CANNABIS MARKET UPDATE JANUARY 2026 – A New Year and New Hope ?

February 4, 2026

CANNABIS MARKET UPDATE JANUARY 2026

A New Year and New Hope ?

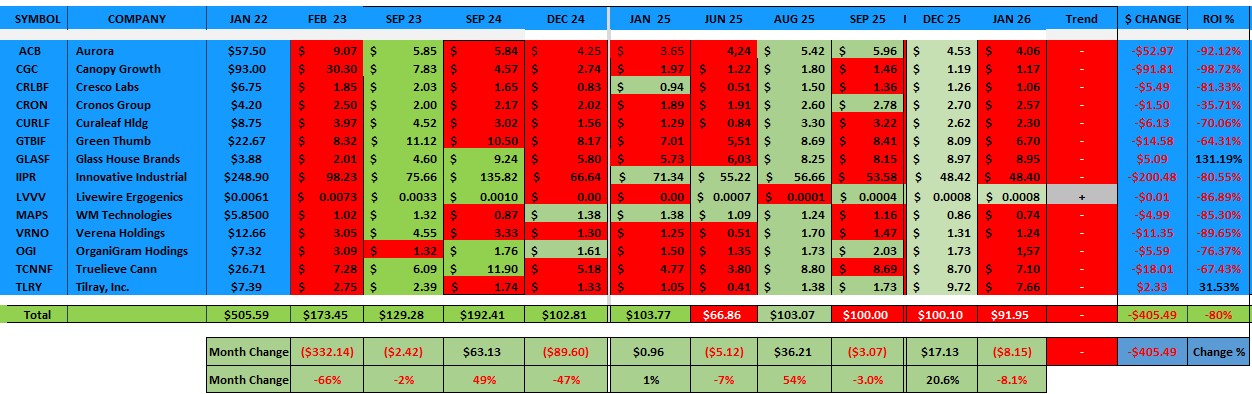

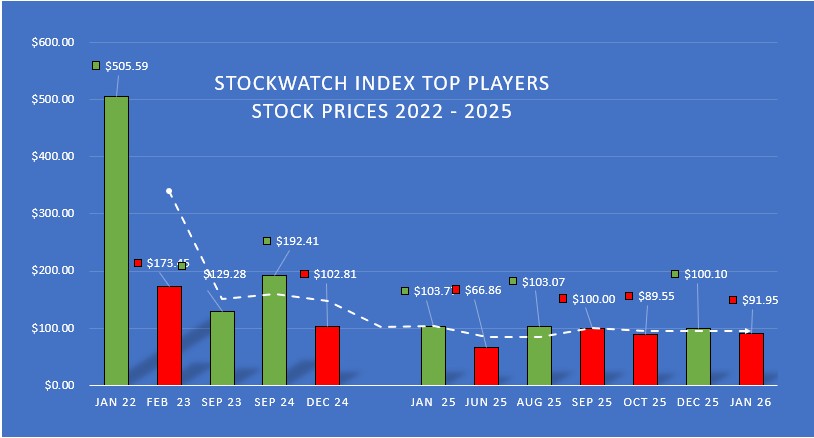

SWI Cannabis Portfolio Stock Values decreased by 8.1% in January

A significant Drop after an Increase of 22.2% in December

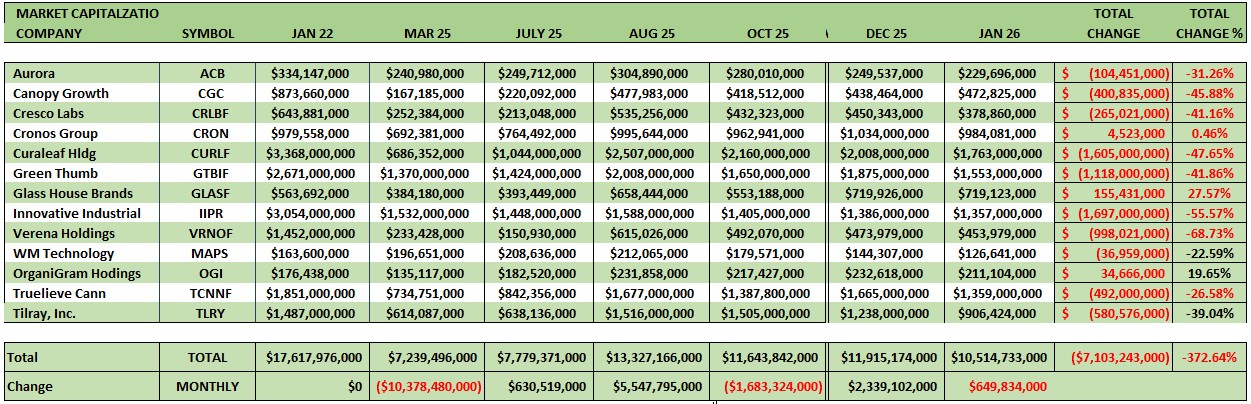

At SWI, we entered the new year with optimism, hoping that the promising momentum of a 22% increase in value in December 2025 would carry us forward and possibly accelerate even further in the new year. Regrettably, that vision did not materialize. The reality is that many cannabis companies, particularly major Canadian players like Canopy Growth, Innovative Industrial, and Tilray, have struggled to achieve profitability for years. Their revenues have stagnated or declined, while persistent issues like mounting losses and cash burn remain significant obstacles. Unfortunately, this troubling trend persists, underscoring ongoing industry challenges.

Regulatory Uncertainty continues sparking Volatility.

Investors have sold on news that didn’t meet expectations — for example, after a federal executive order on rescheduling didn’t include banking reform many had hoped for. Even positive policy moves (like a shift from Schedule I to Schedule III) sometimes spark volatility rather than sustained rallies — because the details and implementation remain unclear.

|

|

If you want to follow other companies that we cover with in-depth articles and research reports,

Go to www.stockwatchindex.com or our research site at www.swiresearch.com.

If this has been passed on to you, and you want to receive the SWI Newsletter,

go to stockwatchindex.com/sign-up

Search

RECENT PRESS RELEASES

Related Post