Cannabis Is Booming In Florida: Here Are The Winners

April 29, 2020

Florida’s medical cannabis market is booming, with flower sales up 3.4x since last summer.

Trulieve dominates with a majority market share in both flower and THC products like vape pens.

Curaleaf, Liberty Health, and Cansortium also boast strong medical cannabis sales.

Future growth will be driven partly by potential legalization of edibles, wholesale sales, and recreational cannabis (someday).

This idea was discussed in more depth with members of my private investing community, The Growth Operation. Get started today »

Source: Florida Politics.

Summary

Florida’s cannabis market is enormous and continues to grow rapidly. Thanks to weekly government reports, this market also offers unmatched transparency: Investors can see cannabis sales figures published each week and broken down by each company.

Trulieve is the sole dominant player in Florida cannabis. They sell more than half of the cannabis in the state despite operating less than one-fifth of dispensaries statewide. Despite that strength, other cannabis companies also are very successful. For example, Liberty Health operates solely in Florida and has generated positive operating cash flow in each of the past two quarters and positive free cash flow last quarter.

I’m bullish on the Florida cannabis market and many of its market participants. Future growth will be driven by consumers continuing to switch to legal marijuana over black market weed, the addition of new product types like edibles, and by the potential for recreational cannabis legalization down the road.

The Sunshine State

This article is a synopsis of the Florida cannabis market based on weekly reports published by Florida’s Office of Medical Marijuana Use (“OMMU”). Florida’s medical cannabis market is (1) booming, and (2) more transparent than any other cannabis market in the country.

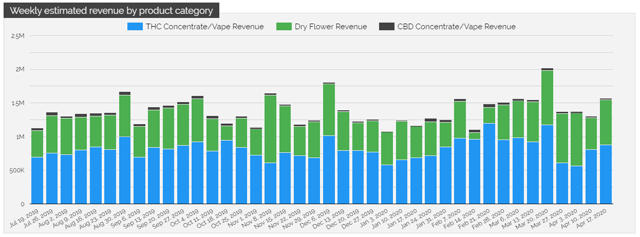

Each Friday afternoon, OMMU publishes weekly reports which provide statewide sales data and provide weekly sales data for each licensed operator in the state. These reports includes weekly sales of dry flower, THC concentrates, and CBD concentrates:

- Flower sales are reported in ounces of marijuana sold. Flower refers to ordinary cannabis, sold as a dried plant product for smoking, vaping, or other use. Florida began selling marijuana flower in March 2019 after a court challenge and subsequent bill.

- THC sales are reported in milligrams of THC sold. These figures include processed THC-based cannabis products like vape pods, cannabis wax, cannabis rosin, concentrates, cannabis powder, cannabis drops, tinctures, and other products. Everything that is prescribed for its THC content is in this category except for flower. Florida began allowing THC sales in 2016, so this market is more mature and slower-growing that the flower market.

- CBD sales are reported in milligrams of CBD sold. These products include a similar array as THC products. These sales only include sales through Florida’s medical marijuana program. CBD products are also sold online and in stores outside of Florida’s medical marijuana programs and those sales are not reflected in OMMU reports. CBD sales make up a small fraction (~1%) of Florida cannabis company revenue and I will ignore them herein for that reason.

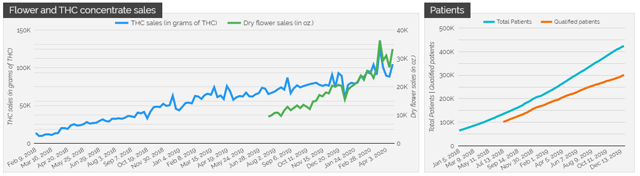

Florida cannabis sales and patient count are rapidly growing as consumers switch to legal cannabis. Source: The Growth Operation Florida Market Dashboard.

Florida cannabis sales and patient count are rapidly growing as consumers switch to legal cannabis. Source: The Growth Operation Florida Market Dashboard.

