Cannabis Advertising Compliance 2026: Strategies That Scale

September 24, 2025

In the early years of legalization, retailers relied on “secret” shortcuts for dispensary advertising. Some slipped cannabis ads onto Google or Meta by avoiding product terms, while others relied on vague “21+ only” disclaimers or recycled the same campaign across states without adjusting to local laws. These workarounds may have bought time, but in 2026, they will no longer be viable.

2025 marked a turning point for cannabis advertising compliance. Federal whispers of rescheduling, stricter state laws, Google’s Canadian cannabis ad pilot program, and platform-level crackdowns have created an environment where shortcuts are risky at best and catastrophic at worst.

This guide explores how dispensaries can navigate the evolving rules of cannabis digital advertising, overcome compliance challenges, seize opportunities in programmatic and Connected TV (CTV), and prepare for the future. The dispensaries that embrace compliance not as a burden but as a strategic advantage will thrive.

How State Laws and Platforms Are Shaping Cannabis Advertising

The cannabis advertising ecosystem has never been uniform, but 2025 introduced a new level of complexity. Dispensaries are caught between shifting state regulations, federal policy uncertainty, and rapidly evolving platform rules. Mapping the current terrain helps to understand why compliance is now central to growth.

State Regulations: Conflicting Rules Across Markets

Each state writes its own rules for cannabis advertising, and those rules often conflict. What’s permitted in one market could be prohibited in another.

- California allows cannabis advertising if at least 71.6% of the audience is “reasonably expected” to be over 21, provided the ad includes disclaimers and avoids medical claims. Companies can show cannabis flower in California ads.

- Pennsylvania restricts ads that include pricing, potency, or product imagery, and requires specific health warnings.

- New York prohibits cannabis ads within 500 feet of schools, playgrounds, and youth facilities, making location-based targeting especially important. Plus, companies must be able to meet a 90% legal drinking age (LDA) threshold (higher than California’s 71.6%).

For dispensaries, the absence of uniform standards means cannabis marketing campaigns cannot scale across multiple states. Instead, advertisers must treat each market as a unique regulatory environment, tailoring copy, imagery, and targeting to local rules.

Federal Context: The Hope of Rescheduling

Although cannabis remains federally restricted, the ongoing discussion about moving it to Schedule III has added momentum to compliance conversations. Rescheduling would not immediately legalize cannabis advertising nationwide, but it would signal that the federal government recognizes cannabis as having medical use and lower abuse potential than Schedule I substances.

Cannabis advertising remains a state-by-state issue, with each market setting its own rules and restrictions. Still, federal policy shifts can influence how the broader ecosystem treats cannabis businesses. The ongoing discussion around moving cannabis to Schedule III under the Controlled Substances Act has added momentum to compliance conversations.

While states would continue to regulate cannabis advertising directly, a Schedule III listing could ease some of the hesitation seen today from advertising platforms, payment processors, and financial institutions.

For dispensaries and brands, the takeaway is clear: Federal rescheduling may open new doors over time, but the best strategy now is to document compliance processes, follow state-level regulations, and strengthen internal controls to be ready to move quickly if restrictions ease.

Platform Policies: More Rules That Shift Beneath Your Feet

Even if an ad complies with state law, platforms ultimately control what runs. Their policies often change without warning.

- Google has begun cautiously piloting cannabis-related ads in Canada and select U.S. states, allowing campaigns for non-ingestible CBD and some dispensary services under strict disclaimers and geo-fencing. This creates limited but important opportunities for compliant advertisers.

- Meta remains the most restrictive, banning most dispensary advertising outright. Brands that attempt to circumvent policies by using coded language or indirect imagery risk permanent account bans.

- Programmatic and Connected TV (CTV) platforms have emerged as more flexible alternatives. By working with compliant partners, dispensaries can run cannabis digital advertising campaigns that reach targeted adult audiences without violating platform restrictions.

Bottom line: In 2026, dispensaries must track compliance on three levels simultaneously: federal, state, and platform. Failing to account for even one can derail an entire campaign and put a business at risk.

Top Compliance Challenges in Dispensary Advertising

Understanding the rules is one thing. Navigating them in practice is another. Dispensaries face a set of challenges that make cannabis advertising compliance uniquely difficult.

State-by-State Patchwork of Rules

Because cannabis remains federally restricted, each state enforces its own advertising code. This patchwork is a compliance minefield. A campaign that mentions discounts may be legal in one state but banned in another. Copy-paste marketing is no longer an option.

Dispensaries and brands must invest in compliance reviews for each jurisdiction in which they operate. If required, regional managers or compliance officers should sign off on ad copy before it goes live, ensuring it aligns with local requirements.

More information regarding each state’s cannabis advertising laws is available here.

Audience Restrictions: Age-Gating and Geo-Targeting

Cannabis advertising rules emphasize protecting minors, which means strict audience targeting:

- Age-Gating: Ads must be designed to reach only adults 21 or older, using audience verification methods such as age-gated websites, platform-level targeting, and third-party data to reasonably ensure compliance.

- Geo-Targeting: Ads must be geographically restricted to locations where cannabis sales are legal.

Failure to meet these requirements can result in fines or license suspension.

