Cannabis Is Mainstream. The Real Question Is Whether Ottawa Will Treat It That Way.

October 29, 2025

Seven years after legalization, cannabis in Canada has quietly done what few policy experiments achieve: it’s become normal. New data from Abacus Data for Organigram Global show that more than a third of Canadian adults have used cannabis in the past six months, and one in three have used it in just the last two weeks. Half of Canadians under 45 have consumed recently.

Cannabis has crossed the cultural chasm from subculture to consumer choice. A quarter of Canadians have eaten an edible in the past six months, 16 percent have used dried flower, and others have vaped, sipped, or applied cannabis-based products. Among users, nearly a third say they actually prefer cannabis to alcohol, while another third view the two as equals. For a product legalized less than a decade ago, that’s a remarkable normalization curve.

A Sector With Social Licence and Economic Upside

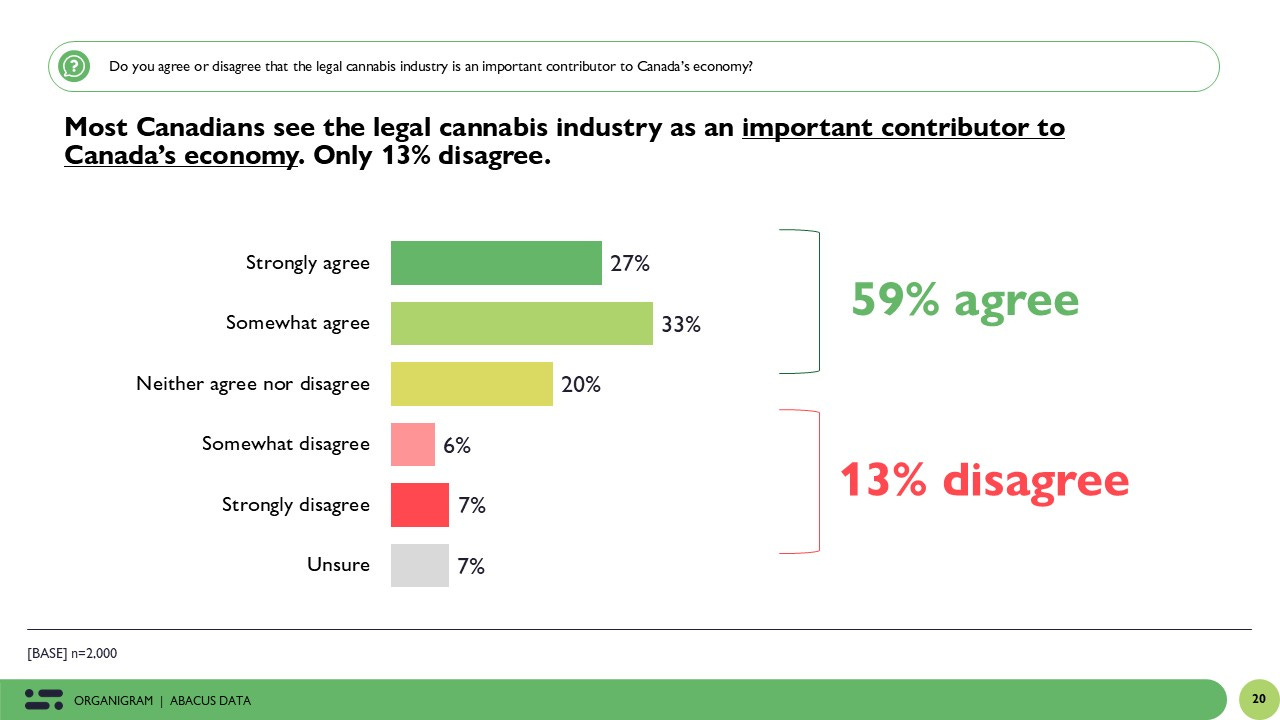

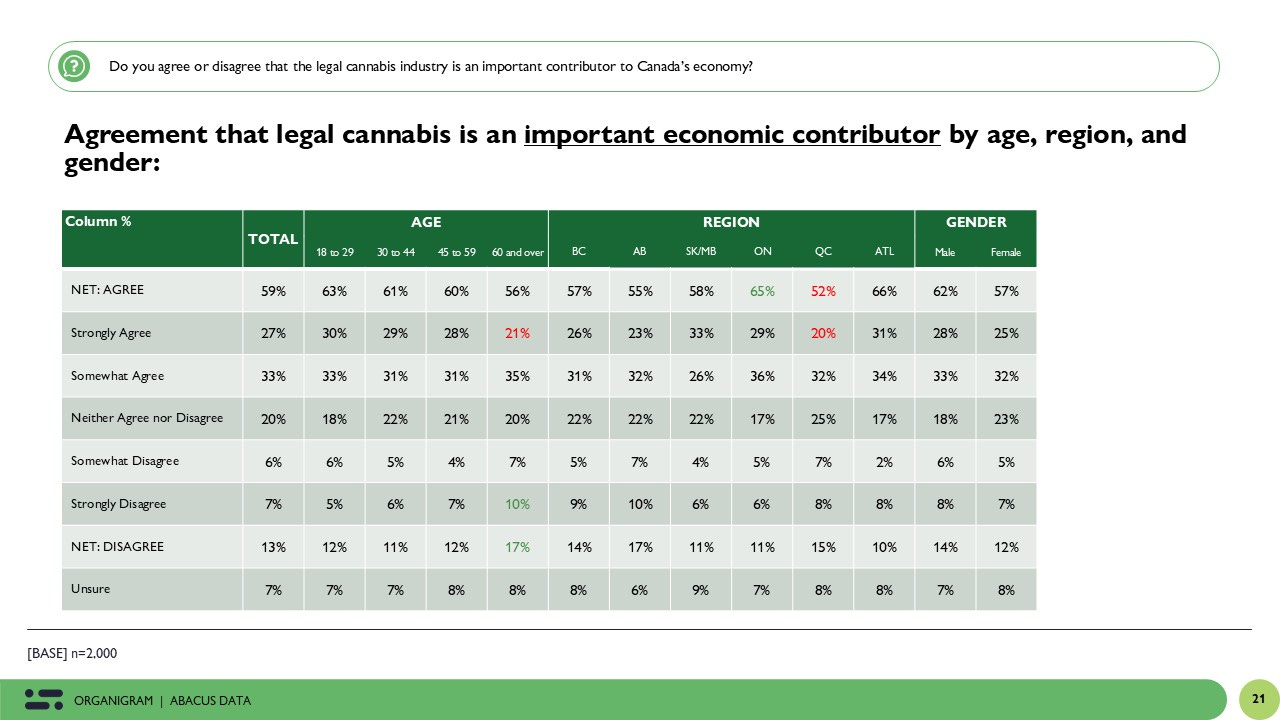

What’s striking in the data isn’t only who’s using cannabis, but how Canadians think about the industry itself. Fifty-nine percent see the legal cannabis sector as an important contributor to the national economy. That consensus cuts across regions and political lines—65 percent in Ontario and 66 percent in Atlantic Canada agree, as do majorities of Liberal and Conservative voters alike.

Canadians see the jobs, the farms, the retailers, the taxes, and the export potential. In an era of global economic turbulence, where Washington’s protectionism threatens cross-border trade and many Canadians fear the next downturn, homegrown industries that employ Canadians and generate reliable revenue look less like niche experiments and more like national assets.

Legal cannabis is one of those assets. And unlike so many other files where regulation lags public sentiment, Canadians appear well ahead of their government.

