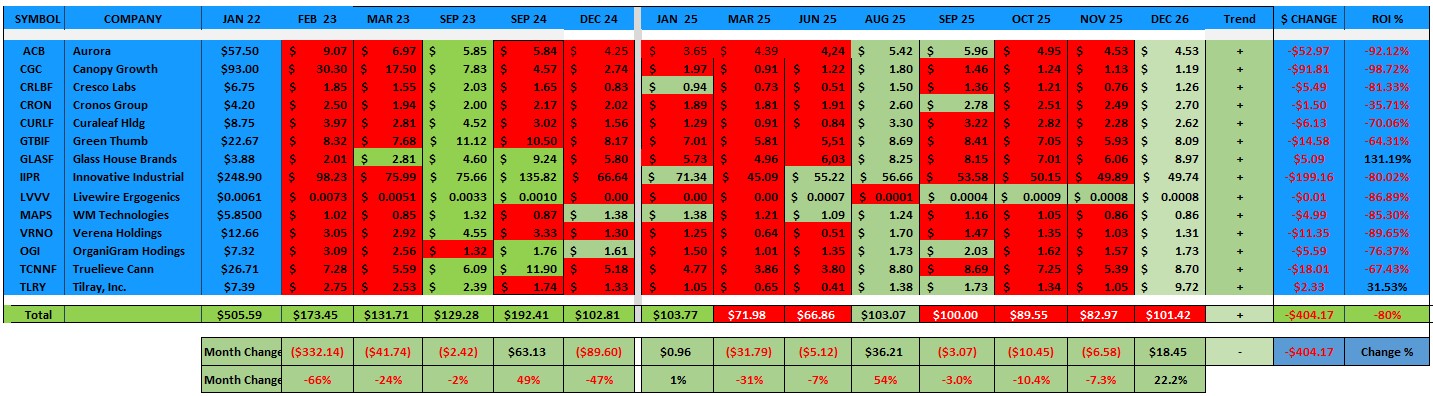

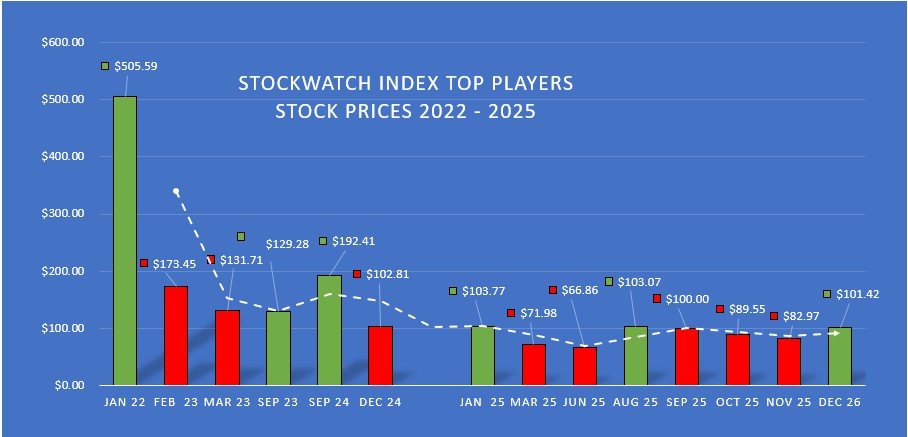

STOCKWATCH INDEX CANNABIS MARKET UPDATE DECEMBER 2025

January 4, 2026

|

|

SWI Portfolio Stock Values increased by 22% – A Spread of 29.3%

The overall SWI Cannabis Portfolio performance has increased by 22% from a 7.3% decline in October, with a spread of 29.3% from November. There is now a growing consensus among analysts that a strong recovery will be underway by 2026. The global cannabis market is projected to expand at a high CAGR through 2030, with some forecasts indicating growth of ~30%+ per year, driven by medical and legalization trends. U.S. federal policy shifts (e.g., rescheduling to Schedule III) are widely seen as major catalysts that could expand access to capital, reduce tax inefficiencies such as 280E, and accelerate institutional adoption.

Strong Financial Discipline – Less Speculative Investment

Improving Analyst Consensus

U.S. federal policy shifts (e.g., rescheduling toward Schedule III) are widely seen as major catalysts that could expand access to capital, reduce tax inefficiencies such as 280E, and accelerate institutional adoption to improve financial performance for major players.

|

Market Caps are improving – Some ROIs swing to Positive

The Typical Financial Yardsticks Apply

The winners will be those who combine CPG thinking, advanced cultivation science, strong brand identity, expansion into the wellness market, and rigorous cash-flow management. In other words, cannabis companies will succeed for the same reasons any sophisticated consumer-goods company does: strategy, execution, differentiation, and discipline.

If you want to follow other companies that we cover with in-depth articles and research reports,

go to www.stockwatchindex.com or our research site at www.swiresearch.com.

If this has been passed on to you, and you want to receive the SWI Newsletter,

go to stockwatchindex.com/sign-up

Search

RECENT PRESS RELEASES

Related Post