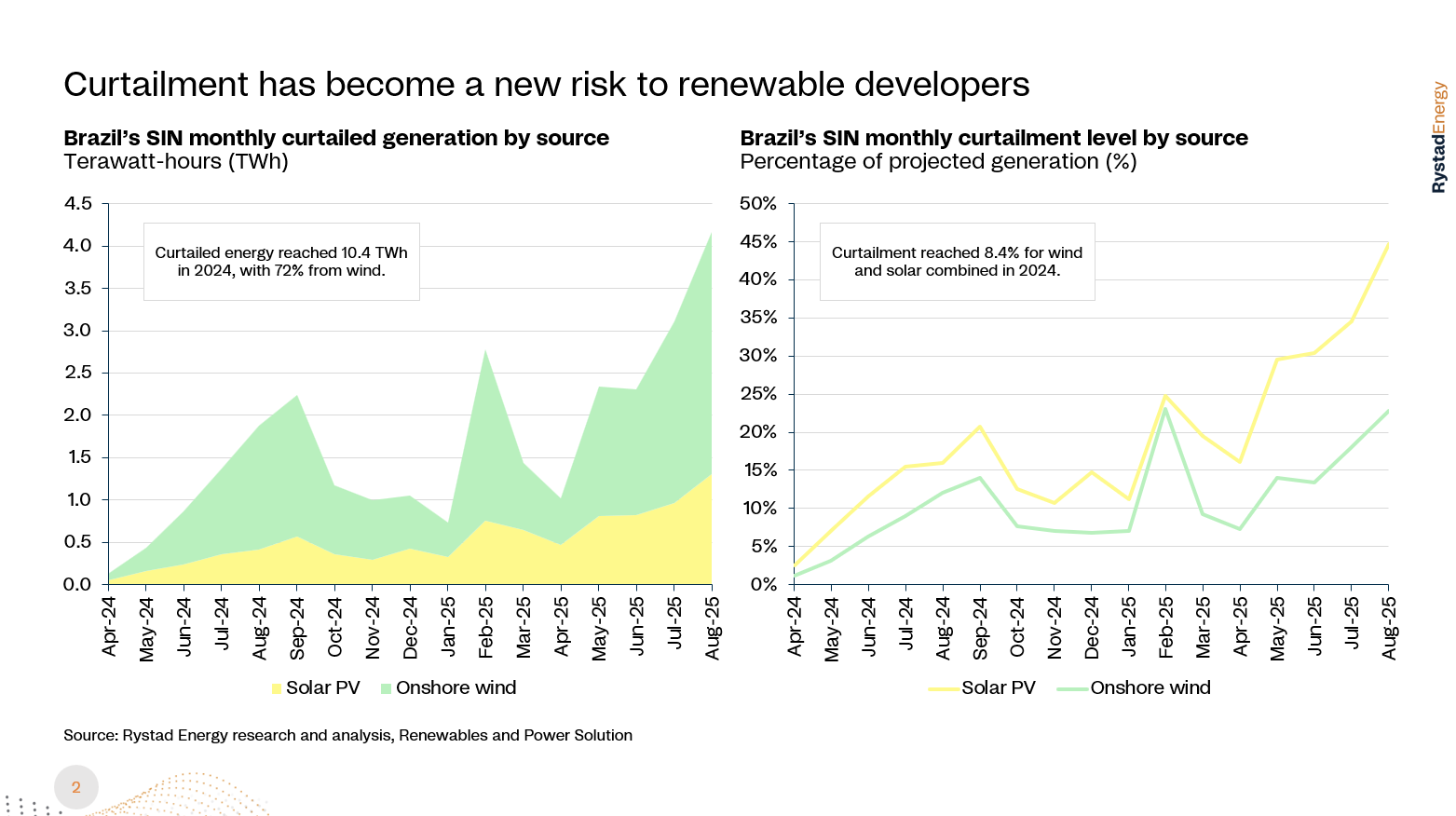

Curtailment has become a very relevant issue in Brazil as renewable penetration grows. In short, curtailment is the forced reduction of renewable generation, which typically occurs when there is too much intermittent generation on the grid and insufficient transmission infrastructure. Operators are then required to shut down units to balance the system. The main drivers are transmission bottlenecks, operational restrictions related to grid stability and reliability and localized oversupply. We can split these into two major categories: infrastructure and demand. As of this year, non-hydro renewables already make up about one-third of Brazil’s power matrix, and curtailment has increased to very concerning levels. By August alone, we estimate nearly 20 terawatt hours of curtailed generation, double the total observed in 2024. Roughly half of this is linked to demand issues, while the other half stems from infrastructure constraints.

