California Bill Aims to Repeal Cannabis Excise Tax Increase

February 20, 2025

Plummeting prices, less revenue, fewer licenses, debt, wildfires and the ongoing threat of a tax hike—that’s the tip of the iceberg for California’s cannabis market in early 2025.

Specifically, California is set to increase its cannabis excise tax at retail from 15% to 19% starting on July 1, 2025, as a result of a compromise elected officials made three years ago with certain beneficiaries of cannabis tax revenue.

However, one legislator is planning to stop that increase from happening.

Assemblymember Matt Haney, D-San Francisco, who chairs the Housing and Community Development Committee, introduced Assembly Bill 564 on Feb. 12. The legislation would repeal a requirement for the California Department of Tax and Fee Administration (CDTFA) to adjust the cannabis excise tax rate by a percentage that was written into law in 2022.

This forthcoming tax hike comes after roughly 27% of U.S. cannabis businesses reported being profitable in 2024, according to a Whitney Economics survey. Meanwhile, approximately 65% of all small businesses in the country were profitable last year.

In California, where the average price per ounce for cannabis flower has dipped 38% since 2020, and statewide sales have shrunk 13% since 2021, according to the California Department of Cannabis Control (DCC), many licensed operators are hanging on by a thread from market conditions alone, much less from some elected officials treating the industry as merely a revenue stream.

At the beginning of 2024, 15% of California’s licensed dispensaries were in default on their excise taxes.

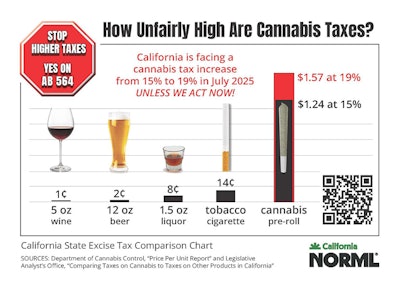

According to California NORML, which sponsors A.B. 564, the state levies a 1-cent tax on a glass of wine, 2 cents on a can of beer, 8 cents on a shot of liquor and roughly 14 cents on a single cigarette, while one cannabis pre-roll is taxed at $1.24 under the current 15% excise tax.

In January, Haney told SFGATE that increasing taxes on cannabis businesses wouldn’t just impact their ability to turn a profit but likely drive many operators out of the licensed market.

“I definitely understand the regulatory authority needs more resources, but that can’t be at the expense of putting out businesses that are already hanging on by a thread,” Haney said.

The scheduled tax hike stems from when Gov. Gavin Newsom signed Assembly Bill 195, which was attached as a trailer to the California 2021-2022 budget. Although A.B. 195 eliminated the state’s $161-per-pound cannabis cultivation tax on July 1, 2022, the legislation included a compromise with Tier 3 entities to make up for the lost funding.

That cultivation tax, in particular, accounted for more than $166 million in state revenue in 2021, according to the CDTFA. Increasing the cannabis excise tax at retail an additional four percentage points would generate roughly that same amount under current market conditions.

Under A.B. 195, childcare programs and youth groups; environmental, wildlife and conservation programs; law enforcement and justice organizations; drug treatment prevention centers; and other Tier 3 programs were to receive a minimum of $670 million in baseline funding from annual cannabis tax revenues to avoid a take hike.

Newsom’s 2025-26 budget estimates $468.2 million in cannabis tax revenue will be available to allocate to Tier 3 programs for the fiscal year:

- Education, prevention, and treatment of youth substance-use disorders and school retention—60 percent ($281 million)

- Clean-up, remediation, and enforcement of environmental impacts created by illicit cannabis cultivation—20 percent ($93.6 million)

- Public safety-related activities—20 percent ($93.6 million)

That’s more than $200 million less than the baseline amount needed to avoid the tax hike.

Fifty-six of these entities signed a letter to Newsom and legislative leaders last year requesting to reinstate the cannabis cultivation tax or increase the excise tax, despite these programs having a surplus of more than $600 million as of March 2024, including roughly $260 million in each the law enforcement and childcare accounts, according to a budget summary from the state Assembly.

Despite the Golden State’s promise to establish a regulated ecosystem that would allow tax-paying cannabis operators to thrive following the passage of Proposition 64 in the 2016 election, the unlicensed market could become more attractive for businesses and consumers alike following the excise tax increase on July 1, 2025.

“Cannabis taxes are already absurdly high, a tax increase would just drive more price-sensitive consumers to illegal shops, further undercutting licensed businesses like ours and lowering overall tax collections for the state,” Bret Peace, CEO at San Diego-based retailer March and Ash, told Cannabis Business Times.

March and Ash, which merged with cultivator and manufacturer CannaCraft in 2022, operates 10 dispensaries in Southern California.

Although the exact size of California’s unregulated cannabis market is unknown, local media outlets commonly cite a $10-billion estimate, meaning roughly two out of three transactions occur outside licensed dispensaries each year. The state’s licensed dispensaries sold $4.66 billion in cannabis in 2024, according to the DCC.

Although the exact size of California’s unregulated cannabis market is unknown, local media outlets commonly cite a $10-billion estimate, meaning roughly two out of three transactions occur outside licensed dispensaries each year. The state’s licensed dispensaries sold $4.66 billion in cannabis in 2024, according to the DCC.

“The fact that Michigan, with just a quarter of California’s population, is selling more cannabis in its regulated market than we are highlights the failure of our state to fulfill the promise of Proposition 64—to ‘tax and regulate cannabis in a manner that eliminates the illicit market,’” Tiffany Devitt, director of regulatory affairs with March and Ash, told CBT. “A tax increase on cannabis would only exacerbate the already significant price gap between the legal and illicit markets.”

Editor’s note: CBT reached out to nine of California’s larger cannabis retail operators, asking how the pending tax hike would impact their businesses. March and Ash was the only business to provide comments at the time this article was published.

While Michigan passed California in cannabis units sold in mid-2023, Michigan is still runner-up in overall sales with $3.3 billion reported from licensed retailers in 2024, according to the state’s Cannabis Regulatory Agency. Still, Michigan’s licensed market sells nearly three times the amount of cannabis per capita as California.

This per-capita discrepancy, in part, is due to 57% of California’s cities and counties prohibiting cannabis retail businesses from operating in their jurisdictions, according to the DCC.

California’s active license count for dispensaries in 2024 was 1,225, meaning the average store sold roughly $4 million of cannabis for the year. That equates to roughly $600,000 in excise taxes owed per dispensary.

For a business that operates 10 dispensaries, that’s $6 million in excise taxes, not to mention the state’s 7.25% to 10.75% sales tax, depending on the region, as well as various local tax structures.

Should A.B. 564 fail to stave off the pending tax hike, each dispensary would be on the hook for an additional $160,000 in excise taxes per year on average.

Search

RECENT PRESS RELEASES

Related Post