Cannabis Market Update February 2025 A Shift in the Funding Landscape

March 5, 2025

Cannabis Market Update February 2025 – A Shift in the Funding Landscape

Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

“If you want to be a lettuce grower, grow lettuce. You don’t need a license to grow lettuce, but if you want to take that same acre and grow cannabis, it’s a whole different process, and you must engage with 10 different agencies,”

Dan Sumner. Professor at UC Davis

According to the Department of Cannabis Control’s data dashboard, wholesale cannabis prices have dropped by as much as 80% by some estimates. As of February 2025, there are now 10,828 inactive and surrendered pot licenses in the state of California, the biggest producer in the country, and only 8,514 active ones; expired pot licenses now outnumber active ones. This inversion comes seven years after the legal cannabis market opened and seems to be the trend throughout the country. While it’s not clear exactly when the threshold was crossed, California’s legal market has been struggling for years, with thousands of companies going out of business or letting their licenses expire

Based on these obstacles over the last few years there has been a significant shift in the cannabis industry’s funding landscape for companies that are still operating. The industry is now relying on debt financing (92% of $1.2 billion) over equity investment in 2024, suggesting a few key factors at play

Investor Caution & Market Uncertainty

-

The cannabis industry has faced regulatory challenges, market volatility, and pricing pressures, which have made investors more hesitant to deploy equity capital.

-

Uncertainty about federal legalization in the U.S. may be leading traditional venture capital and institutional investors to take a “wait and see” approach.

-

Declining Valuations & Equity Hesitance

-

Many cannabis companies have seen declining stock prices and compressed valuations, making it less attractive for companies to raise funds through equity issuance.

-

Existing companies may hesitate to sell shares at a discount, opting for debt instead to maintain ownership

-

Limited Access to Traditional Banking

-

Since cannabis is still federally illegal in the U.S., many operators still lack access to traditional banking and low-interest loans, forcing them to pursue higher-cost private debt options.

-

Capital Needs & Profitability Challenges

-

With cash flow struggles, many companies are using debt to cover short-term operating costs rather than long-term expansion.

-

Due to their revenue streams, larger, more mature cannabis firms may have better access to debt markets, while early-stage companies struggle to attract equity or debt investors.

The Outlook

-

Increased Financial Strain on Companies

-

Higher Interest & Repayment Pressure: Debt must be repaid, often with high interest rates, especially given the limited access to traditional banking.

-

Cash Flow Challenges: If cannabis companies don’t generate enough revenue to cover loan payments, defaults and financial distress could increase.

-

Refinancing Risks: Many companies might struggle to refinance their debt if market conditions tighten, or interest rates remain high.

-

Mergers & Acquisitions (M&A) Activity Could Rise

-

Companies burdened with debt but struggling to grow may need to look for strategic partnerships or M&A opportunities to survive.

-

Larger, better-capitalized cannabis firms may acquire distressed companies at lower valuations, consolidating and compressing the industry further.

-

Reduced Expansion & Innovation

-

Debt financing is often used for stabilization rather than stimulating growth, meaning fewer companies will invest in R&D, new markets, or product innovation.

-

Without fresh equity capital, startups and smaller operators may struggle to scale, leaving the industry dominated by larger multi-state operators (MSOs).

Potential Catalyst for Federal Reform

The ongoing banking struggles and reliance on expensive private debt could push regulators toward cannabis banking reform, the SAFE Banking Act. If federal legalization progresses, it could facilitate institutional investment, better loan terms, and a shift back toward equity financing.

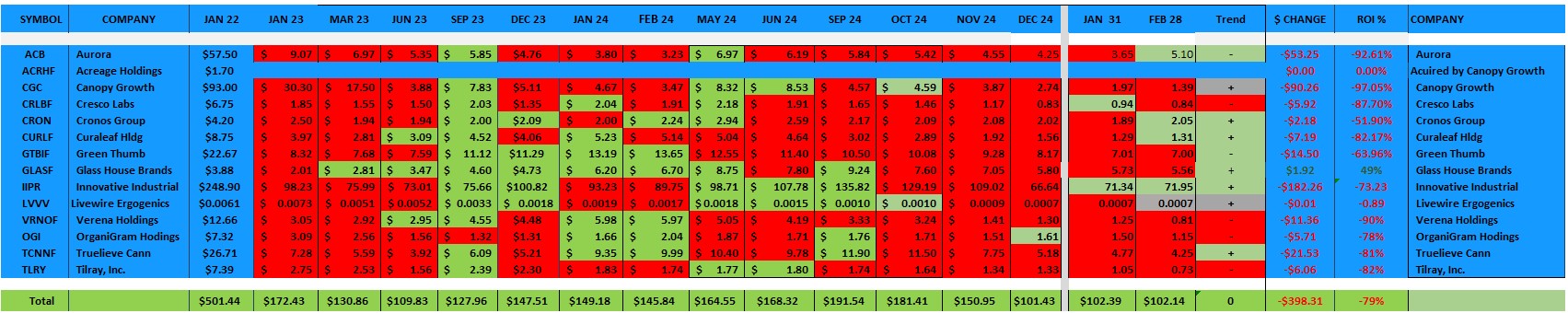

We have been reporting on the trends of our “Top Players” Cannabis Portfolio since January 2022. From 2022 to early 2025, major cannabis stocks experienced significant volatility, influenced by regulatory challenges, market dynamics, and shifting investor sentiment. The StockWatchIndex cannabis portfolio represents a reasonable average of most cannabis stocks. After continuing to trade lower since October 2024, January 2025 saw a slight increase.

The SWI Top Cannabis Players Portfolio

Slight Progress

Nevertheless, investor confidence could rebound. If companies prove they can manage debt effectively and achieve profitability, investor confidence in the sector might return, leading to a shift back toward equity investment. Federal legalization or changes in banking laws could unlock institutional capital, easing the reliance on expensive private debt.

In summary, from 2022 to early 2025, major cannabis stocks have faced downward pressure due to ongoing regulatory challenges, market saturation, and cautious investor sentiment. While there are growth opportunities, particularly with potential regulatory changes, stabilizing prices, and market expansion, the industry remains in a state of flux, with investor sentiment hesitant and requiring staying informed and exercising caution.

|

|

Search

RECENT PRESS RELEASES

Related Post