Florida’s cannabis market is booming by every metric. The above charts illustrate some of the phenomenal growth of this market, including:

- THC sales are up nearly 11x since February 2018, growing at a CAGR of 199%.

- Flower sales are up 3.4x since July 2019, growing at a CAGR of 406%.

- Qualified patients are up 3x since July 2018, growing at a CAGR of 85%.

This growth cannot continue forever as Florida has a finite demand for cannabis. At present sales rates, Florida sells approximately $1 billion per year of medical cannabis or ~$46 per capita. For comparison, Colorado sold ~$302 per capita of cannabis during the past 12 months, including both medical and recreational cannabis. Recreational cannabis is not legal in Florida, although advocates hope to get it on the 2022 ballot after the 2020 ballot initiative failed.

Market Shares

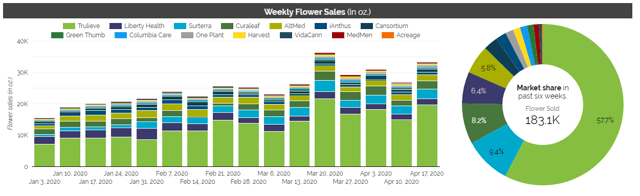

Trulieve had 58% market share in dry flower sales as of April 17, 2020. Source: The Growth Operation Florida Market Dashboard.

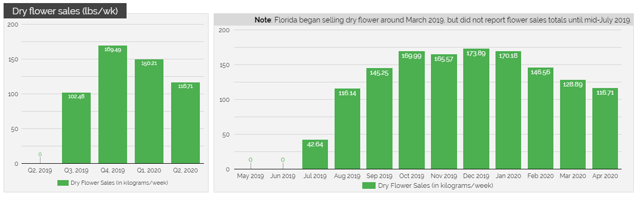

Flower is the most rapidly-growing segment of Florida’s medical cannabis market. Since being legalized in March 2019, flower sales have grown from nothing into sales of over 30,000 oz (1,875 lbs) per week. These sales generate roughly half of the revenue of Florida cannabis companies.

Trulieve (OTCQX:TCNNF) is the dominant company in Florida cannabis sales, with an enormous market share compared to its competitors. As of April 17, Trulieve owned 19% of the dispensaries in Florida but sold 58% of flower. Trulieve’s per-store flower sales are three times higher than the state average.

Note that Florida’s unique market structure bans wholesale sales of cannabis. This means that each Florida company grows all of the cannabis sold in each of its stores – so Trulieve is growing and selling all of this cannabis themselves and selling it in their 46 company-owned stores and through delivery.

Other top flower sellers in Florida include:

- Surterra (a private company): 9% market share while operating 17% of dispensaries state-wide.

- Curaleaf (OTCPK:CURLF): 8% market share while operating 12% of dispensaries state-wide.

- Liberty Health (OTCQX:LHSIF): 6% market share while operating 10% of dispensaries state-wide.

- AltMed/MÜV (a private company): 6% market share while operating 8% of dispensaries state-wide.

Each of these companies have been successful in building up their Florida flower sales, outselling a range of peers including Cansortium (OTCQB:CNTMF), iAnthus/GrowHealthy (OTCQX:ITHUF), Columbia Care (OTCQX:CCHWF), MedMen (OTCQB:MMNFF), Harvest Health (OTCQX:HRVSF), Green Thumb (OTCQX:GTBIF), and Acreage/The Botanist (OTCQX:ACRGF). Each of these peers also run dispensaries in Florida, but do not make the top five in flower sales.

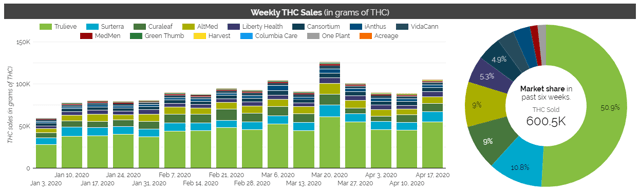

Trulieve had 51% market share in THC sales as of April 17, 2020. Source: The Growth Operation Florida Market Dashboard.

