Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

Key Trends from 2022 to 2025

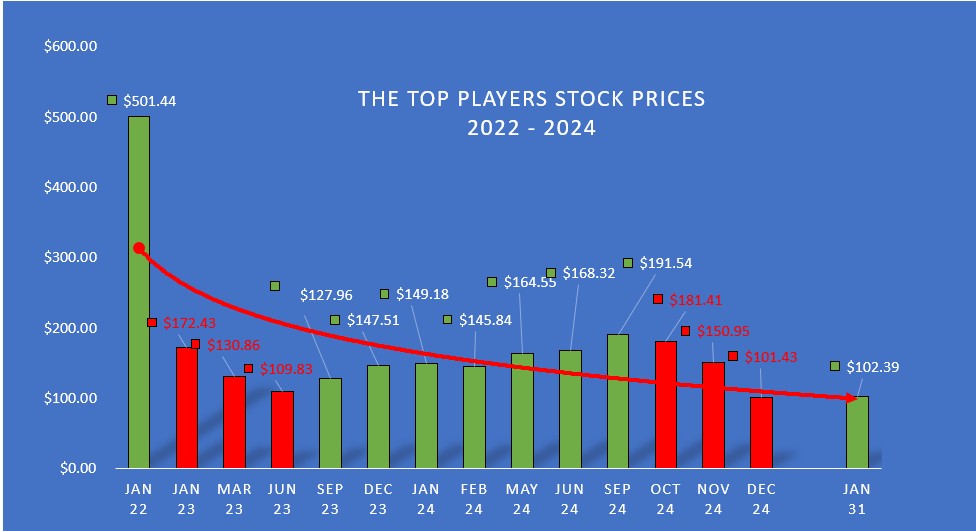

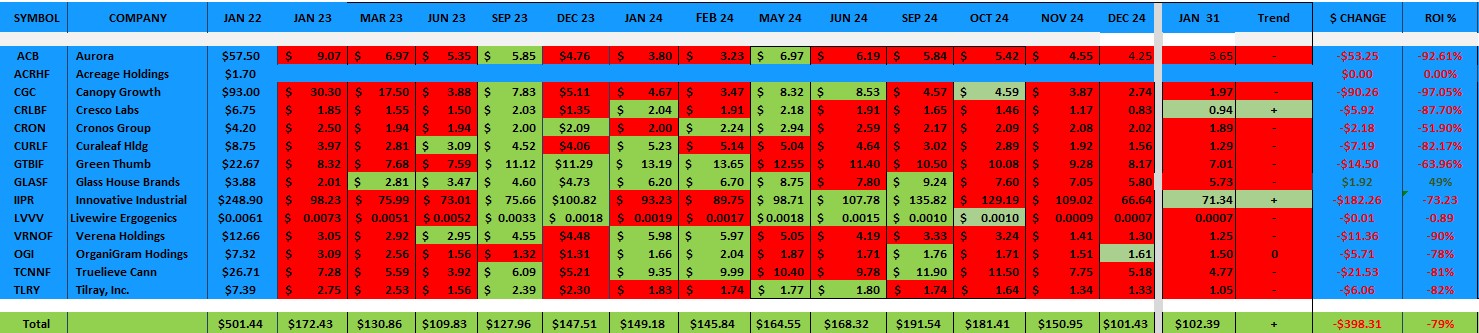

We have been reporting on the trends of our “Top Players” Cannabis Portfolio since January 2022. From 2022 to early 2025, major cannabis stocks experienced significant volatility, influenced by regulatory challenges, market dynamics, and shifting investor sentiment. The StockWatchIndex cannabis portfolio represents a reasonable average of most cannabis stocks. After continuing to trade lower since October 2024, January 2025 saw a slight increase.

Key Factors Influencing the Trend

The trend for cannabis stocks from 2022 to today has been quite volatile

2022: Cannabis stocks experienced a significant downturn due to regulatory hurdles and market saturation. Investors were cautious, and many stocks saw a decline in value

2023: The market remained unstable, but there were some positive movements as companies focused on profitability and expansion. The global cannabis market continued to grow, with sales reaching an estimated $36 billion

2024: The trend improved as state-level legalization expanded and medical programs developed rapidly. The potential for federal policy reform, including the SAFE Banking Act, sparked renewed investor interest

2025: The market is showing signs of recovery, with cannabis stocks becoming more attractive to growth-oriented investors. The legal cannabis market is expected to surpass $60 billion by 2030, driven by expanding legalization and increasing public acceptance

Overall, while the cannabis stock market has faced challenges, there are promising opportunities for growth as the industry continues to evolve.

1. Regulatory Environment: The cannabis industry continues to face regulatory hurdles. In the U.S., federal prohibition persists, limiting access to traditional banking and major stock exchanges for cannabis companies. Recent political developments suggest that significant federal reforms remain unlikely in the near term.

2. Market Dynamics: The legal cannabis market has experienced slowed growth. As of mid-2024, industry sales grew modestly by 2.6% yearly, and cash operating profits increased by 15% due to improved gross margins and reduced operating expenses. However, challenges such as low consumer demand and falling wholesale prices persist.

3. Investor Sentiment: Regulative uncertainties and market challenges have dampened investor confidence. For instance, the defeat of a cannabis legalization measure in Florida led to a significant drop in cannabis stock indices, reflecting the market’s sensitivity to policy outcomes.

The SWI Top Cannabis Players Portfolio

Slight Progress

In summary, from 2022 to early 2025, major cannabis stocks have faced downward pressure due to ongoing regulatory challenges, market saturation, and cautious investor sentiment. While there are growth opportunities, particularly with potential regulatory changes and market expansion, the industry remains in a state of flux, requiring investors to stay informed and exercise caution.

No matter what, The cannabis market is here to stay – will stabilize

and continue to grow. It may just look and smell a little different.

We are not selling. Instead, we are looking for new investment opportunities, and we consider this a good time to buy, especially if you have somewhat of a mid-term investment horizon. Nevertheless, doing your due diligence and picking the right company is more crucial than ever. |

|

| If you want to follow other companies that we cover

with in-depth articles and research reports,

go to www.stockwatchindex.com or our research site

at www.swiresearch.com |

|

|