Although wind makes up most of the curtailed generation in absolute terms, solar is proportionally the most affected. Curtailment has reached about 27% for solar in 2025, compared to 16% for wind, both much higher than last year.

Which regions of Brazil are most exposed to renewable curtailment?

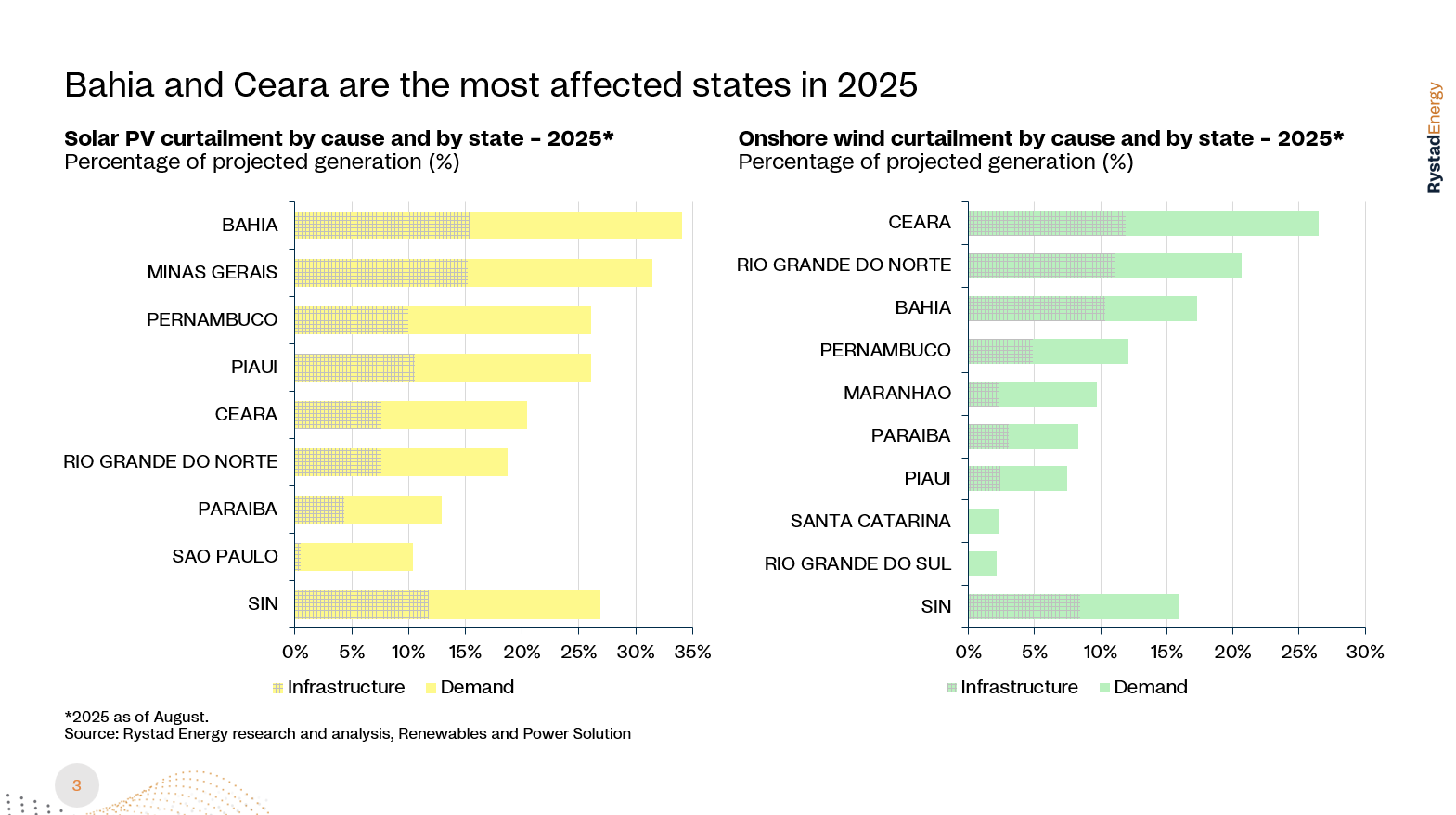

Most of Brazil’s solar and wind resources are concentrated in the northeast, and this is the region most affected by curtailment. Transmission bottlenecks in the area limit the ability to export surplus generation to the main load centers in the southeast, leading to congestion and forced shutdowns.

Looking more closely, Bahia is the most affected state for solar generation, with curtailment surpassing 30%. For wind, Ceará is the most exposed, already exceeding 25%. Other states in the northeast are also impacted, along with Minas Gerais in the southeast. Overall, the northeast stands out as the most vulnerable region, making new transmission lines critical for alleviating the issue.

What risks does curtailment pose for project developers?

For operational projects, curtailment leads directly to revenue losses, as compensation mechanisms remain under discussion. This reduces predictability of future revenues and lowers asset valuations.

For new projects, the implications are even more serious. Lenders perceive higher risks, which translates into more expensive loans, stronger guarantee requirements and higher risk premiums. As a result, PPA prices for renewables are expected to rise as developers incorporate these risks. Large consumers should therefore anticipate more expensive renewable energy in the near future.

Curtailment also impacts the development pipeline, since investors are now more cautious and uncertain about long-term risks. For context, we estimate curtailment costs this year to be around $10 per megawatt hour for wind and $20 per megawatt hour for solar, very significant compared to current PPA prices. Curtailment is thus a structural problem likely to persist, even if not at today’s extreme levels.

What actions must be taken to reduce curtailment, and how can developers mitigate curtailment risks?