Political Opportunity, Not Political Risk

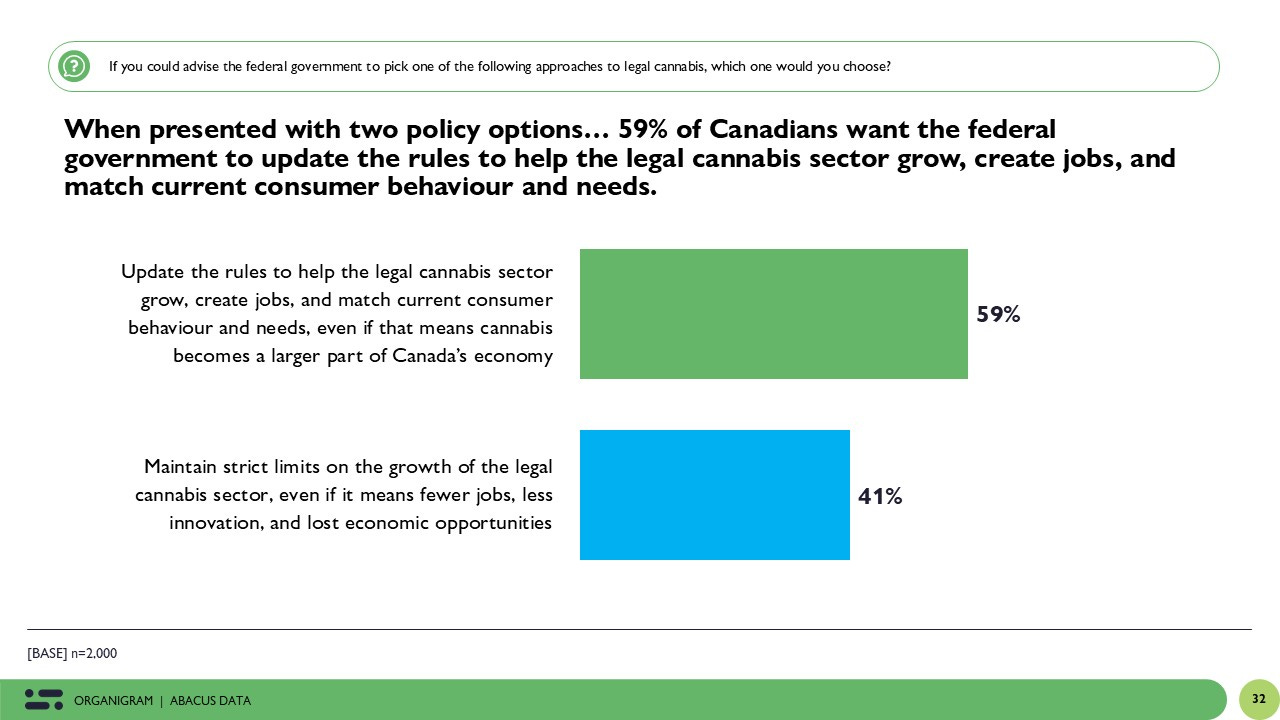

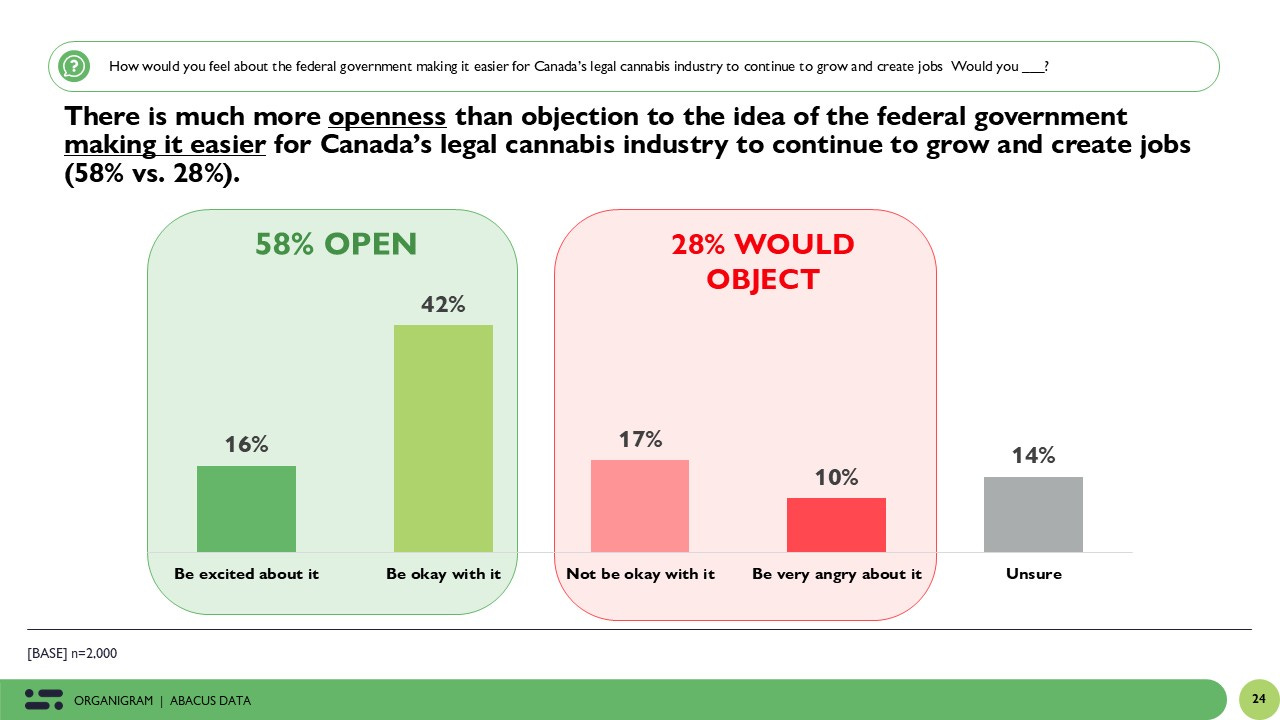

Nearly six in ten Canadians prefer updating the rules to help the cannabis sector grow and meet consumer needs, rather than keeping today’s strict limits. Even more (58 percent) say they’d be excited or okay with Ottawa making it easier for the industry to expand and create jobs.

Just 28 percent would object. That’s almost unheard of for any economic or social policy question, particularly one still stigmatized a generation ago.

Support spans parties. Two-thirds of Liberal voters, 69 percent of New Democrats, and even a slim majority of Conservatives back growth-oriented reforms. The political calculus is clear: there is little to fear and much to gain.

For a federal government still searching for credible growth stories that resonate beyond Ottawa, cannabis is a gift. It’s a sector Canadians already accept, view as valuable, and associate with jobs and innovation rather than controversy.

Canadians Want Economic Policy, Not Moral Panic

When asked what Ottawa should actually do to support the sector, Canadians focus squarely on economics, not ideology.

-

47 percent want economic departments—Industry Canada or Agriculture—at the table with Health Canada.

-

43 percent want tougher enforcement against the illegal market that still siphons away jobs and tax revenue.

-

33 percent favour lower business taxes for producers.

-

31 percent support new product categories such as edibles, beverages, and wellness products.

That list could be lifted straight from a competitiveness agenda. Canadians want policy coherence: if cannabis is legal, regulate it sensibly, tax it fairly, and let entrepreneurs innovate.

An Appetite for Innovation

A majority of Canadians (57 percent) say they’re open to federal investment in next-generation cannabis products—wellness lines, beverages, edibles. Openness jumps to nearly two-thirds among Canadians under 45.

