Buy Bitcoin Now, But Take Care

December 8, 2025

Two weeks back, I wrote that Bitcoin would likely not pass $100k yet. Price hit $99k briefly, then fell. It now trades flat under $90k.

Most ask the same thing: “Is it time to buy?”

To start: yes. It is a good time to buy in parts.

But you must set a tight stop loss.

This report was independently authored by Ryan Yoon, separate from Tiger Research’s views.

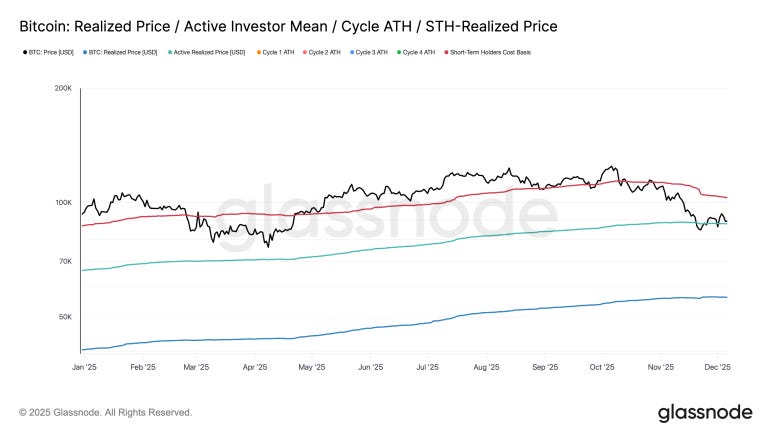

Price sits safe above the $87.9k (Active Realized Price). This is the mean cost for active buyers.

It acts as a break-even line for the whole market. After the 2022 crash, it took a year and a half to reclaim this level. Since price dipped and came back up, the market can breathe.

Watch this point close. Use it as your cut line.

Also, watch the relationship between the short-term holder cost and the Active Realized Price. If the short-term line crosses below the active line, risk grows fast. For now, this bad cross has not taken place.

Key on-chain tools show a dip, but the chance for gain is high. We are at the base of a fair zone.

The MVRV Z-Score sits at 1.17. It left the cheap zone but has not climbed far. Growth slows here as buyers and sellers mix. The trend is weak and unclear.

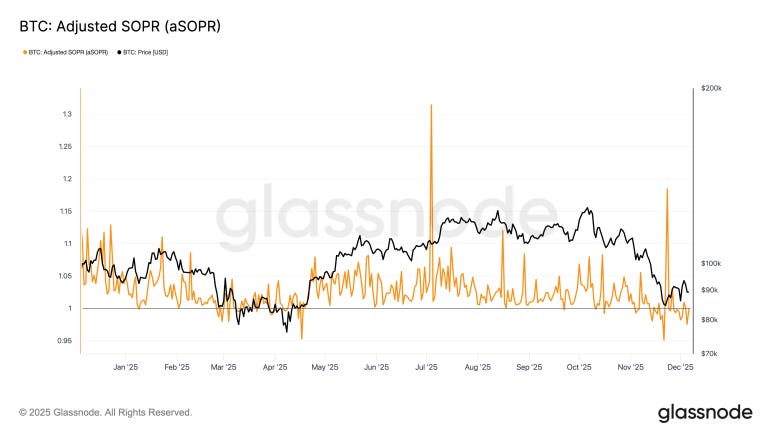

aSOPR is flat at 1.0. Sellers trade at cost. They sell even with low gains.

