Can Federal Bitcoin Policy Talks Enhance MARA (MARA)’s Competitive Edge in a Shifting Regu

September 21, 2025

- MARA Holdings participated in a high-profile Bitcoin policy roundtable with U.S. lawmakers and crypto executives following its recent expansion moves in Europe and role at the Gastech Exhibition & Conference 2025.

- An important aspect of this development is the company’s direct engagement with legislative efforts like the proposed Bitcoin Act, signaling growing institutional interest in Bitcoin as a national asset.

- We’ll look at how MARA’s participation in federal Bitcoin policy discussions could reshape its investment narrative amid shifting regulatory priorities.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Advertisement

MARA Holdings Investment Narrative Recap

To believe in MARA Holdings as a shareholder right now, you need conviction in both the long-term potential of institutional Bitcoin adoption and the company’s push beyond mining into digital infrastructure. While MARA’s participation in high-level Bitcoin policy talks could influence sentiment, the most pressing short-term catalyst remains the company’s ability to maintain Bitcoin mining economics and execute on new ventures. The key risk is regulatory, unless legislative momentum directly alters market access or mining economics, the impact of recent news appears incremental rather than transformative.

Among MARA’s recent announcements, its expansion into Europe stands out for relevance. The opening of a Paris headquarters and acquisition moves position the firm to benefit if regulatory efforts shape the industry more favorably for operators with scale, cross-border expertise, and government relationships. These steps tie in with MARA’s ambitions to diversify revenue, yet near-term results will still be significantly influenced by Bitcoin price trends and the evolving regulatory climate.

Yet, against this backdrop, investors should also remember that regulatory change is not always immediate, and MARA’s reliance on Bitcoin mining leaves it exposed to…

Read the full narrative on MARA Holdings (it’s free!)

MARA Holdings is expected to reach $1.1 billion in revenue and $31.5 million in earnings by 2028. This projection assumes annual revenue growth of 12.4% but a steep earnings decline of $647.3 million from current earnings of $678.8 million.

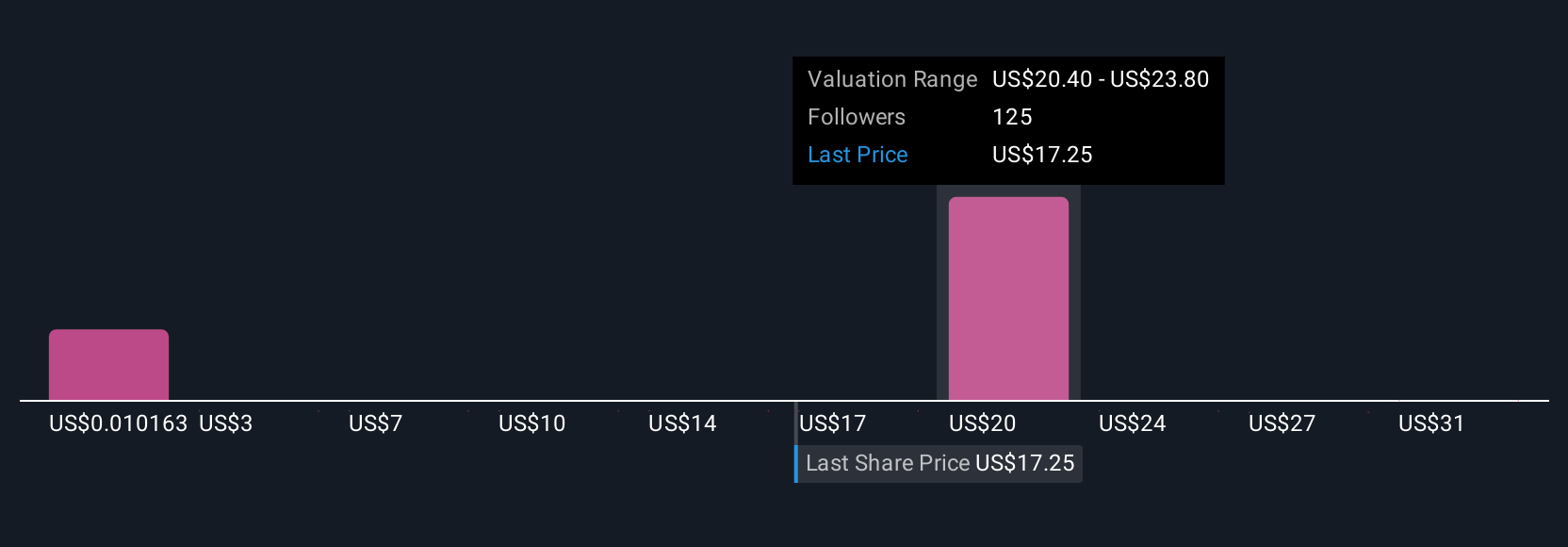

Uncover how MARA Holdings’ forecasts yield a $23.32 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community investors have set fair values for MARA Holdings ranging from US$17.45 to US$74.31, with 11 different estimates highlighting both caution and optimism. With regulatory outcomes around Bitcoin still uncertain, consider how this wide spread of opinions underscores the need to weigh several viewpoints on future business performance.

Explore 11 other fair value estimates on MARA Holdings – why the stock might be worth just $17.45!

Build Your Own MARA Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your MARA Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free MARA Holdings research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate MARA Holdings’ overall financial health at a glance.

Contemplating Other Strategies?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post