BYD: The ‘Better Tesla’ Is A Bargain

December 3, 2023

Summary

- BYD is growing at a much faster rate than Tesla and is expected to overtake Tesla in pure BEV sales this quarter.

- BYD has better control over the supply chain and is partially owned by Berkshire Hathaway, giving it a strong endorsement.

- BYD has higher business and revenue growth rates, expanding gross margins, and increasing profits compared to Tesla.

- I am Jonathan Weber. I hold a degree in engineering and I’m a freelance analyst covering primarily value stocks for nearly a decade. I contribute to the investing group Cash Flow Club

Leonhard Simon/Getty Images News

Article Thesis

BYD (OTCPK:BYDDY) (OTCPK:BYDDF) is an electric vehicle maker that is, I believe, in several ways advantaged versus Tesla (TSLA). While it does not get the hype and attention Tesla gets, it is growing at a much faster rate, has better control over the supply chain, and trades at a much lower valuation.

Past Coverage

I wrote an article on Tesla’s investor day, in which I also discussed BYD and Lucid, at the beginning of the year. In this article, I argued that if Tesla were to introduce a lower-priced model in the near term, that could negatively impact BYD’s sales trajectory. But since the model 2 is still very likely several years out, it does not look like this will be a major near-term headwind for BYD. In that article, I gave BYD a “hold” rating. Since then, prices pulled back slightly and the company has enjoyed significant business and profit growth since then, which is why I am now more bullish compared to the beginning of the year.

BYD: An Underfollowed EV Leader

BYD, which stands for “Build your Dreams”, is one of the largest electric vehicle players in the world. When one counts both battery electric vehicles and plug-in hybrids (which have both an electric and a combustion engine), BYD has been the biggest EV company in terms of vehicle sales for a while. When one counts battery electric vehicles only, which is something that some investors believe is a more telling metric, then BYD has been the second-biggest EV company for some time, trailing Tesla. The company will, however, according to some forecasts, e.g. by fellow Seeking Alpha author The Asian Investor, likely overtake Tesla in pure BEV sales in the foreseeable future due to its higher growth rate.

BYD is a Chinese company, so many Western investors are somewhat reluctant to invest in BYD, but BYD is even underfollowed compared to other Chinese EV players such as NIO (NIO) or XPeng (XPEV), despite BYD being a lot larger. The fact that BYD is partially owned by Berkshire Hathaway (BRK.A) (BRK.B) makes for a very serious endorsement by one of the most prominent investors in the world — Warren Buffett. Many other Chinese companies don’t have similar endorsements, which makes the fact that BYD is underfollowed by Western investors even more surprising.

Advantages Of BYD Versus Tesla

Tesla is seen, by many, as the best stock to be in when it comes to EV investments. And the company has been a first-mover which has also been the first to hit profitability on a major scale. Nevertheless, I believe that a good case can be made for BYD being the more favorable pick among these two companies, as I will lay out in this section.

First, BYD is growing at a way faster pace. During the most recent quarter, Tesla saw its deliveries rise by 27% compared to the previous year’s period, reaching 435,000 vehicles, which was good enough for a 9% revenue growth rate. While a deliveries growth rate in the 20s is far from bad, it also is far from dramatically high — BYD saw its deliveries soar to 824,000 vehicles. Its BEV sales, not counting its plug-in hybrid sales, totaled 432,000 vehicles during Q3, marginally below Tesla’s delivery number. But while Tesla saw its deliveries rise at a high 20s pace, BYD saw its BEV deliveries rise by close to 70% during the most recent quarter — around 2.5x the growth rate that Tesla has generated. Not surprisingly, this is also reflected in the revenue growth rate of the two companies. Tesla’s 9% revenue growth is reasonable in absolute terms, but not what a high-growth investor would want to see from an EV player — BYD, however, saw its revenues rise by 37% during the most recent quarter. BYD’s revenues grew less than its deliveries, due to the fact that some of its revenue is generated in other business units, such as the battery supplier business. Nevertheless, BYD grew its revenue at a rate that is more than 4x as high as Tesla’s revenue growth rate.

The EV industry is a growth industry, and the company that grows faster will gain more market share and benefit more from operating leverage and scale advantages. At least for now, the faster-growing company among these two clearly is BYD, which has both a higher business/deliveries growth rate and a way higher revenue growth rate at the same time.

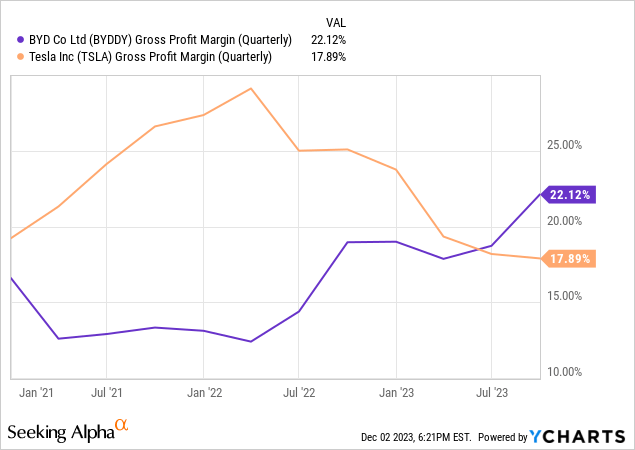

The second reason for me to favor BYD over Tesla is that BYD’s margins are, unlike those of Tesla, moving in the right direction. Tesla has long been called a premium company due to its above-average margins, and many bulls believed that this would warrant a high valuation. But Tesla’s margins have been declining for quite some time, while BYD’s margins keep rising further and further:

Data by YCharts

Tesla’s gross margin peaked in early 2022 and has been declining since, now standing at less than 18% as of the end of the most recent quarter. Meanwhile, BYD’s margin has moved upwards over the same time frame, now a little north of 22% — or more than 400 base points higher than Tesla’s gross margin.