Platform Policies: Legal Doesn’t Always Mean Allowed

Even when state law permits advertising, platforms can block campaigns. Meta’s outright ban on most cannabis ads is the clearest example. Google’s evolving pilot programs allow some campaigns but restrict others without transparent explanations.

The challenge is that dispensaries cannot simply “go where the eyeballs are.” They must find compliant channels, often through programmatic partners that specialize in cannabis digital advertising.

Data Privacy and Consumer Protection

Alongside cannabis-specific regulations, dispensaries must also comply with broader privacy laws such as California’s Consumer Privacy Act (CCPA) and Europe’s General Data Protection Regulation (GDPR). Collecting customer emails for loyalty programs, for example, requires clear consent and transparent privacy policies. Failing to safeguard consumer data damages not only compliance but also trust.

Best Practices for Cannabis Advertising Compliance

While these challenges seem daunting, dispensaries and cannabis brands can manage them through structured best practices:

- Use Clear Disclaimers and Truthful Claims: Always include disclaimers like “For use only by adults 21 and older.” Never make unverified medical claims.

- Target Responsibly: Limit campaigns to age-verified, geo-fenced audiences. Avoid placements near schools or youth content.

- Work With Compliant Platforms and Partners: Choose advertising vendors who understand cannabis compliance and provide audit trails.

- Monitor and Audit Regularly: Conduct monthly compliance reviews. Document decisions to show regulators if questions arise.

2026 Growth Opportunities: Programmatic and CTV

While restrictions dominate the conversation, 2026 offers new opportunities for dispensary advertising. Programmatic and Connected TV (CTV) channels are becoming promising paths for cannabis digital advertising.

Programmatic Advertising: Scalable but Selective

Programmatic platforms allow dispensaries and brands to reach large audiences through automated bidding and targeting. The advantage lies in precision: Banner ad campaigns can be geo-fenced to legal jurisdictions, targeted to verified 21-plus audiences, and filtered for brand safety.

For example, a dispensary in Denver can run an age-compliant mobile display ad campaign featuring its top-selling in-house brand, targeting local ZIP codes where it delivers. This level of control makes programmatic advertising both scalable and compliant.

Connected TV and OTT: Premium Environments

CTV and over-the-top (OTT) advertising offer cannabis brands placements alongside mainstream content on streaming platforms. These environments allow for high-quality storytelling, reaching consumers in a context that feels professional and brand-safe.

The key is to apply the same compliance guardrails: age verification, geo-fencing, and disclaimers. When executed correctly, CTV advertising positions dispensaries as legitimate, trusted businesses rather than fringe operators.

Takeaway: Programmatic and CTV are not loopholes. They are compliant pathways that allow cannabis digital advertising to scale responsibly.

The Future of Cannabis Advertising Compliance

The only constant in cannabis advertising is change. Dispensaries that want to future-proof their marketing strategies must prepare for three key trends.

Artificial Intelligence: Powerful but Risky

Where AI makes a difference is in augmentation: speeding up creative versioning, analyzing campaign performance, and spotting audience patterns within compliant datasets. Dispensaries that use AI to support, rather than replace, human strategy can test messaging faster, identify which segments respond best, and optimize budgets without risking noncompliant placements. The technology is a helpful assistant, not a compliance safety net.

First-Party Data: The Backbone of Compliant Retargeting

With third-party cookies disappearing, cannabis marketers can’t rely on the same retargeting tricks as mainstream e-commerce. Instead, first-party data, emails, phone numbers, loyalty program enrollments, and point-of-sale data are the foundation for compliant cannabis advertising.

When collected with clear consent, this data unlocks retargeting and personalization across programmatic, CTV, and other channels that accept cannabis ads. A dispensary or brand can, for example, serve compliant display ads to loyalty members who haven’t purchased in 30 days, or deliver CTV storytelling to high-value customers segmented by purchase behavior. Done right, first-party data isn’t just a workaround for lost cookies; it’s the most powerful, sustainable asset for compliant cannabis digital advertising.

Federal Rescheduling and Global Lessons

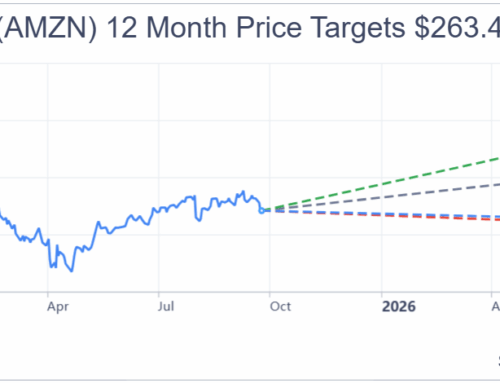

If cannabis moves to Schedule III, platforms and regulators may revisit advertising restrictions. While this won’t create an overnight revolution, it could open new opportunities. Meanwhile, global developments (such as Google’s Canadian pilot) offer lessons for U.S. dispensaries. Watching how international markets evolve provides a preview of what might come next.

Turning Compliance Into a Competitive Advantage for Dispensaries

Shortcuts won’t get dispensaries far in 2026. The era of vague disclaimers, recycled campaigns, and loophole chasing is over. Compliance builds trust with regulators, platforms, and consumers. It enables scale by opening doors to programmatic and CTV opportunities. And it positions dispensaries as responsible, credible players in a competitive market.

Search

RECENT PRESS RELEASES

Related Post