Can Ethereum’s price surge past $4K? – THESE indicators say yes

July 23, 2025

Key Takeaways

Ethereum eyes $4K breakout as Funding Rates rise, long positions dominate, and U.S. institutional demand grows. Technical support and bullish sentiment suggest strong momentum for continued upward movement.

Ethereum [ETH] may be gearing up for a breakout, and this time, the signals are hard to ignore. With a cluster of technical and behavioral indicators converging, the path toward the $4K milestone price level looks increasingly viable.

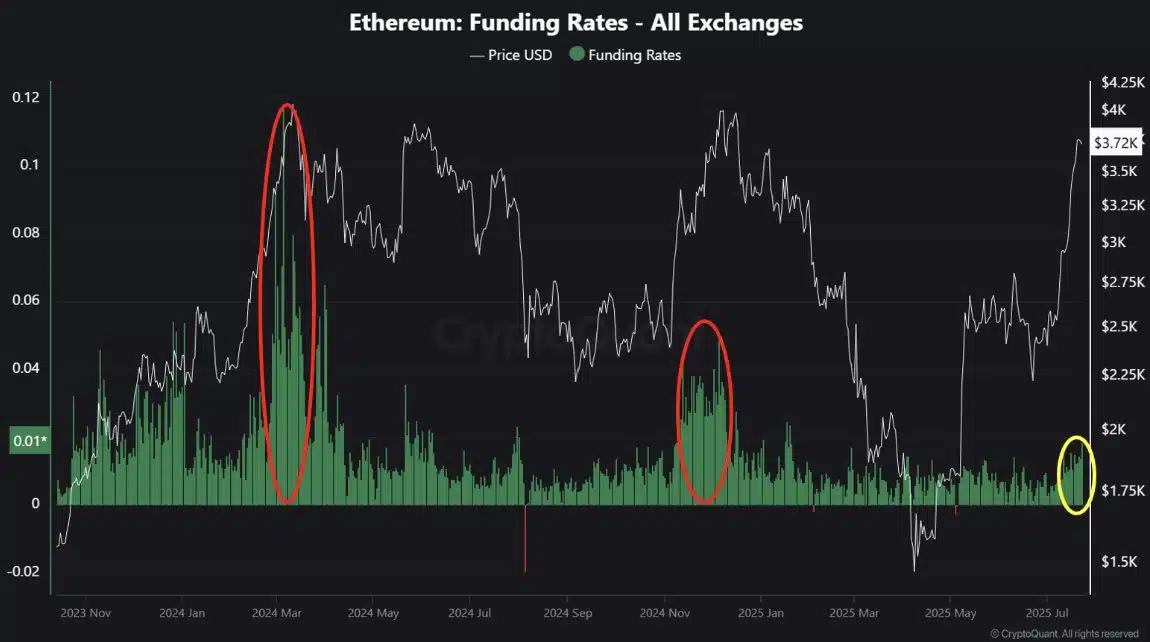

Funding Rates hint at another rally

AMBCrypto’s recent analysis highlights Ethereum’s steadily rising Funding Rate as a key bullish indicator.

This metric—representing the cost to hold long futures positions—is following a familiar pattern seen before ETH’s last two major rallies.

Instead of jumping sharply, the Funding Rate is climbing gradually, showing growing confidence among long traders without signs of risky over-leveraging.

Historically, this type of consistent increase tends to be a more dependable signal for an upcoming breakout.

Ethereum bulls are in control

Supporting the Funding Rate signal is a shift in trader positioning.

Hyblock data shows 61% of global trading accounts held long positions, at press time, slightly above the weekly average.

Although high long ratios can sometimes alarm investors during overheated rallies, the current distribution looks more like deliberate, strategic accumulation than speculative excess.

Coinbase premium gap also aligns with the rally

A growing premium on Coinbase is reinforcing Ethereum’s upward momentum.

Though the price gap may seem small, it’s significant—Coinbase is often seen as a barometer for U.S. institutional interest.

Historically, this kind of premium has aligned with strong buying activity from American investors, signaling that larger players are entering the market.

It also tends to appear alongside major catalysts, such as ETF speculation or broader macroeconomic developments.

Historically, such divergence has coincided with periods of strong buying pressure from American investors, often signaling that bigger players are stepping in.

This kind of premium mostly coincides with major fundamental catalysts, such as ETF speculation or macroeconomic shifts.

Zooming down to technicals, Ethereum is retesting a key resistance zone that recently turned a key support level.

If current support zones continue to hold, initiate a clean breakout towards $4K milestone price level—especially with rising volumes and U.S. investor demand.

With all indicators pointing to bullish sentiments, the rally to 4K looks more than likely.

Search

RECENT PRESS RELEASES

Related Post