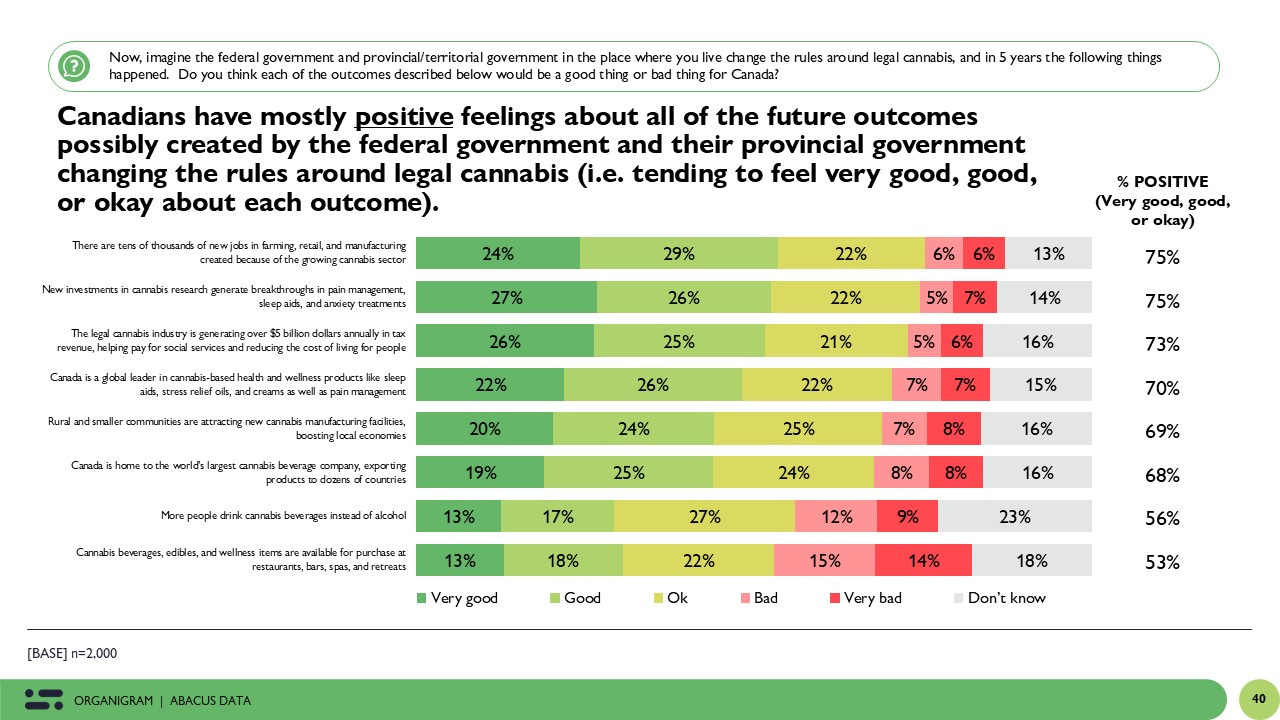

In other words, the public isn’t clinging to the status quo. They’re ready for the next chapter—one that could create tens of thousands of new jobs in farming, retail, and manufacturing, and generate billions in new tax revenue. Three-quarters of Canadians say it would be positive if Canada became a global leader in cannabis-based pain or anxiety treatments. The same share support reinvesting cannabis tax dollars in social programs or affordability relief.

That’s not a protest vote. That’s a pragmatic coalition for growth.

A Low-Resistance Economic Win

In a political environment defined by precarity—where every new dollar of spending or growth policy invites partisan combat—legal cannabis stands out as an area of alignment. It already employs Canadians, pays taxes, and operates within a well-regulated framework.

Yet the federal conversation about it has largely stalled at legalization. We still talk about cannabis as a health-risk file rather than an economic-opportunity file. The public has moved on. Ottawa hasn’t.

Updating the rules—modernizing retail models, rationalizing excise taxes, or opening pathways for innovation—wouldn’t spark cultural backlash. It would signal seriousness about industrial strategy, in smaller communities and some regions who need good news at the moment. It would also show that Canada can learn from its own successes rather than perpetually reinventing the wheel.

The Upshot

Cannabis is no longer controversial. It’s cultural infrastructure. Canadians use it, work in it, and increasingly want their government to treat it like any other legitimate, job-creating industry.

For policymakers searching for growth stories that feel Canadian—rooted in domestic talent, science, and entrepreneurship—the cannabis sector offers precisely that. The data show broad social licence, visible economic value, and political upside.

Seven years after legalization, the real question isn’t whether Canadians accept cannabis. They clearly do. The question is whether Ottawa will finally act like it.

Methodology

This research was conducted by online survey with 2,000 adults living in Canada (age 18+) from June 25 to July 2, 2025. A random sample of panelists were invited to complete the survey from a set of partner panels based on the Lucid exchange platform. These partners are typically double opt-in survey panels, blended to manage out potential skews in the data from a single source.

The margin of error for a comparable probability-based random sample of the same size is +/- 2.2%, 19 times out of 20.

The data were weighted according to census data to ensure that the sample matched Canada’s population according to age, gender, and region. Totals may not add up to 100 due to rounding.

The survey was paid for by Organigram Global.

Search

RECENT PRESS RELEASES

Related Post