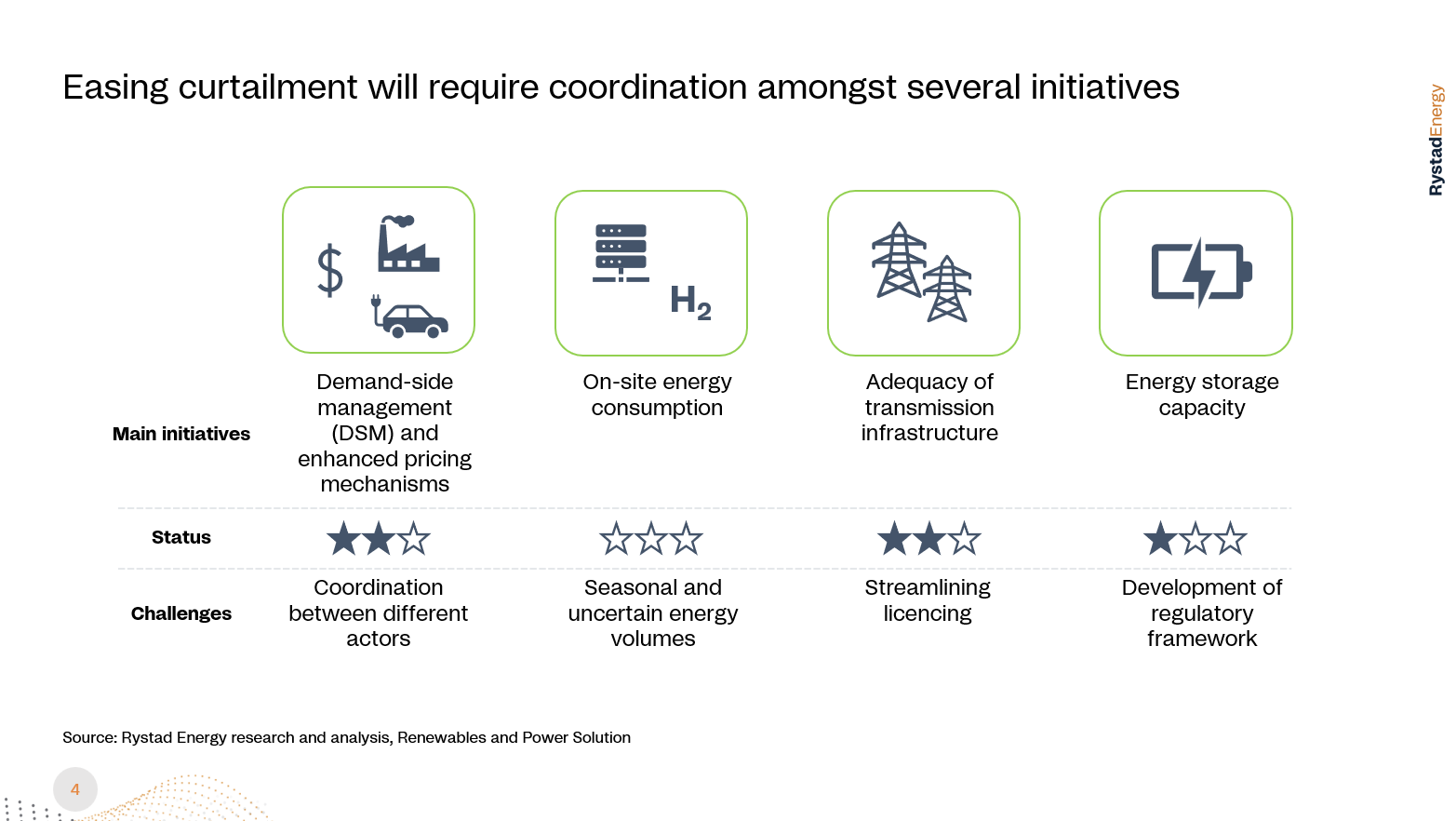

Easing curtailment will require coordinated actions across both demand and infrastructure. On the demand side, one option is to enhance pricing mechanisms for end users, incentivizing greater consumption during times when solar or wind generation peaks. Another approach is to add new on-site demand, such as crypto mining or green hydrogen production, to absorb surplus generation.

Related: EIA Rattles Oil Markets With Reports of Crude Oil, Product Builds

On the infrastructure side, expanding transmission remains the most important action. Brazil has successfully used transmission auctions, and new lines are expected online soon to increase export capacity from the northeast. However, more planning is needed to accommodate future demand drivers such as hydrogen production, data centers and fleet electrification.

Battery storage is another potential solution for highly affected projects, but Brazil still lacks a regulatory framework for energy storage. We expect regulation to be introduced next year, which should help unlock investment.

In the meantime, developers can mitigate risks by carefully selecting project sites with stronger grid infrastructure, diversifying portfolios geographically and by energy source and including contractual provisions in PPAs to account for curtailment events. At Rystad Energy, we track curtailments on a daily basis for every project in Brazil, enabling our clients to make more informed decisions when evaluating assets.

A new conflict in the Middle East… a surprise OPEC+ decision… a massive shift in Chinese demand. Most investors only react to the headlines.

Oilprice Intelligence brings you the signals before they become front-page news. This is the same expert analysis read by veteran traders and political advisors. Get it free, twice a week, and you’ll always know why the market is moving before everyone else.

You get the geopolitical intelligence, the hidden inventory data, and the market whispers that move billions—and we’ll send you $389 in premium energy intelligence, on us, just for subscribing. Join 400,000+ readers today. Get access immediately by clicking here.

By Muched Nassif, Vice President, Renewables & Power Research for Latin America at Rystad Energy

More Top Reads From Oilprice.com

- Fire Erupts at Chevron Refinery in California

- India Eyes Long-Term U.S. LPG Supply

- AI Demand and Grid Upgrades Drive Fresh Copper Boom

Search

RECENT PRESS RELEASES

Related Post