I believe that it is telling that Tesla’s comparatively weak business growth is only made possible by sacrificing margin, i.e. by lowering prices to push vehicles into the market. This does not hold true for BYD, which is scaling up its operations while growing profitability quite a lot at the same time. Over the last one and a half years, BYD’s gross margin has expanded by ~1,000 base points, while Tesla’s gross margin has dropped by ~1,000 base points over the same time frame — which is a dramatic difference that is not recognized by many Tesla bulls.

BYD saw its net profit grow by 82% year over year during the most recent quarter, as profits soared to 10.4 billion Renminbi, or around $1.5 billion. Tesla, on the other hand, saw its net profit decline by 44% year over year, with net profit hitting $1.9 billion for the period. So while Tesla is still slightly more profitable, its profits are slumping, while BYD’s profits are soaring — with much better business growth and expanding gross margins thanks to pricing power, that’s not a surprise. Unless something changes drastically, I believe that BYD’s profit growth rate will remain superior compared to Tesla’s profit growth rate in the near term.

The third reason why I believe that BYD is in a good position relative to its overall peer group and relative to its most important competitor Tesla is the fact that BYD controls a highly important section of the BEV supply chain directly: Batteries. BYD is not only an EV manufacturer but also a battery producer. Batteries are highly costly and extremely important for the performance (charging speed, range, and so on) of an EV. The company that has the best battery tech and that controls said tech is in an advantaged position — and since BYD can manufacture its own batteries, it looks like the best-positioned EV player from that viewpoint. BYD supplies batteries to other EV players, including Tesla, which means that BYD also generates profits and revenues when other EV players experience business growth — other EV players are solely dependent on their own delivery growth rate.

Tesla And BYD: Non-Auto Business Units

Many Tesla bulls claim that Tesla is much more than an automobile company as it also has some non-auto business units such as energy storage and production. And while it is true that Tesla has these additional business units, it remains highly dependent on its auto revenues and profits. The energy storage business isn’t really a unique thing for Tesla, either — BYD has the same business. One can buy home energy storage systems from BYD, with BYD making money across the entire value chain of that product, as it produces batteries itself.

On top of that, BYD is leading Tesla in another attractive growth market: Commercial electric vehicles. While Tesla has gotten some attention for its Semi trucks, BYD is way ahead of Tesla. It has been manufacturing commercial vehicles such as buses and trucks for quite some time, while Tesla’s Semi hasn’t generated meaningful sales yet. The fact that BYD has not gotten a lot of attention despite being a leader in the commercial EV market could be advantageous for those who buy shares of this still pretty cheap EV giant at current prices.

Risks To Thesis

I believe that BYD is advantaged versus Tesla and other EV players, but there are some potential risks to this thesis.

First, due to being a Chinese company, BYD has higher political risks. I do not believe that it is in the interest of China to hurt its top companies, but one never knows. It should be noted, however, that Tesla’s most important and most profitable factory is in China, so Tesla could be at risk as well in case Chinese politicians were to move against the company in the future.

Second, while Tesla has been overpromising and underdelivering when it comes to its self-driving tech for years, Tesla might hit a home run eventually. If Tesla can solve self-driving under all conditions before anyone else, that would be a huge advantage for the company relative to BYD and other EV competitors.

Is BYD A Good Investment?

BYD has not gotten a lot of attention, but the company combines many positives. First, it has been highly successful at ramping up production without running into significant bottlenecks. Its delivery growth rate remains excellent, driving superior revenue growth. The company is also faring very well in the current EV price war, as it is, unlike competitors, able to grow its margins. When a company’s margins keep climbing while competitors see their margins get squeezed, the company with the expanding margins has to be doing something right.

With control over its battery tech and production, BYD also could be more independent compared to EV manufacturers that are highly dependent on key suppliers.

Last but not least, BYD is extraordinarily cheap for an EV company. While BYD is not a bargain compared to legacy auto companies that oftentimes trade at single-digit earnings multiples, BYD’s forward earnings multiple of 17 is very low compared to how other EV players are valued. Most are not profitable anyway, while Tesla is trading at 75x forward net profits. When one can buy shares of a company with rising margins and a ~70% delivery growth rate for less than 20x net profits, that seems like quite the bargain. Of course, this does not guarantee any share price gains, but I believe that BYD is among the best positioned to generate meaningful gains in the coming years in this embattled market with a lot of competition. And Warren Buffett seems to agree, as he has decided to own BYD, but not Tesla, Lucid, Rivian, NIO, XPeng, and so on. I believe that BYD is a superior choice for those who want EV exposure, although investors should note that automobile companies can be cyclical, and even BYD will feel headwinds during a potential recession.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Is This an Income Stream Which Induces Fear?

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BYDDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Search

RECENT PRESS RELEASES

Related Post