From a speculative Frontier Market to a complex, hyper-competitive Sector

Why Some Cannabis Companies Will Fail or Succeed

It’s been the Wild West for some time now, exciting and maybe even profitable for some fast traders who benefit from extreme market vulnerability. But now the legal cannabis industry has progressed from a speculative frontier market to a complex, hyper-competitive sector defined by tightening margins, regulatory fragmentation, and shifting consumer behavior. While early entrants benefited from scarcity, today only the strongest operators, those with disciplined management, differentiated products, and scalable economics, are positioned to endure. From an analyst’s perspective, the reasons certain cannabis companies fail while others succeed can be understood through five core categories: Regulation, Capital Discipline, Brand Differentiation, Operational Efficiency, and Strategic Positioning.

Companies that might succeed

-

Brands with a strong focus on quality and consistency will likely do well. People are willing to pay for unique, top-notch products, and companies that build a credible reputation, keep customers coming back.

-

Those who navigate regulations like pros will be ahead of the game. The laws around cannabis are changing fast, so companies that can adapt quickly will thrive.

-

Those who dynamically adjust their struggling business models to changing market conditions and reduce operating costs will survive

-

Those who utilize their experience in the cannabis market and translate it into a general wellness market will succeed.

-

E-commerce and delivery services will continue to grow rapidly. As more states legalize, companies that make it easy for people to buy cannabis online or have it delivered will win big.

On the flip side, companies that might struggle

-

Companies with high overhead costs might struggle to stay afloat. Running a cannabis business is expensive; companies that can’t manage their finances will be in trouble.

-

Companies that don’t prioritize marketing and branding will have a tough time standing out. With so many players in the game, you must have a solid brand identity.

-

Those with poor quality control will get left behind. If products are inconsistent or unsafe, people won’t come back.

-

Companies that don’t innovate will get stuck in the mud. The cannabis market is crowded, so you must stay fresh and consistently offer something uniquely new.

-

Companies that cannot reduce their extreme debt burden, increase their profit margins, or generate new investment will eventually fade away