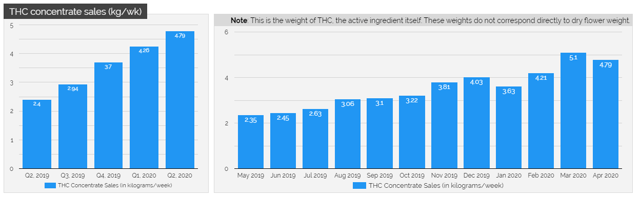

THC concentrate sales are more “mature” and slower growing than flower sales. Many of these products have been available since 2016, although new products are being legalized which could grow THC concentrate sales. Florida is currently working to legalize cannabis edibles which could aid these sales. As of April 2020, Floridians consume approximately 100 kilograms (100,000,000 mg) of THC per week through these products.

Trulieve also is the leader in THC concentrate sales with a 51% market share over the past six weeks. As with flower, Trulieve is dramatically outselling their closest peers and has very high sales per store, with 51% market share selling out of 19% of stores statewide.

Trulieve also is the leader in THC concentrate sales with a 51% market share over the past six weeks. As with flower, Trulieve is dramatically outselling their closest peers and has very high sales per store, with 51% market share selling out of 19% of stores statewide.

Other top THC sellers in Florida include the sale four companies as before:

- Surterra has 11% market share in THC products while operating 17% of dispensaries statewide.

- Curaleaf has 9% market share in THC products while operating 12% of dispensaries statewide.

- AltMed/MÜV has 9% market share in THC products while operating 8% of dispensaries statewide.

- Liberty Health has 5% market share in THC products while operating 10% of dispensaries statewide.

AltMed’s THC sales per store are higher than average (with 9% market share in 8% of stores), which is the only company in either this list or the previous one that is outselling the average Florida store aside from Trulieve.

Top-Selling Public Companies

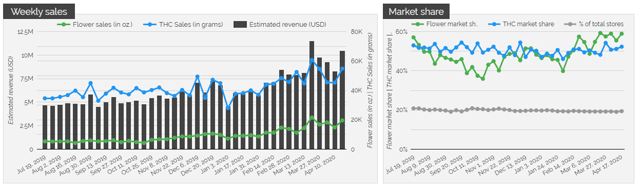

Trulieve sales have grown steadily since Q3 last year with their strongest four sales weeks all occurring after COVID-19. Source: The Growth Operation Florida Company Spotlight.

Trulieve is the top dog in Florida cannabis, taking a majority of market share in both flower and THC sales. Based on past Trulieve revenue, which are ~96% from Florida, we can estimate Trulieve’s weekly sales revenue as shown above. Florida does not publish sales in dollars – only by weight of product sold.

Based on published sales figures and estimated revenue, Trulieve has posted all four of its best-ever weeks during the past five weeks. The week of March 13-19 was Trulieve’s strongest ever week, likely due to patients stocking up on cannabis before the COVID-19 crisis locked down the state. During that week, Trulieve may have generated ~$11.5 million in revenue.

Curaleaf Florida sales have been very stable since mid-2019. Source: The Growth Operation Florida Company Spotlight .

Curaleaf is the second-largest publicly-traded seller of cannabis in Florida. While Trulieve’s sales show a long-term growth trend, Curaleaf’s sales have been ~flat in the Sunshine State.

These flat sales are likely the result of Curaleaf focusing on other markets. As a company, Curaleaf is growing rapidly even if their Florida sales are not: The company reported 22% sequential revenue growth in the fourth quarter of 2019 with revenue rising to $75.5 million. Analysts are forecasting 33% sequential growth in the first quarter with revenue rising past $100 million. First quarter results will be announced on May 18.

Liberty Health flower sales grew rapidly last year, but have been on the decline since fall. Source: The Growth Operation Florida Company Spotlight.

Liberty Health was briefly the darling of the cannabis market with rapidly-rising flower sales from July to October of last year. Sales quickly climbed to 170 lbs/week in October, peaking at high as 24% market share in flower sales one week while only operating 9% of stores statewide.