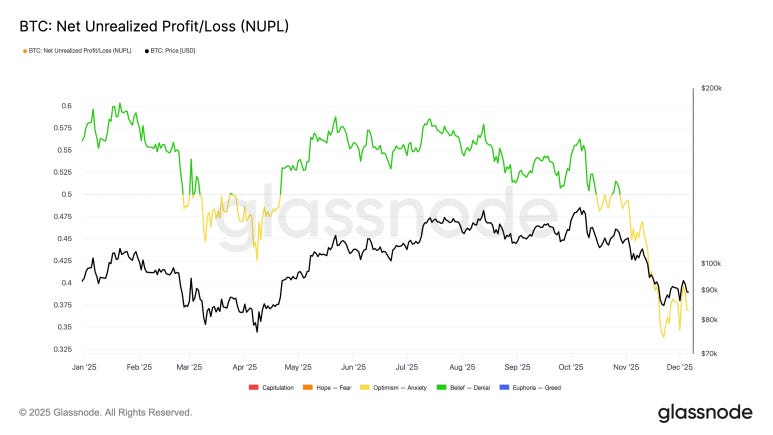

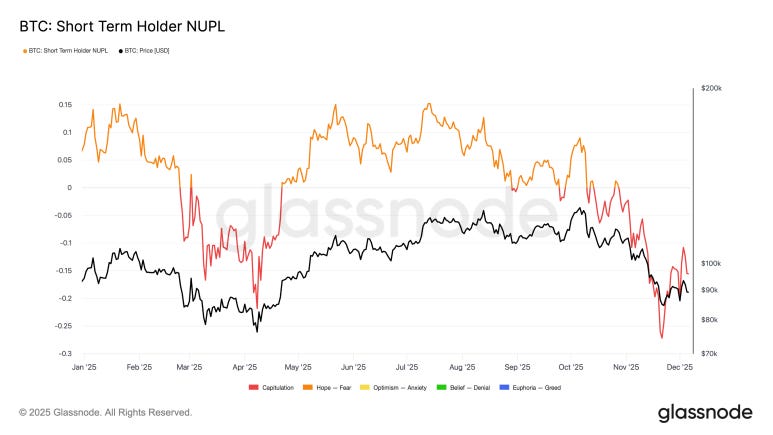

NUPL is 0.36, just inside the fair zone. Short-Term Holder NUPL is -0.155. New buyers hold a loss. As soon as price hits their cost, they sell. This confirms a weak mood.

In sum, holders sell at slight gains. But note this: MVRV near 1.10 is a prime spot to buy for the long haul. Risk is low. Past data shows a 40% gain a year from this point.

A drop below $84k brings huge risk. It causes long-term harm.

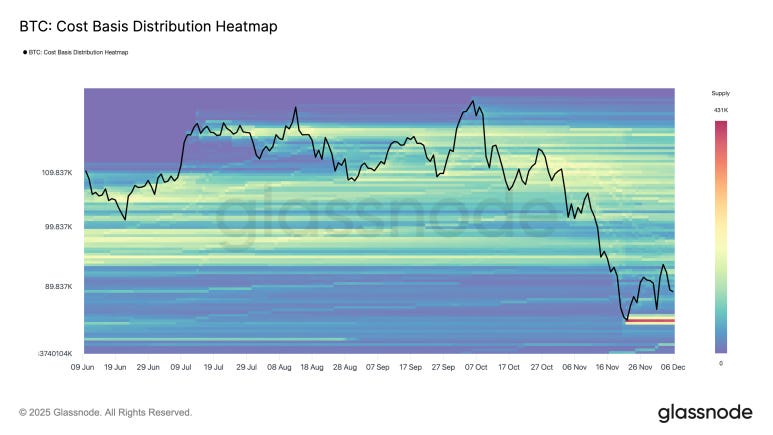

The Cost Basis map shows a thick wall of supply near $84k ($83k–$85k). This is the buy price for recent crowds. If price fails here, short-term holders face deep loss. This sparks panic sales.

A hard break below $84k breaks the market structure. When price hit $83k on Dec 1, fear spiked. $84k is not just a line on a chart. It stands as the last guard for the group break-even point.

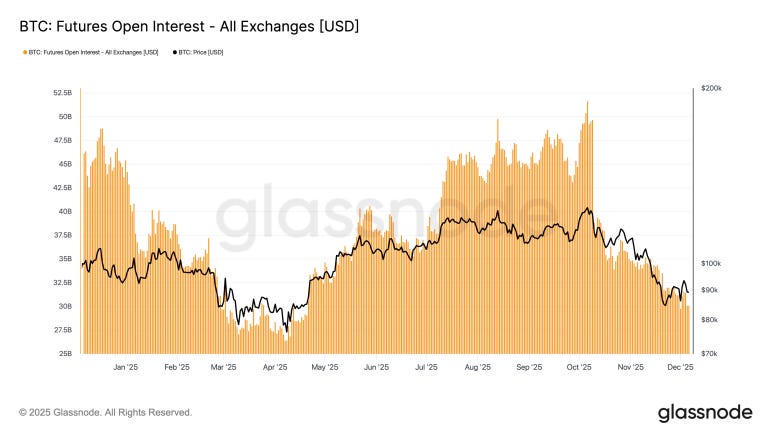

Open Interest (OI) in the futures market fell back to April lows. This drop shows that wild leverage bets have been flushed out.

This sharp drop is good news. Low leverage cuts the risk of a crash or cascade. The market has purged the froth. It can now try to rise on firm ground. We can look for a new trend to start from this safe base.

On-chain tools show a prime spot to buy. The froth is gone. Expecting reward beats risk. It makes sense to build a position now.

But if you care about risk, do not just buy. Set a clear stop-loss line. The market is still vague.

If price falls below the Active Realized Price, most active traders will face a loss. This shifts the mood to fear. A crash could follow.

Set your stop at $87,900. This lets you buy the dip but cuts risk if the main support breaks. Save your cash if the floor falls out.

This report was authored by Ryan Yoon and published via Tiger Research. The views expressed are solely those of the author(s) and do not reflect Tiger Research’s views. Neither the author nor Tiger Research warrant the accuracy or completeness of the information. We disclaim liability for losses arising from use of this report. This document is for informational purposes only and should not be considered investment, legal, or tax advice.

When citing this report: 1) attribute the original author, 2) state ‘Published via Tiger Research’, 3) include the Tiger Research logo. Restructuring or commercial use requires separate negotiation with the author. Unauthorized use may result in legal action.

Search

RECENT PRESS RELEASES

Related Post