Can Meta (META)’s AI-Powered Creator Tools Deepen Its Lead in Digital Advertising Innovati

October 11, 2025

- Aspire.io recently announced the launch of Aspire’s AI Instagram Discovery, developed in close collaboration with Meta’s product team to help brands find high-performing creators using Instagram’s new creator marketplace API.

- This innovation leverages first-party data and AI-driven search functionality, showing how Meta’s technology is enabling more precise and efficient creator-brand partnerships in the digital marketing ecosystem.

- We’ll examine how Meta’s advances in AI-powered ad technology, highlighted by this client launch, influence the company’s investment narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Advertisement

Meta Platforms Investment Narrative Recap

To invest in Meta Platforms, you must believe that ongoing advances in AI-driven ad technology will drive sustained revenue and profit growth, even as the company faces mounting costs, regulatory scrutiny, and competitive pressure. The recent Aspire.io partnership underscores Meta’s leadership in enabling more efficient digital ad targeting, but this collaboration is unlikely to alter the most important short-term catalyst, upcoming Q3 earnings that will reveal whether AI initiatives are translating into stronger ad revenue, and does not materially reduce the greatest risk: accelerating operating expenses outpacing top-line growth.

Aspiring to further showcase Meta’s ecosystem approach, the new Ray-Ban Meta (Gen 2) and Oakley Meta Vanguard AI glasses, announced in September, directly exemplify its ambitions in merging hardware, AI, and social engagement. These products highlight Meta’s willingness to invest heavily in long-term technology bets, though the immediate financial impact remains limited compared to near-term stakes tied to ad revenue growth and cost management.

Yet, just as growth stories dominate the headlines, investors should not lose sight of looming risks such as …

Read the full narrative on Meta Platforms (it’s free!)

Meta Platforms’ outlook anticipates $275.9 billion in revenue and $92.1 billion in earnings by 2028. This implies a 15.6% annual revenue growth rate and a $20.6 billion increase in earnings from the current $71.5 billion.

Uncover how Meta Platforms’ forecasts yield a $863.20 fair value, a 22% upside to its current price.

Exploring Other Perspectives

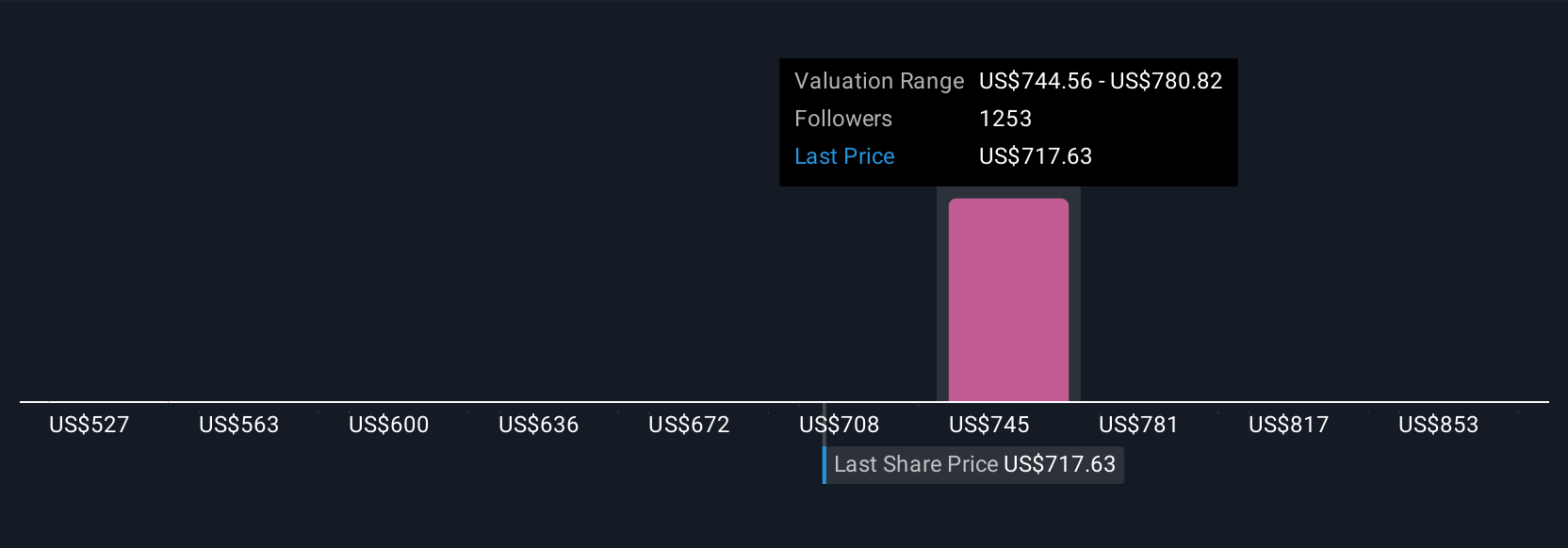

Community estimates for Meta’s fair value span from US$527 to US$1,101 per share across 101 opinions. While many in the Simply Wall St Community expect rising AI-driven revenues, the risk of expense growth overtaking sales remains central to future performance, so compare these views as you consider your own approach.

Explore 101 other fair value estimates on Meta Platforms – why the stock might be worth as much as 56% more than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Meta Platforms’ overall financial health at a glance.

Looking For Alternative Opportunities?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post