Share prices followed this uptrend, albeit on a delay: LHSIF share doubled in price from late September to early December as sales increased and the company became operating cash flow positive in their late October earnings report and free cash flow positive in their late January earnings report.

However, both share prices and cannabis sales have slumped since then. Shares are now back down to near their late September lows while Liberty Health’s monthly flower sales have been in steady decline since December. It’s likely that this decline is caused by (1) the end of sales which occurred in fall, and (2) the plateauing of cannabis cultivation capacity after the first LHS360 cultivation facility harvest in June 2019.

Cansortium THC sales have grown very steadily over the past year in Florida. Source: The Growth Operation Florida Company Spotlight.

Cansortium has also seen very steady growth in Florida over the past year. The company operates as Fluent in Florida and other states, with 20 stores and sixth-place market share in both flower and THC concentrates.

Over the past year, Fluent’s THC sales have grown very steadily, with solid improvements each quarter and nearly every month. This steady growth has been aided by an increasing store count from 11 stores in mid-2019 to 20 stores today. The company also has been able to successfully grow their cultivation capacity alongside opening new stores, leading to steady growth in THC sales. Flower sales have been slightly more uneven, but still show relatively steady sales growth.

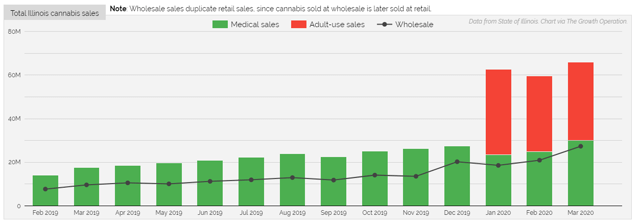

Illinois cannabis sales increased 2.3x in a single month with the legalization of recreational cannabis. Source: The Growth Operation Illinois Market Data.

Legalizing recreational cannabis failed to make the 2020 ballot, but would help all companies in the state. When Illinois legalized recreational cannabis on Jan. 1, 2020, cannabis sales jumped 2.3x overnight, growing from $27 million in December to $63 million in January. These figures were generated with relatively few open cannabis stores as well: Illinois had only 55 cannabis stores at the end of December while Florida has more than 5x as many dispensaries. Activists hope to add recreational cannabis to the 2022 ballot.

For my part, I remain bullish on the Florida cannabis market and its companies.

Happy investing!

Thoughts

Florida’s medical cannabis market has been very successful since it was launched in 2016. Starting from nothing, the market has grown to perhaps $1 billion in run-rate sales.

Legal changes could aid the growth of this market further. Plans are in the works to allow wholesale sales, legalize and regulate edibles, and activists would like to legalize recreational cannabis as well. Each of these moves would increase the total size of Florida’s cannabis market. The gains from this growth are likely to be uneven, with some companies winning more than others.

Trulieve potentially has the most to lose from legal change, as they are in a dominant position if the status quo remains in place. For example, some fear that wholesale cannabis legalization may reduce Trulieve’s market share. Legalizing wholesale sales would reduce the barriers to entry for the market, as it would allow new entrants to build either dispensaries or cultivation capacity rather than forcing every company to build both aspects of their business simultaneously. It’s unclear whether this would ultimately help or hurt Trulieve’s revenue and profitability, as they would also be able to sell their cannabis to peers, increasing sales without the time and expense of opening new retail locations.

Make better cannabis investments with better information

The Growth Operation is the largest community of cannabis investors on Seeking Alpha. During difficult market conditions, our active chat room and daily news updates help investors make sense of the rapidly-evolving cannabis market. The Growth Operation also includes interactive data, illustrating market sales trends and highlighting companies with best-of-breed financial performance.

Disclosure: I am/we are long TRULIEVE, GREEN THUMB, LIBERTY HEALTH, CURALEAF, MEDMEN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Search

RECENT PRESS RELEASES

Related Post