CANNABIS MARKET UPDATE MAY 2025 – Modest but Notable Market Improvement Mid June

June 11, 2025

Published by: StockWatchIndex Editorial Team

Rainer Poertner, Chief Analyst

-

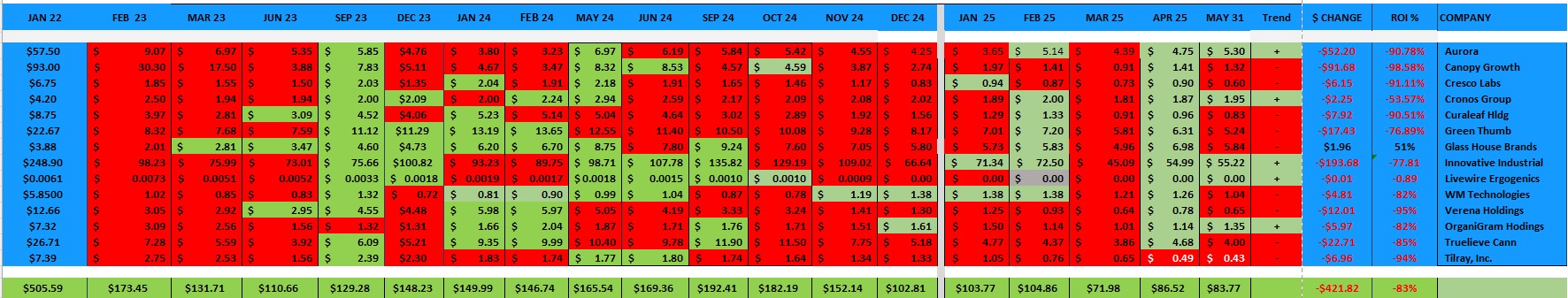

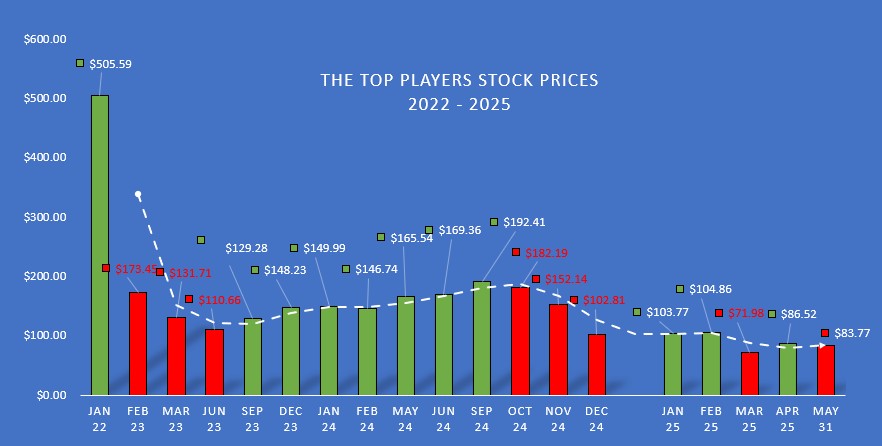

While our portfolio still shows a downtrend by the end of May 2025, and the Global Cannabis Stock Index still fell 7%, many cannabis-related stocks and the broader market have seen a relatively stronger performance in the past month and into mid June, even though the sector continues to underperform the general market year‑to‑date.

-

While Tilray is still down ~81% from its 52‑week high, it has shown three consecutive positive days as of mid-June, including recent daily gains of +4.5% and +1.1%, suggesting some short-term bullish sentiment.

-

The broader Global Cannabis Stock Index showed a mild Q2 uptick of +3.8%, bouncing back somewhat after declines in Q1, although it still fell ~7% in May.

-

Despite dropping by roughly 17% in May, Glass House Brands (GLASF) keeps outperforming its peers and thus stands out as a “success story”. Its strong year-to-date revenue growth (+49% YoY) as of Q1 further supports this narrative, even if profitability may remain elusive.

The SWI Top Cannabis Players Portfolio

Industry Restructuring is Underway

As we have reported before, the “healthy shrinking” and industry consolidation are underway. Many weaker players are being acquired or exited. Stronger, better-capitalized companies (like GLASF and major players such as IIPR and GTBIF are better positioned for long-term profitability. Our view of a structural shakeout yielding industry leaders is well-supported by current data. Let’s keep monitoring these trends and signals!

-

Federal U.S. legal clarity remains a key catalyst. Absent progress, such as SAFER Banking or DEA rescheduling, might cause sector-wide recovery to remain sluggish.

-

Continued consolidation may favor leading companies with economies of scale and diverse constituents.

-

Watch for earnings and trade data from top portfolio names.

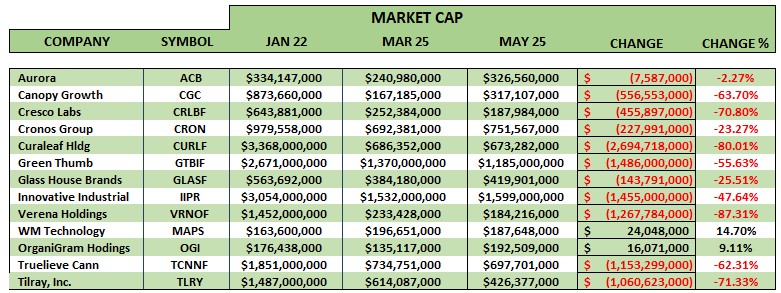

While most market caps still lag behind their highs in January of 2022, there are now more increases than decreases compared to March 2025, with two outliers., WM Technologies (MAPS) and OrganiGram Holdings (OGI) have market cap increases of 14.7% and 9.1%, respectively. A faint glimmer of hope is emerging. While the industry still lags and challenges persist, a few key players are showing signs of resilience. Continue tracking.

Loss (Improvement) in Market Capitalization

If you want to follow other companies that we cover with in-depth articles and research reports,

go to www.stockwatchindex.com or our research site at www.swiresearch.com.

Dynamic Market Concepts (DMC) or its affiliate Stockwatchindex (SWI) are marketing publications with a team of writers and analysts that publish articles and research reports about subjects of interest for the editorial teams and reflect the writers’ opinions. Some of the published information has been provided by the companies covered, generated by publicly available sources, or by what the team deems reliable third-party entities. This is not meant as investment advice or stock solicitation, and the author is not responsible for any errors, mistakes, or shortcomings that may be occasioned when publishing the information in this publication and accepts no liability for any mistakes.

Search

RECENT PRESS RELEASES

Related Post