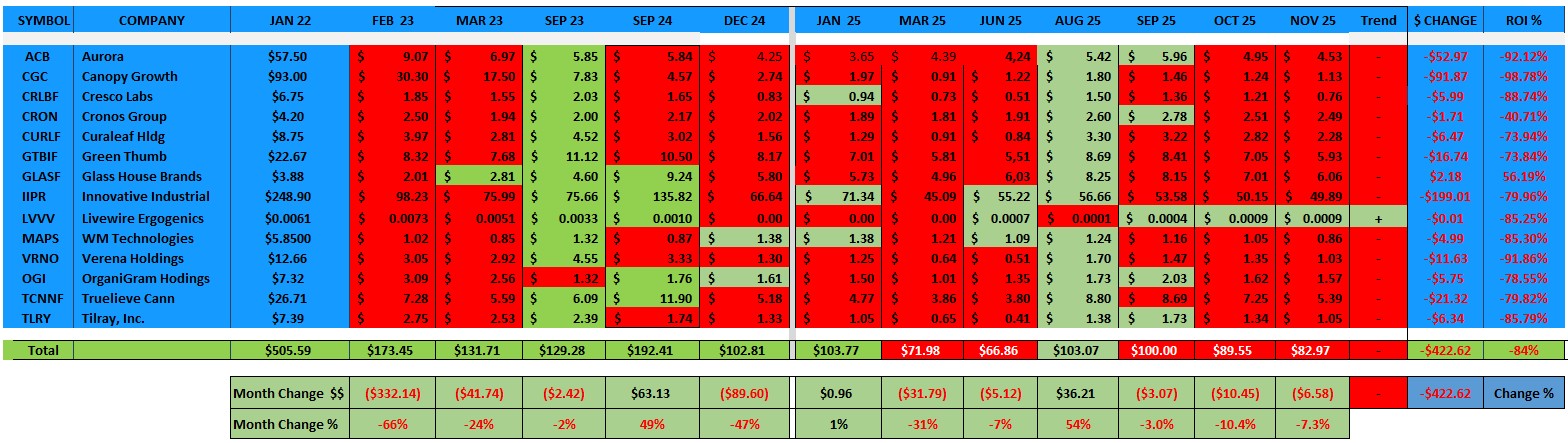

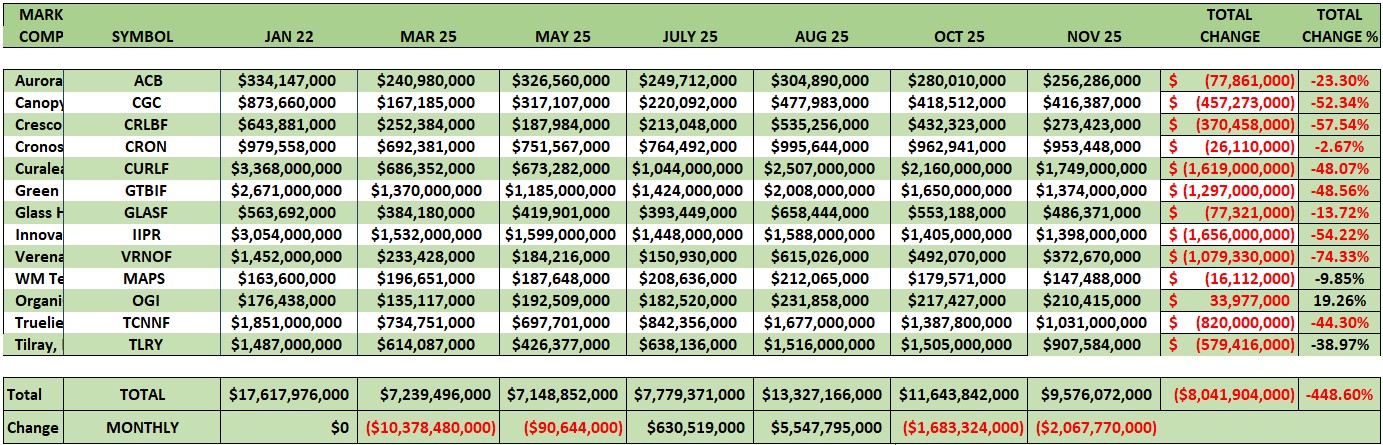

The SWI Cannabis Portfolio Performance

The overall SWI Cannabis Portfolio performance declined by a further 10.4% in October, followed by a slightly smaller decline of 7.3% in November. These figures present a challenging situation for investors, especially for those with a short-term investment horizon. Despite these setbacks, there is still a reasonably broad consensus among analysts that the market is still undergoing a period of consolidation and health-shrinking, with expectations for a strong recovery by 2026. This may necessitate a reshuffling of your investment strategy and an adjustment of your risk tolerance.

Strong Financial Discipline – Less Speculative Investment

The cannabis sector has historically been fueled by speculative capital. But as markets mature and capital tightens, companies without strong financial discipline face a harsh reality: high debt loads, declining wholesale prices, and an unforgiving investor environment.

The Phase of Consolidation

The cannabis industry is entering a phase of consolidation and maturity. Many companies, especially those built on hype, overleveraged expansion, or weak product quality, will not survive this cycle. But disciplined, consumer-focused, operationally excellent, financially responsible companies will thrive as the market stabilizes and regulatory barriers eventually ease.

The Typical Financial Yardsticks Apply

The winners will be those who combine CPG thinking, advanced cultivation science, strong brand identity, and rigorous cash-flow management. In other words, cannabis companies will succeed for the same reasons any sophisticated consumer goods company succeeds: strategy, execution, differentiation, and discipline. |

|

|

If you want to follow other companies that we cover with in-depth articles and research reports

go to www.stockwatchindex.com or our research site at www.swiresearch.com.

If this has been passed on to you, and you want to receive the SWI Newsletter,

go to stockwatchindex.com/sign-up

|

|

|